Equity markets have recovered significantly in recent years and are now considered fully valued or overvalued.

Bond markets have experienced 30 years of declining interest rates and are also expected to have low returns for a while.

This suggests it’s time to consider other asset class solutions such as global corporate real estate, infrastructure, private debt and hedge funds.

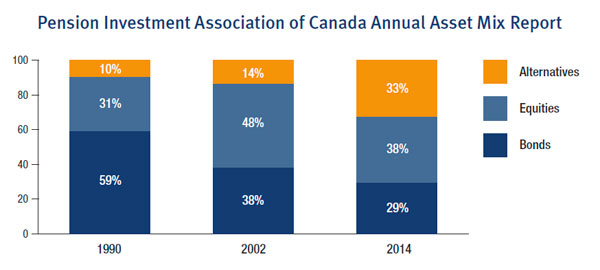

In fact a review of asset shifts amongst the world’s largest pension and endowment plans reveal that this so called smart money has already shifted their investment allocations significantly to alternative investments and reduced stock and bond exposure.

- Providing high income

- Diversification to reduce risk

- Lowering portfolio volatility

- Enhancing returns

- Protecting capital during periods of market declines

The case for investing in alternative investments

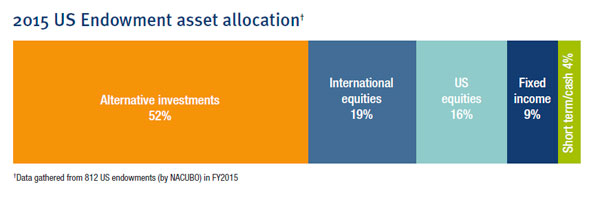

At TriDelta we research the marketplace for viable portfolio solutions including an analysis of where leading pension and endowment funds invest. They have been reducing their bonds and, to a lesser extent, their publicly traded stock portfolios. Under the catch-all phrase of alternative investments, many pensions and endowments have instead been investing between 25 per cent and as much as 75 per cent (Yale University Endowment Fund) in alternative investments.

Consider that the top 1,000 pension plans in Canada shift allocations to various asset classes each year. Of particular note is that allocations to alternative investments have nearly doubled over five years since 2011.

What are Alternative Investments?

Alternative investments are essentially any asset that is not a public stock, bond or cash security. Alternative investments often provide higher returns than traditional assets by focusing on less efficient or private asset classes, such as infrastructure and private equity.

They can generate stable, high levels of income by investing in private income oriented investments, such as real estate and private debt. Hedge Funds, such as Market Neutral Hedge Funds can also reduce volatility by using sophisticated hedging strategies.

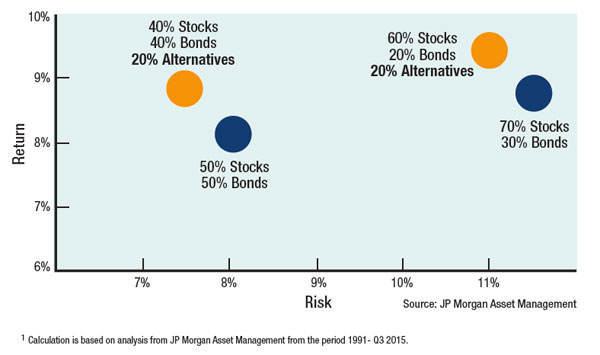

1. Returns can be meaningfully improved and risk reduced by including alternative investments

According to JP Morgan research, portfolio returns were improved by more than 10% p.a. and volatility was significantly reduced by adding 20% to alternatives.

A balanced investor with 50% invested in stocks and 50% invested in bonds would have seen their return improve and their risk reduced by moving to an asset mix of 40% stocks, 40% bonds and 20% in alternative investments.1

Growth oriented investors with a 70% stocks, 30% bonds asset allocation would also have benefitted by including alternative investments to earn higher returns and reduced risk.

2. Invest where the ‘smart money’ invests

The ‘smart money’ generally refers to professional investment managers. We research where they invest given that they have consistently achieved superior investment returns versus more traditional models. We then fine tune our own investment allocations and strategies.

The Pension Investment Association of Canada, which includes Canada’s largest pension plans and nearly $1.6 trillion of assets under management, provides an annual asset mix report. As the chart below highlights, in 1990 alternative assets comprised only about 10% of the total asset mix. By 2015, alternative assets comprised over 33% of the asset mix, an increase of over 200%.

Years ago a Canadian Government bond portfolio could fund a long, prosperous retirement when the yield was between 8 & 12% (1980 – 1990s) and a few years ago they delivered about 5%, but this is certainly not the case today.

The new normal of ultra-low global yields and interest rates poses an unprecedented challenge for all investors and it’s no wonder that endowment giant Harvard only has a 12% portfolio allocation to bonds.

U.S. Endowment funds, such as Harvard and Yale University and Canadian Pension Funds, such as the Ontario Teacher’s Pension Plan have achieved some of the highest returns for their clients over the past 30 years. During that time, they have been significantly increasing their allocation to Alternative Investments to enhance overall returns and reduce volatility.

3. Changing Times

The world has changed in recent years; investors need to look beyond only traditional investments to achieve their goals of income, stability and growth. As the chart below demonstrates, in 1990 an investor could earn 9.9% on a 10 year Government of Canada bond vs. only 1.5% today.

The equity market in 1990 was also much cheaper with a Price Earnings ratio of only 15 times vs. over 22 times today.

Investors are also expected to live much longer, meaning that their investments have to work harder to meet their cash flow and spending needs.

| 1990 | 2017 | |

|---|---|---|

| Bond Yield* | 9.9% | 1.5% |

| Equity Market P/E Valuation** | 15 x | 22 x |

| Baby Boomer | 35 years old | 61 years old |

| Retiree (OTPP) | Worked for 29 years; Retired for 25 years | Worked for 26 years; Retired for 30 years |

| Life Expectancy*** | 77 years | 82 years |

Sources: *bankofcanada.ca **S&P500 average P/E based on historical ***statcan.gc.ca

The world is different and we believe it’s time for your portfolio to change as well.

4. The TriDelta Strategy

TriDelta’s Alternative Assets Investment Committee focuses on putting the odds in our clients’ favour by focusing on:

- Proven managers with strong track records and disciplined investment philosophies

- Earning more stable returns

- Generating premium yield in less liquid investments

- Solutions that lower clients’ portfolio volatility

- Alternative Investments are often restricted only to Accredited Investors (those with family income of $300,000+ or an investment portfolio of $1 million+)

- Many large Canadian financial firms simply do not make them available to their clients because alternative investments are often more complex and require a specialized skill set to analyze, review and select managers; and

- Many of the best alternative managers provide only restricted or limited access to their funds.

At TriDelta Investment Counsel, we solve all of these problems.

As an investment counsellor, we are able to offer these investments to all clients on a discretionary account basis. Alternative investments are a key element of our overall investment strategy.

Contact to Discuss:

President and CEO |

Exec VP and Portfolio Manager |