Q4 and in particular December, was a period to forget from an investment perspective.

An example of the damage includes the following quarterly returns in their home currency:

| S&P 500 (US) | -14.6% |

| TSX (Canada) | -11.1% |

| Euro Stoxx 50 | -11.7% |

| China Stocks | -12.1% |

| Japan Stocks | -16.4% |

| Oil Prices | -40.0% |

| CDN Preferred Shares | -11.6% |

Fortunately, TriDelta clients were cushioned somewhat from the damage by three main factors:

- A diversified portfolio that is not close to 100% in stocks.

- Exposure to our select group of Alternative Investments that were mostly up in the range of 1% to 2.5% on the quarter.

- The Canadian dollar decline helped to boost the return of foreign investments.

Most TriDelta clients ended the quarter down in the range of 3% to 5% depending on their exposure to stocks and overall asset mix.

As mentioned last quarter, the recent pullback has been caused by:

- Rising interest rates – which lead to higher borrowing costs for companies, and higher returns on lower risk investment alternatives like GICs (although they remain low historically)

- U.S.-China Trade Wars (and broader trade conflicts globally)

- Fears of higher inflation

- Declining earnings growth in the U.S. following the one time benefit of a new lower tax policy.

We are now fairly positive on stocks for the short term – and the rationale goes back to the four points above.

- We see interest rates in a stable range in 2019 with few if any rate hikes. While this is somewhat a comment on the general economy, we believe that stock markets will mostly react positively to news of slow to no rate hikes.

- While the U.S.- China Trade war is the hardest to predict for a variety of reasons, we do believe that there is a good chance of a “deal” taking place in the next few months and the stock market reacting positively on a global basis. The Chinese stock market fell 24% in 2018. U.S. markets were negative. Both countries are looking for a way to show investment growth in 2019 and the one area they can control is the negotiations and substantive agreements.

- As Oil prices fell 40% in the quarter, this has had a meaningful impact on inflation. Central banks in Canada and the U.S. like to keep inflation in the 2% range. Canadian inflation dropped to 1.7% in November, and U.S. inflation rate was at 2.2%. These rates ease some fears of higher inflation.

- The 20 year average of stock market valuations in the U.S. as measured by price/earnings, is 15.8. On December 31st it stood at 14.4 times earnings, almost 10% below its average. The TSX has a forward price earnings ratio of only 13 times earnings, compared to its 10 year average of closer to 15 times earnings. For the first time in several years, stock markets are ‘undervalued’ with Europe, Japan and Emerging Markets trading at even lower multiples.

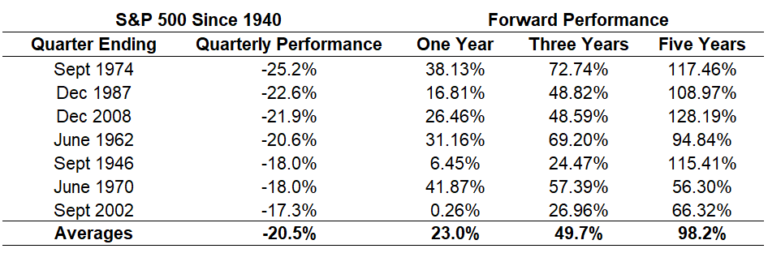

The last reason that we are more positive about stocks is captured in the chart below. The chart looks at the S&P500 since 1940, focused on the seven worst quarters it has experienced. It then looks at the market performance in the one year, three year and five year periods after that terrible quarter.

Most investors would have been happy with the one year return in six of those seven scenarios, and happy with seven of seven scenarios for three year and five year returns.

Essentially, the stock market tends to go up in the long term. When it has a particularly bad period, it tends to bounce back, based in part on simply catching up to fair value.

Our positive outlook is not blind to some of the prevailing risks, which include:

- higher U.S. borrowing costs

- increasingly high debt levels (both government and consumer)

- political gridlock

- unwinding of previous stimulus

Nevertheless, we are looking to see decent stock market growth in 2019.

- Better than average stock market returns in most major markets including Canada and the U.S., barring a breakdown on global trade.

- Interest rates being mostly flat with maybe one ¼% increase in both Canada and the U.S with a real possibility of an interest rate decline in Canada before the year is out.

- The Canadian dollar being fairly flat vs. USD, but being tied more to oil than we have seen in the recent past.

- Oil prices rising, but only slowly.

- Preferred Shares having a strong year, bouncing back from their late year steep declines.

- Marijuana stocks will see a general decline overall as high valuations and uncertain revenues work their way through, but with increasing gaps between the winners and losers. In fact, we expect to see several bankruptcies in 2019 among the weak players in the market, and at least one major blow up of a more established firm (we just don’t know which one).

- Corporate bonds outperforming Government bonds.

Based on these short term beliefs, we have reduced our cash weightings in our stock funds down to essentially fully invested in both our Pension and Growth funds.

In the Growth fund, which is more active in terms of adjusting industries, we will be adding to Energy and Industrials, while reducing Telecoms and Utilities.

In the Fixed Income world we are looking to add some High Yield Debt and Preferred Shares to the fund.

Overall, most clients had returns in the 0% to -5% range on the year depending on their individual asset mix. Given the major stock market declines, most of our clients did much better than the average Canadian investor for the year.

Our 2018 returns were as follows:

| TriDelta Pension Pool (Stocks) | -2.2% |

| TriDelta Growth Pool (Stocks) | -8.1% |

| TriDelta Fixed Income Pool | -2.2% |

| TriDelta High Income Balanced Pool | -1.9% |

| Most Alternative Investments | +5.2% to +10.5% |

- The 2019 Edition of our TriDelta Retirement Income Guide has just been released. It contains a wide range of tips and information on the different sources of retirement income, and how best to draw that income. Ask a TriDelta Wealth Advisor for a copy.

- A reminder that now is a great time to top up TFSA’s. They have added $6,000 per person to contribution room in 2019. If you have the funds, January is also a good time to do 2019 contributions to RRSPs, RESPs and RDSPs, as appropriate, as it will help you to have tax sheltering for a full year.

- U.S. consumer debt payments as a percentage of disposable income were 9.9% in 2018. That is the lowest rate in over 30 years.

- For a 65 year old couple (male and female), there is a 22% chance that a male will reach age 90, a 33% chance that a female will live to age 90, and a 48% chance that at least one person in the couple will live to at least age 90, so investors need to plan for the long term.

- According to studies by the U.S. research firm Dalbar, in the 20 year period from 1998 to 2017, the S&P 500 averaged a 7.2% annual return, the U.S. bond market averaged a 5.0% return, yet the average U.S. investor only averaged a 2.6% annualized return. The reason for this underperformance is primarily attributable to too much trading and shifting of portfolios, particularly moving away from risk after stock markets have declined, and too heavily to stocks when markets are peaking.

As long term investors know, down markets eventually recover and great markets don’t last forever. Right now we believe that we are in the ‘down markets recover’ stage and are acting accordingly.

In the very short term, anything can happen (all it takes is one Tweet). Having said that, most stock markets historically go up 7 years out of 10, and are more likely to go up in the year after having declined. Even for our older clients, there is usually lots of time to recover. There is an old adage that says “Investing is about time in the market, not market timing.”

At TriDelta we will continue to be nimble while focusing on the long-term plan. This would include a steady and diversified asset mix that is built appropriately for the goals of each client, and an eye on tax minimization.

Here is to a better investment year in 2019.

TriDelta Investment Management Committee

VP, Equities |

President and CEO |

|

Exec VP and Portfolio Manager |

VP, Portfolio Manager and |

|