The 3rd Quarter report would have had a different feel if it was written in early September. At that point Bonds were down, Canadian stocks were down, and with a strong rise in the Canadian dollar, US stocks were down in Canadian dollar terms.

The 3rd Quarter report would have had a different feel if it was written in early September. At that point Bonds were down, Canadian stocks were down, and with a strong rise in the Canadian dollar, US stocks were down in Canadian dollar terms.

Fortunately the quarter ended on September 30th, with Bonds recovering some of their losses and stock markets globally and locally all ending up stronger.

The Canadian dollar, however, had a negative impact on U.S. dollar based investment returns, as the Canadian dollar ended up 4% on the quarter (after posting a 2.8% gain in Q2).

The TSX was up 3.7%, but the U.S. S&P500 in Canadian dollar terms was actually down 0.1%.

Other Non-North American stock markets were strong, in particular Emerging Markets, which were up 8.3% (4.3% after the Canadian currency impact).

The FTSE Bond Universe (previously the DEX Bond Universe) was down 1.8% on the quarter, in large part based on sooner than expected interest rate hikes in Canada.

The third quarter of 2017 was a mixed bag. Most growth oriented clients ended the quarter up in the area of 1% to 1.5%. Most conservative clients ended the quarter closer to flat.

The difference was twofold. Growth stocks outperformed Value and more conservative clients had higher exposure to Bonds as well. Currency negatively impacted all clients.

Our TriDelta Growth Fund had a 2.2% return on the quarter.

Our TriDelta Pension Fund was down 0.1% after a strong first half of the year.

Our TriDelta Fixed Income (Bond) Fund was down 0.2%, but that was in a quarter when the Bond Universe was down almost 2%. Overall, while the Bond market has done poorly, TriDelta has meaningfully outperformed.

Our TriDelta High Income Balanced Fund was down 0.5%, largely due to its high Bond exposure.

Our Preferred share portfolio continued to do well, led by rate reset Preferred shares, with a 2.1% gain on the quarter.

Most of our Alternative Income strategies continued to do what they are supposed to do, which is provide consistent annual income and growth of 6% to 10% a year, regardless of stock or bond market performance. This translated into a 1.5% to 2.5% return on the quarter.

- Interest Rates – Canada has raised rates twice in Q3, and while some believe that another rate increase is coming by year end, we do not believe it will happen. To some degree these rate increases have come from greater confidence in Canada’s economy. We believe there will not be another Canadian rate increase for several months for four reasons:

- 4%+ GDP Growth Numbers are unsustainable and will be coming down, removing some of the support for future rate hikes.

- NAFTA uncertainty will take some confidence away from the Bank of Canada.

- Canada is a real estate economy these days, and the Bank of Canada and others do not want to risk a real estate decline by raising rates too fast or too soon.

- Oil appears to be in oversupply at the moment, especially with the flexibility of fracking production. We believe this limits Canadian dollar upside through price increases.

The implication of this is that a lack of rate increases should help Canadian bond returns to be stronger this quarter. No further interest rate increase should also support high dividend yielding Utilities and REITS, but may be a little bit negative for Banks and Insurers.

We do expect the U.S. Fed will be raising rates again before year end, and likely again in the first quarter of 2018. This will impact our U.S. bond positions and will likely have the opposite impact on certain stock sectors that we discussed above.

- Canadian Dollar – The Canadian dollar moved from 72.5 cents to 82.5 cents over a period of less than 4 months. In the past month, the Canadian dollar has declined back under 80 cents.

As per the interest rate discussion, we believe the Canadian dollar will likely lose more ground this quarter. Rising rates in the U.S. coupled with flat rates in Canada will be the biggest driver.

NAFTA discussions that have pushed the Mexican peso meaningfully lower, have had little impact on the Canadian dollar thus far, but we believe it will have some negative impact. However, these discussions could drag well into 2018.

A last note relates to U.S. Tax changes. If there is some headway on these Corporate Tax changes in the U.S., we believe it will lead to a sizable repatriation of U.S. Corporate dollars from foreign subsidiaries back to the United States which could translate into special dividends, share buybacks or acquisitions. This will also strengthen the U.S. dollar.

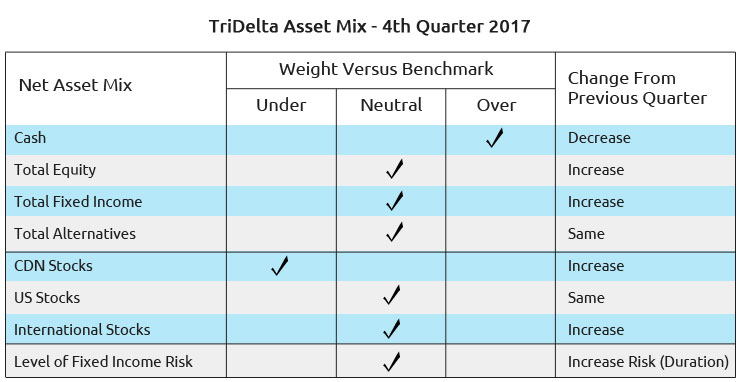

- Stock Markets – We have recently lowered our cash weightings in favour of adding some money to Canadian and International Markets. While we believe that the U.S. economy and corporate earnings remain solid, we will not be adding significantly to a market that has high valuations and is showing signs of being in the latter stages of its long bull market run.

Canada, Europe, Japan and Emerging Markets all have lower valuations and have certain sectors which are trading below their long term historical averages. Despite expected increases in interest rates in the United States, we believe that rates will remain very low in these other markets, which will continue to provide a backdrop supportive of stocks.

- Preferred Shares – For the past 18 months, Canadian Preferred shares have been an excellent investment, particularly Rate Reset Preferred Shares that have gone up alongside higher bond yields. While we believe that Fixed Rate Preferred Shares may outperform in the period ahead, both Fixed Rate and Rate Reset Preferred Shares continue to provide strong tax preferred dividend yields of 4.5% to 5.5% from some of the strongest companies in Canada.

- Alternative Investments – TriDelta continues to like these high yielding investments that are not correlated (don’t move up and down) with stock markets. Our expertise in this area is allowing us to be exposed to more innovative investments and in some cases receive lower fees than most others in the industry. This should lead to higher returns for our clients.

It is worth reminding clients that these investments are less liquid than stocks and bonds. There is a possibility that during periods of market disruption these investments could be ‘gated’, meaning that withdrawals are restricted until they can be done without hurting the underlying investments. This is the reason that, even though we are very positive on these types of investments, we like to maintain at least 70% of a portfolio in more liquid securities.

Edward Jong, the Portfolio Manager for TriDelta’s Fixed Income Fund, likes to say that there is an ability to make money in Bonds in declining, flat or rising interest rate environments.

He has worked through all scenarios in his 25 years managing Fixed Income investments, although it would be safe to say that declining interest rates have been the predominant direction during his career.

Over the past year, Edward’s active approach has led to a 3.6% return. On its own, that return isn’t overly exciting, but in comparison to the -3.1% return of the benchmark (BMO Aggregate Bond ETF), it is a 6.7% ‘beat’. As a result, the fund ranked in the top 3% of all Canadian Fixed Income funds in the past year.

Clients who transitioned to the fund on day 1 (May 2016), are up 8% over the past 17 months – during a time of rising interest rates.

The fund takes an active approach and that can be seen in the various tools that are used to generate this performance.

Two months ago the fund had:

*A shorter duration than the index, meaning that it had a higher exposure to bonds with a short term to maturity, and a lower weighting in long term bonds. This was done to reduce the funds exposure to the expected interest rate increases.

*The fund had significant exposure to Corporate bonds and little to Government bonds. This was reflective of our view that the overall economy was strong, and that the higher yields on Corporate bonds would come with a relatively low level of risk.

*The fund had some exposure to higher yielding names – again reflecting a comfort in both the names and the overall economic environment.

*We owned some Preferred shares in the fund as they provided higher yields and Rate Resets actually benefit when interest rates are increased.

*We owned some U.S. $ bonds, but had a partial currency hedge in place to lessen our U.S. dollar exposure.

Today, two areas of the fund have changed:

*Due to our view that Canada will not be raising rates in the coming few months (while the market still believes this is a reasonable possibility), we have extended duration on the fund, essentially selling some short term bonds and replacing them with longer term bonds.

*We have removed the U.S. dollar currency hedge, and are exposed to currency fluctuations on our U.S. holdings. We believe that the Canadian dollar will decline, and it will improve our overall returns.

The bottom line is that in this low yield environment with flat to rising interest rates, it is this active approach to the market that enables our clients to significantly outperform on the Fixed Income portion of their portfolios.

The current mood is steady as she goes, while keeping a firm hand on the tiller.

The level of stock market volatility over much of the year has been ‘unseasonably’ low. In fact, in the United States, the largest market decline this year at any point has been just 3%. Almost every year you will see a decline at some point of at least 5% to 10%. That is normal. What we have seen this year is not.

While we are confident in markets overall, we should also keep in mind that there will likely be a decline in stock markets of 5% to 10% in the months to come. We should mentally prepare for it. The good news is that when this happens, a diversified portfolio of Bonds, Alternative Investment Solutions, Preferred Shares and maybe cash, help protect your capital and lower your risk.

In cases, where your stock weightings have grown beyond their traditional weights, we will be working to rebalance portfolios by taking a little profit over the coming weeks. Consider it to be our TriDelta version of the Squirrel busy putting some nuts away for the long winter.

All the best and our continued appreciation for putting your trust in us.

TriDelta Investment Management Committee

VP, Equities |

VP, Fixed Income |

President and CEO |

Exec VP and Portfolio Manager |

VP, Portfolio Manager and |

|