Overview

It is amazing how the day to day can seem very volatile, but when you step back far enough, returns have been fairly steady. Q3 was one of those quarters. July was good, August was bad, and September was good. When you add it all up, the quarter was not great, but decent.

The TSX was up 2.5%, the S&P500 in Canadian dollars was up 1.5% and the MSCI world index was up 2.1%. This was a rare quarter where Canada outperformed on the strength of Utilities, Consumer Staples and Financials.

The TriDelta Pension fund had a strong quarter, up 4.5%, while the Growth fund was still solid with a 2.3% gain.

The Canadian Bond Index was up 1.2% while preferred shares were up 0.5% on the strength of a rebound in September (after more weakness in July and August).

Despite these numbers, the recession chatter is as strong as ever.

Should we be worried?

How is TriDelta responding?

Where do we see things today and what are we doing about it?

We do not believe that a bear market is imminent.

Historically, bear markets occur when at least two of the following four circumstances are found:

- Economic Recession – Two consecutive quarters of negative growth.

- Commodity Spike – A movement in oil prices of over 100% over an 18 month period.

- Aggressive Fed Tightening – Unexpected and/or significant increases in the Fed funds rate.

- Extreme Valuations – When S&P500 trailing 12 months price/earnings levels were approximately two standard deviations higher than the long term average.

Today, we see none of the four circumstances in place.

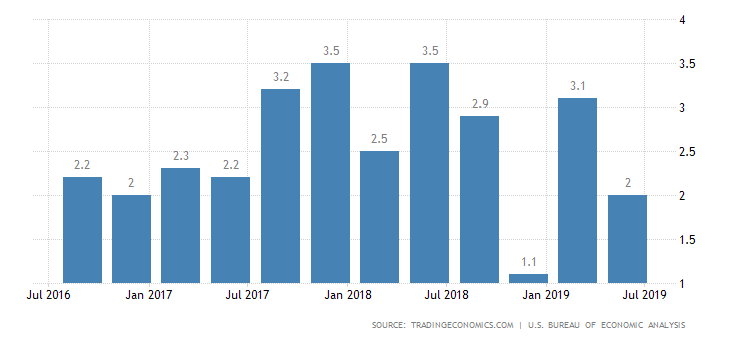

Current growth rates in the U.S. are 2.0%, while Canada is at 1.6%. These are not booming growth rates, but solidly better than a recession.

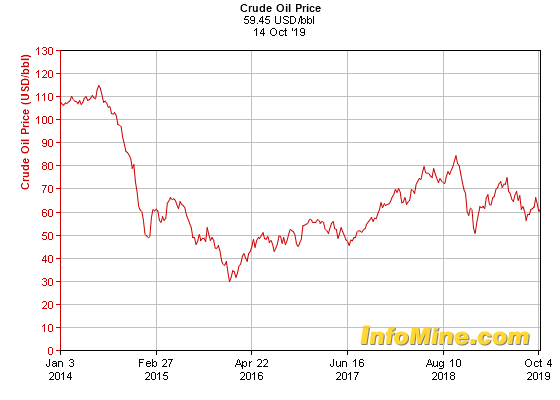

Oil prices did see a big drop from October 2018 to December 2018 and rebound, but it was well under 100%. 2019 has actually had more stable oil prices than we have seen in general. As you can see below, there has been small positive trend for the past 3.5 years.

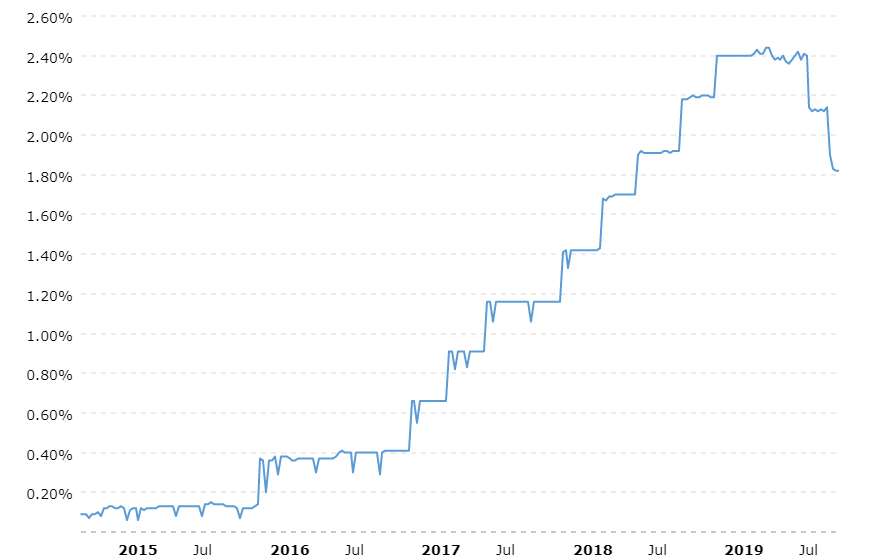

We are actually seeing Fed loosening of policy as the Fed Funds rate has been lowered twice this year. As per the chart below, after four years of slowly raising rates, the tide has turned the other direction in 2019.

Valuations on the S&P500 are currently just slightly above their

When we take these factors along with our belief that Donald Trump will ease up on China trade demands and tariffs if stock markets are falling, we do not believe in an imminent bear market.

Despite this relative optimism, we do recognize some real risks that include:

- Slowing growth

- Few obvious catalysts for near-term market growth

- Fear that the Fed won’t lower rates as fast as the market expects

- Brexit dangers

- Trump….just saying

- Middle east hotspots in Syria, Iraq, Turkey.

When we net things out our view

Stocks

We are spending a little cash by adding to Emerging Market exposure. We simply believe that Emerging Markets are undervalued and will benefit more than the rest of the world if the U.S. and China trade improves. Year to date, Emerging Markets are up only 2.0% while the S&P500 in CDN dollars is up 18.8%, and we believe that gap should narrow.

We are also moving a little more towards Financials and Consumer Staples and a little away from Consumer Discretionary.

Interest Rates

U.S. – The Federal Reserve looks likely to lower rates another quarter percent in late October. There may be a tougher case to be made for another cut in December as there are currently some Fed Governors clearly against further cuts. Having said that, the market is still expecting further cuts after October.

Canada – The Bank of Canada is really standing alone as the only major economy that is not planning to lower interest rates any time soon. Their view is that growth is reasonable and employment is strong while their biggest concern is consumer indebtedness.

Preferred Shares

We see more value in Preferred Shares than many Bonds at this point, in particular perpetual or straight preferred shares that have dividend yields in the 5% to 5.5% range. While rate reset Preferred Shares provide the most value, and did see a big improvement in September, we still see more volatility on this side of the market.

Alternative Investments

We will soon be sharing information on a new offering from TriDelta that will represent some of our best thinking on the income focused Alternative Investment space along with better liquidity, better pricing, and full flexibility to be held in registered and non-registered accounts. Stay tuned.

Canadian Dollar

We believe that there could be some strength in the Canadian dollar over the next year as U.S. interest rates fall below Canadian levels. The very different view on interest rates between the two countries should provide a solid support for the Canadian dollar. In fact, we have now put in place a 25% hedge on US$ in our funds when we often have no hedge in place.

TriDelta Private Funds

We paid another distribution in the first week of October. Over 17% of the remaining value of the TriDelta Private Fund 2 (High Income Balanced Fund) was distributed out as cash. Over 4% of the remaining value of the TriDelta Private Fund 1 (Fixed Income Fund) was distributed out as cash. We expect to pay further distributions next quarter as more of the underlying investments mature or are sold.

TriDelta Ranked one of the Top 10 Wealth Management Firms in Toronto by AdvisoryHQ

Here is what California-based Advisory HQ had to say about our firm:

“TriDelta’s holistic financial services approach ensures clients get personalized help from experts in a variety of financial specialty sectors. This provides additional value and ensures a client’s financial strategy is fully integrated.

With a deep bench of professionals, a wealth of financial education resources, and a talented team, TriDelta Financial earns 5-stars as one of the best financial advisors in Toronto….”

Summary

As we head into the final quarter of the year, 2019 continues to feel like a recovery year from the weaknesses of the second half of 2018. Despite the fear that seems ever present, we do not see a particularly weak investing environment. In the short term, anything can happen, but our slightly cautious approach should weather such storms and allow us to take advantage of opportunities.

At TriDelta we will continue to focus on being nimble in the short term, being a leader in the Alternative Income space, and helping clients plan for the long term.

Here is to a beautiful fall for everyone.