Where everything Canadian was bad in 2015, in terms of local currency, Canada was the place to be in Q1. In an economy that still remains very commodity driven, Canada had the double benefit of better numbers in Oil, metals and mining, and with it the support of a stronger Canadian dollar.

Where everything Canadian was bad in 2015, in terms of local currency, Canada was the place to be in Q1. In an economy that still remains very commodity driven, Canada had the double benefit of better numbers in Oil, metals and mining, and with it the support of a stronger Canadian dollar.

Canadian Material stocks were up 17% on the quarter, while Energy names were up 7%.

The quarter also highlighted why all investors need patience. By mid-February, Q1 seemed like a ‘total disaster’ (to quote Donald Trump), yet by the end of the quarter many markets were positive for the year. The volatility involved this quarter was very high. At one point in late January, the Canadian market was down 10% but moved up 14% from that point to the end of the quarter.

Most TriDelta clients were up between 2% and 4% on the month, while on the quarter, conservative clients had a small positive and more aggressive clients were mostly a little down on the year to date.

The TriDelta High Income Balanced Fund ended the quarter up slightly.

Our continued focus on capital preservation in times of high volatility has continued to help clients lower their overall volatility and maintain peace of mind during market whipsaws. The one thing to remember is that investors can’t be momentum investors and dividend growth investors at the same time. Each style comes with positives and negatives, and one of our goals is to fit the right style with the right client.

There could be a very positive run for the TSX as energy, metals and mining make a rebound. If you are looking for less volatility and strong income, you will underperform the TSX during these periods. This doesn’t mean that we won’t participate in some of these gains, but for those who are Pension style clients, expect that your portfolio will not gain as much as the TSX when companies with names like HudBay Minerals and Labrador Iron Ore Royalty lead the charge up (or down).

On a Canadian Dollar basis, stock returns were very mixed.

The TSX was up 3.71%

The US S&P 500 was down 6.12% (despite being up 0.77% in US dollars)

The Euro Stoxx index was down 10.16%

As mentioned, Canada was the place to be in the first quarter.

The DEX Canadian Bond Universe was up 1.4%

Canadian Preferred shares finally saw a big positive move in March, up 9.9%. Even with this tremendous return, the index was still down 4% for the quarter.

The Canadian dollar went from 72.2 cents to 76.7 cents vs the US dollar.

The price of WTI Oil started the quarter at $40, went under $28, back to $41, and dipped to $36 and change at the end of the quarter. Of course it has risen back to $42 in the first couple of weeks of Q2.

- A German 10 Year Bond is now paying just 0.11% a year. This tells us a few important things. The first is that with Canada at 1.24%, there really is still room for interest rates to go lower. The second is that for many, simply the safety of their capital is of such importance that they are essentially willing to earn nothing on their money as long as it is safe.

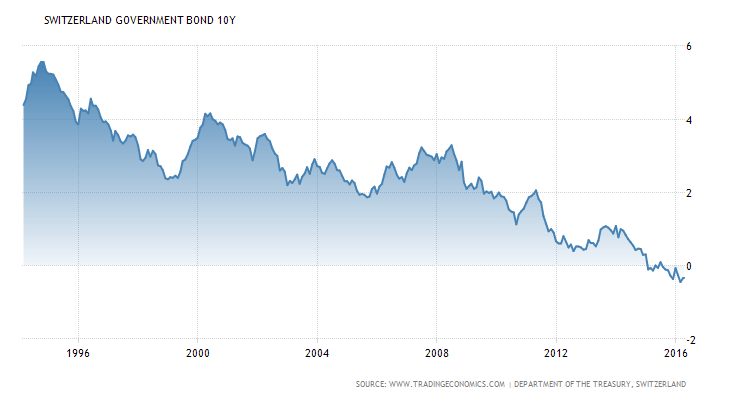

- Interest rates can even go negative. Today, Switzerland 10 year bonds pay MINUS 0.40% annually. The chart below shows rates in 1995 in the 5% range, steadily heading down until it went under 0%. While that may seem crazy to many of us, many of us are invested to some degree at similar rates, as bank accounts pay 0% in interest and then charge us fees for the privilege of holding our money there.

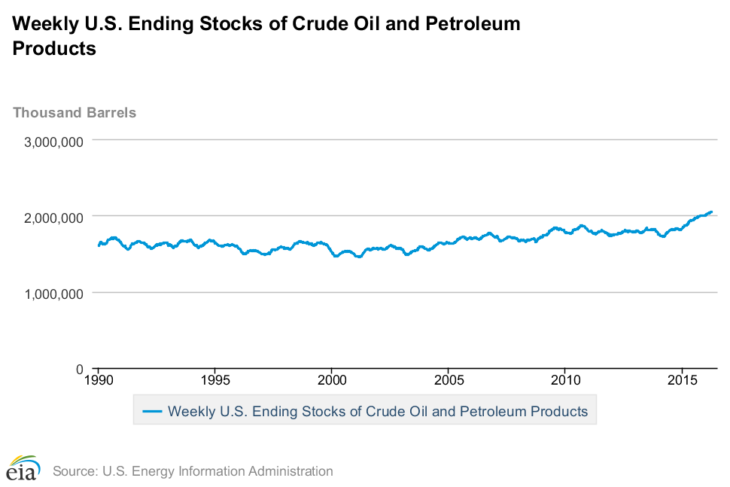

- U.S. Oil Inventories are still going up. Despite cuts in Oil production and supposed agreements among OPEC nations, Oil and Petroleum inventories haven’t stopped growing. It will stop at some point, and there are some positive signs in terms of increased demand, but this current Oil rally is very tenuous. We believe that even small negative comments from key OPEC producers can cause a meaningful pullback, and we believe this will happen. While we do believe that two years from now, Oil will be a fair bit higher than today, it will be a very bumpy ride with many pullbacks along the way.

- Canadian Banks are Cheap. The chart below is the Price Earnings ratio for Royal Bank of Canada for the past 12 years. What it shows is that the company has generally traded between 10 and 16 times earnings. Today it is at 11.5 and was down close to 10 in February. There are not that many companies that have such long term strength and happen to pay 4%+ dividend yields along the way. There are always reasons for lower valuations, but the past 20 years have shown that if there are low valuations the best response is simply to grab it.

- The Big Picture: While the World is always changing, your investment approach shouldn’t be. Our most important job is to ensure that your portfolio is built to meet your long term financial planning needs, your risk profile, your cash flow needs and personal tax situation. If we are doing those things correctly, then you are will be in good shape over the long term regardless of whatever is happening in the market this day, week or month.

- The Smaller Picture –

- Global Stocks: We are seeing some strengthening in Emerging Markets and some strength in China. As a result we are reinvesting a little bit back in Emerging Markets, pulling the money from developed economies in the EAFE (Europe, Australasia and Far East).

- North American Stocks: We remain ready to add more back into Canada but don’t feel that this is necessarily the right time. We believe that there will be a better entry point after there is a little pull back in Oil and likely in the Canadian dollar as well. In addition, US Multinationals may see some positive earnings coming up as the US currency decline will improve their Foreign earnings – when converted back to US dollars.

- Preferred Shares: We continue to believe that this sector is undervalued, and when you combine undervalued prices, with 5.5%+ dividend yields, and tax preferred income, we see a number of benefits. It is a tough sector to love, but we do remain very comfortable holding beaten down names. We believe that the rally seen in March has some room to continue.

- Bonds: For now we have moved away from Government Bonds and back to Corporate Bonds. There seems to be more comfort level with Corporate Bonds in the market place and the increased yield certainly helps. While we believe that the Bank of Canada will remain steady and that long term interest rates will be fairly range bound, we believe that shorter term bonds may be a safer place to be in the short term.

- Alternative Income: We are continuing to add to Alternative Income streams where we can. We believe that in a low yield world, it is worth taking a little added risk in the Private Lending, Factoring and Mortgage space to achieve higher returns.

As always, we believe that Dividends and Dividend Growers play a key role in long term returns and lower volatility. This quarter, the dividend growth continued.

| Leading growers were: | |

| CCL Industries | 33% |

| Canadian National Rail | 20% |

| L Brands | 20% |

| Enbridge | 14% |

We actually saw a dividend decline in one of our holdings. Cal-Maine (an Egg producer) directly ties their dividends to annual profits, and lowered their dividend 41%. Largely as a result, we sold the stock.

One other Q2 note for TriDelta is the introduction of our TriDelta Fixed Income Pool. Clients will be hearing more about it shortly, but we believe it will allow us to deliver better returns on Bonds for clients. Through the ability to do better currency management, getting better pricing on trades, and easier liquidity for clients adding or withdrawing Fixed Income money, it should add up to stronger returns.

We believe that while things seem more positive in the investment markets, we are trying to pick our spots. With a possible pullback in Oil and CDN dollar from here, the possible Brexit or British exit from the European Union, and ongoing Terrorism risks, we are taking only small steps out of our more conservative positions.

TriDelta Investment Management Committee

VP, Equities |

VP, Fixed Income |

President and CEO |

Exec VP and Portfolio Manager |

Lorne Zeiler VP, Portfolio Manager and |

|