Market Overview

The first three months of 2023 saw much of the financial drama we have grown accustomed to coming off a volatile few years. Stock markets continued their momentum from the end of 2022 into January but pulled back in February on renewed fears of a recession and concerns markets may have got ahead of themselves. The real drama came in March with the failure of three U.S. regional banks and one Swiss bank resulting in heightened anxiety about what that means for the stability of the banking sector as a whole and the future path of interest rates. Despite all this, investors largely shook off these concerns and pushed markets higher to end the quarter.

The first three months of 2023 saw much of the financial drama we have grown accustomed to coming off a volatile few years. Stock markets continued their momentum from the end of 2022 into January but pulled back in February on renewed fears of a recession and concerns markets may have got ahead of themselves. The real drama came in March with the failure of three U.S. regional banks and one Swiss bank resulting in heightened anxiety about what that means for the stability of the banking sector as a whole and the future path of interest rates. Despite all this, investors largely shook off these concerns and pushed markets higher to end the quarter.

In this quarterly review we will be discussing these key developments, what that means for investment decisions moving forward, and what actions we are taking to benefit client portfolios. Key themes discussed include:

- The interest rate increases that began in Spring 2022 finally began to reveal cracks in the system, particularly with mismanaged U.S. and European banks.

- Stock markets rallied in the first three months of the year, but this growth was largely focused on only a handful of large companies.

- There continues to be fears that central banks will raise interest rates too much or too little.

- Recent enthusiasm that our U.S. counterpart would be nearing their peak may be short lived in light of a historically low unemployment rate and stubbornly high inflation.

- The global economy is slowing and we are likely to see measures of economic health get worse before they get better.

- Earnings season is here and investors will weigh concerns over a recession while the health of the consumer will be in the spotlight.

- Canadian economic growth has remained resilient while the U.S. is decidedly weaker.

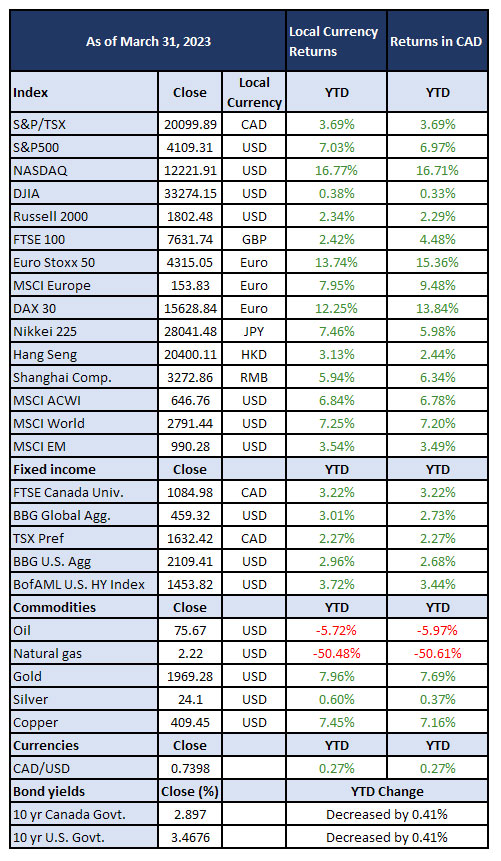

Year to Date Market Returns

The Return of Growth Stocks?

2022 was an extremely difficult year for growth stocks – those companies anticipated to grow significantly above the average growth rate of the market. This was evidenced by the technology heavy Nasdaq declining over 30% for the year and largely resulted because of the sharp rise in interest rates and associated uncertainty of a pending recession.

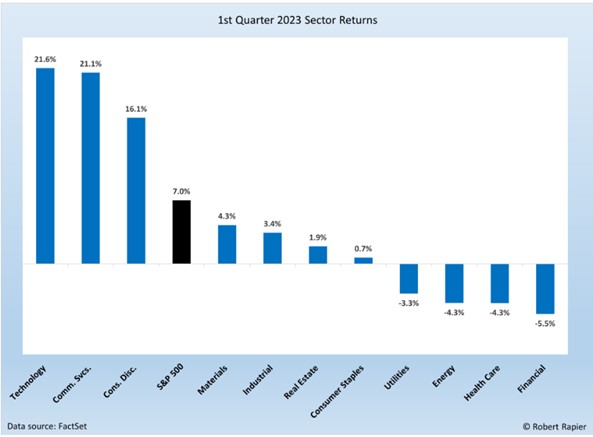

To begin 2023, a handful of growth stocks have dominated stock market returns causing many to ask the question if this is the recovery we have been waiting for after so many months of negativity.

As can be seen in the year to date market returns chart above, the S&P 500 is up 7% but interestingly the average stock in this index is up just 1%. It’s fair to ask how this is possible and without getting into overwhelming detail, the S&P 500 is a market capitalization weighted index. What that means is larger companies account for a greater share of the overall index. In fact, the largest 10 companies in the S&P 500 account for 25% of the index. Removing just these 10 stocks of the total 500 in the index would see the year to date return be negative. Apple alone accounted for 1.6% of the total growth for the S&P 500.

The disconnect between the few and the many has several key implications for investors.

- Narrow leadership tends to signify a shakier rally than one with a broader group of stocks participating.

- Notable outperformers include Amazon, Tesla, Apple, Google, and Meta.

- It remains to be seen if these companies will be immune to a possible recession or, at the very least, a slowing global economy.

- A growing stock market doesn’t always indicate a healthy economy. If the economy was strong, would energy and financials be negative?

- We will need to see a broader rally in stocks before getting excited about this recent recovery.

We continue to be focused on adding long term value for client portfolios and refuse to be swept up in short term gains we feel may not be sustainable. Risks remain and we favour those trading at discounts to fair value and providing a nice dividend while we wait for better times ahead.

Bank Failures

Investors have spent months pondering whether the impact of rising interest rates, which began in March 2022, would finally reveal cracks in the system. A full year later and we have now seen the 2nd and 3rd largest bank bankruptcies in U.S. history as well as Credit Suisse, once a staple in world banking.

While the failure of these banks has been well covered there are some interesting take aways:

- Silicon Valley Bank (SVB), which kicked off these troubles, was a regional U.S. bank heavily exposed to the deposits of their also risky clientele. This coupled with management’s reckless decision to invest these deposits in long term bonds resulted in a significant drop in value when interest rates began to rise.

- Regional banks in the U.S. are subject to less strict regulations when compared to federally regulated banks and those in Canada.

- Officials in Europe and the U.S. took quick action to reassure depositors and the general public in an effort to prevent contagion.

- Canadian banks continue to be globally recognized for their stability and benefit from strict regulatory oversight and diversification. On March 15th we spoke to the differences of the U.S. and Canadian banking sectors: TriDelta Financial – Response to U.S. Banking Concerns

- History appears to be repeating itself. Canada’s banks provided a safe haven in 2007-09 as U.S. and European peers’ profits collapsed.

- Canadian bank earnings are expected to consistently grow in 2023 while U.S. bank profits are forecast to decline.

A frequent question we receive is how no one saw this coming. Many will be pleased to learn that we did act on both of our equity funds to reduce our exposure to the financial sector one week prior to the collapse of SVB. We did this on several indications of weakness in the sector. While no one could have known a bank failure was right around the corner, we were able to take advantage of this and remained highly active in the following weeks to the ultimate benefit of our clients.

An Update on the 2023 Federal Budget

While a detailed breakdown of all points laid out in the recent Federal Budget is outside the scope of this commentary, there are key takeaways worth discussing.

Canada’s Alternative Minimum Tax (AMT) is applicable to high income earners and is used to limit tax deductions available to taxpayers who benefit from certain incentives. The Budget proposes several changes to the calculation of the AMT – including to expand the base on which the tax is calculated, raise the AMT exemption to $173,000 (from $40,000; indexed to increase with inflation) and increase the AMT rate to 20.5% (from 15%). It is estimated that under the AMT reforms, more than 99% of the AMT paid by individual Canadians would be paid by those who earn more than $300,000/year.

One frequent tool we use with high income taxpayers is Flow Through Shares. The proposed changes, beginning in 2024, would still allow for Flow Through Shares to be used, but at a lower amount. Where before the rule of thumb was 35% of income to avoid triggering AMT. With the new rules proposed, in 2024 the rule of thumb might be 25%. We encourage those with incomes of $250,000+, to speak with your TriDelta Wealth Advisor to ensure that you can maximize the tax savings in 2023 and beyond.

The First Home Savings Account (FHSA) is an exciting addition to assist those Canadians looking to purchase their first home. The FHSA will allow for tax deductible contributions up to $40,000 and can be used in combination with the First Time Home Buyers Plan of an RRSP. This account officially became recognized April 2023 but is not yet available on many platforms. While we know many of our clients own their own home, you may have someone important to you, like a child or grandchild, who this may be relevant to. In any case we would be happy to share more details about strategies for how this may benefit those looking to purchase their first home.

What we are doing and why

Stocks

There was enthusiasm among investors stemming from the March banking issues that led some to believe it could be enough for interest rates to finally relent. Although interest rates and inflation remain key drivers of market volatility, the uncertainty over a potential recession has garnered renewed attention as investors look to company earnings and what business leaders are indicating for what to expect moving forward.

Both the TriDelta Pension and Growth Funds were positive year to date returning 0.62% and 3.28%, respectively. While positive, both funds returned less than the broader indices due to the broader market growth being driven by only a handful of growth stocks. Our funds have always been different than the broader indices which served us especially well in 2022. Key considerations include:

- Our funds remain defensive with the continued use of tactical allocations to cash to allow us to benefit from swings in the markets.

- We do not believe investors should become complacent with narrow market gains concentrated in only a few companies. Our funds remain highly active and continue to find exceptional value we anticipate has not yet been recognized by the broader markets.

- The Toronto Stock Exchange underperformed to begin the year due to declines in the financial and energy sectors, which are two larger weights in the index.

- Growth expectations have slowed below historic norms. Our emphasis is on high quality businesses with exceptional leadership, and positive cash flow.

Risks remain and, although volatility is expected to continue, we take great pride in knowing the opportunities we see today should create long term value for client portfolios.

Bonds

Bond returns to begin the year were positive and our focus remains on high quality investment grade bonds with an emphasis on short term maturities. Coming off what was the worst year in history for bond returns, we see an opportunity for both elevated income yields and capital gains if (when) interest rates decline. Key considerations include:

- The Bank of Canada has signaled that rate hikes are on pause as it assesses the impact on the economy and inflation.

- The U.S. Federal Reserve have renewed their commitment to raise rates higher despite the recent banking disruption discussed earlier.

- On March 13th we discussed the differences between the U.S. and Canada: TriDelta Financial – Interest Rates – what is happening, why it is happening, and what we are doing about it

- Bond markets do not expect further interest rate increases and have predicted rate declines in both Canada and the U.S. later in the year. We disagree with this prediction and find it more likely that the U.S. continues to increase rates as originally intended.

- Inflation is expected to trend lower throughout the year but gone are the days of persistently low inflation. Inflation will continue to be a more meaningful component of future interest rate decisions and a pain for consumers and businesses.

We continue to prioritize quality and remain active as the interest rate dynamic changes. At higher income yields, bonds present a much more attractive investment opportunity than pre-pandemic.

Preferred Shares

Preferred shares had a strong start to the year as end of year tax-loss selling in 2022 reversed. Since then, shares have held up well in both rising and falling interest rate scenarios and the primary reason for owning this asset class remains to be the shrinking issuances of new preferred shares.

Presently, preferred shares have an average income yield of 6.3%.

Alternatives

Alternative investments, those not publicly traded, have continued to provide steady income and diversification benefits for investment portfolios. To the end of February, the TriDelta Alternative Performance Fund is +1.41%.

Alternatives have proven a valuable source of income and diversification in the face of volatile markets elsewhere. Our clients have benefited from this allocation as we continue to do further due diligence on several funds for inclusion in client portfolios, but the asset class is not without risks.

- Private real estate has not been immune from rising interest rates. Rising rates have brought down real estate values globally but some areas have been better able to weather the storm more than others.

- Many of our partners refinanced in 2021 at the low rates previously available. Many are locked into those fixed rates until the mid-2020’s.

- Rising rents and continued increases in demand have helped provide support.

- Regardless of near term impacts to real estate due to increases in interest rates, the fundamental reason for investment has not changed. There is simply not enough affordable housing for people to live.

- Our private credit partners have continued to manage the new interest rate environment well.

- Rising interest rates have provided an opportunity for greater income for investors.

- The pool of opportunity has materially expanded due to many small and medium sized businesses no longer qualifying for traditional bank lending.

Conclusion

In our 2022 year end review we discussed the struggles of traditional balanced portfolios and the need for active management moving forward. No one can be sure what the future holds, but if we are entering a period where markets trade sideways rather than the persistent up trend we grew used to pre-pandemic, those who can remain nimble should benefit the most. We believe strongly that active management will be at a premium for managing investments moving forward and encourage thinking beyond the past decade. Times have changed. We have entered a period of higher interest rates, stubborn inflation and we caution against letting the belief that “what worked before will work again” drive decision making.

If you would like to discuss your financial plan or investment portfolio, please give us a call or send a note.