In 2022 we saw a steep global rise in interest rates at a pace few could have ever expected. Even into 2023, many central banks are still indicating they are not finished and more needs to be done to bring stubbornly high inflation back to their 2% target.

In 2022 we saw a steep global rise in interest rates at a pace few could have ever expected. Even into 2023, many central banks are still indicating they are not finished and more needs to be done to bring stubbornly high inflation back to their 2% target.

Heading into the new year many expected interest rates to continue to climb for the first half of the year and then pause or even decline in the latter half. While the Bank of Canada recently made the decision to pause further interest rate increases, the US Federal Reserve has continued to push ahead, repeatedly noting there is more to do and the increases thus far have not had the needed impact.

Interest rates have continued to be a significant driver of uncertainty for investors so we wanted to provide an update on what we are doing to manage this volatility and address some of the important questions you may have had yourself.

It’s worth noting where interest rates and inflation stand today.

Inflation

- Headline inflation in Canada cooled to 5.9% January, down from a peak of 8.1% in the Summer.

- US headline inflation peaked at 9.1% in June, but presently stands at 6.4%.

- Inflation remains elevated globally which has had significant impacts on our everyday spending and although it continues to cool, it will not be in a straight line.

Interest Rates

- The Bank of Canada has paused interest rates at 4.50%, rising from 0.25% in 2021.

- The US Fed interest rate stands at 4.75%, also up from 0.25% in 2021.

What caused inflation to get so high?

Too much money chasing too few goods and services is ultimately what drives inflation. Government stimulus during the pandemic was a life saver for many households and companies but the impact this stimulus had on the economy was not intended to be this long. Consumers still have excess savings and, although many of the pandemic driven supply chain issues have been resolved, consumers continue to spend. This accompanied by the strong job market and associated rise in wages has added fuel to an already hot economy.

What are central banks trying to accomplish with higher interest rates?

Higher interest rates are an attempt to slow consumer and business activity across the economy – and, by extension, inflation – by making debt-based spending more expensive. Big ticket items, like homes and cars, begin to cost more because buyers are paying higher interest rates for their mortgage and other loans.

It’s also worth noting that interest rate increases take time to work through the economy. While those with a variable rate mortgage may feel the impact immediately, other forms of spending like business expenses take longer to feel the impact.

Why is Canada pausing interest rate increases while the US continues to climb higher?

There is a variety of reasons why this may be happening, but a significant factor is how our two economies are structured and what household consumer debt looks like.

Canadians carry much more debt than the average US consumer. This is especially true as it relates to mortgage debt. Many Canadians carry variable rate mortgages that are subject to 5-year renewals. This differs from many US homeowners who, after the 2008-09 financial crisis, shifted away from variable rates and towards fixed rate options. Prior to 2008, 40% of US households had variable mortgages, while only 10% have variable mortgages today. Our neighbors to the south also benefit from 30-year terms, meaning they are less likely to be faced with a renewal in the near term at today’s higher rates.

These are notable differences and mean that Canadians have felt the brunt of increasing interest rates much more quickly than Americans. This also means that as interest rates have climbed in the US, the intended impact of driving down spending has not happened as quickly when compared to past periods of increasing interest rates.

Will higher interest rates drive us into a recession?

If we do enter a recession in the near term this will likely be the most foreseen recession in history. Every day we are inundated with news that a recession is coming but no one can agree when. Recently, the Wall Street Journal published an article titled “Why the Recession Is Always Six Months Away”. This is largely a play on many economists constantly having to revise their expectations as a recession fails to materialize.

Employment remains very strong in Canada and in the US and wages continue to grow. This, coupled with continued consumer spending, is not a characteristic you would expect heading into a recession.

- Canada added 150,000 jobs in January compared to a Reuters survey estimating 15,000.

- In the same period, the US added 517,000 jobs compared to an expected 185,000.

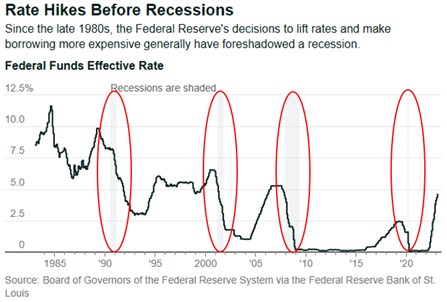

The below chart looks back at past recessions and how interest rates have developed over time.

Also of key concern is the inverted yield curve. While the details of this phenomenon are not important in this forum, what’s important is this signifies that investors expect interest rates to rise in the near term but that those hikes will ultimately damage the economy, forcing rates back down over time.

- Investors have used this as an indicator for a pending recession. Typically, an inverted yield curve puts a recession 11 to 14 months away from that point on. This would have us see a recession in October at the earliest.

How severe of a recession will we see?

This is the million-dollar question driving fierce debate among economists, politicians, and investors.

Most are betting on a “soft-landing” characterized by a gradual reduction in inflation and a slowing but still strong economy. Despite this, the longer interest rates remain elevated and the higher they get, the greater risk of a policy error by central banks resulting in a more severe and prolonged recession.

What is TriDelta doing?

No one knows for sure what the next several months will bring and we continue to be active within our portfolios with a focus on ensuring we are able to preserve capital and look to be opportunistic when others let emotion drive decisions.

- Both of our actively managed equity funds continue to have a higher allocation to cash than historic norms.

- This tactical exposure to cash allows us to take advantage of opportunities in the market and benefit from a greater income yield with many money market funds yielding almost 5%.

- We manage volatility using options contracts which help to limit near term downside in the funds. These contracts allow us to protect portfolios on the downside while still allowing for upside if markets swing to the positive.

- Just as in 2022, our focus is on companies with strong and stable cash flows, tenured management teams, and those often paying a healthy dividend.

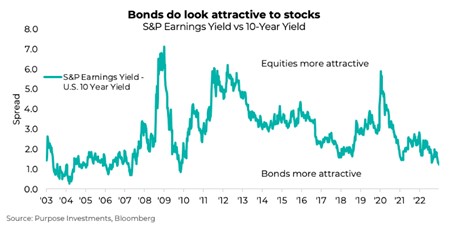

- Bonds had their worst year on record in 2022 and have become much more attractive in recent months.

- As the interest rate dynamic has changed so too have the expectations around the stock market. Rising income yields for bonds have added to the volatility seen in stocks as investors weigh the perceived safety in greater income yields from bonds relative to the riskier stocks.

- Interest rates are likely to remain higher for longer and unlikely to get near 2021 levels anytime soon. This changing dynamic will play a significant role moving forward and we stress the need for actively managed portfolios to work through this.

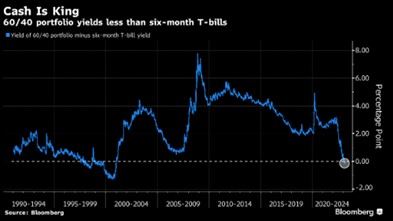

- In our year end commentary, we spoke to the disappointing returns investors in “balanced portfolios” saw in 2022. These largely passive stock/bond only portfolios experienced much more downside than investors anticipated and, today, are providing income yields often worse than holding money market funds.

- Alternative investments were a top performing asset class in 2022 and helped to dampen volatility. Our clients benefited from this added diversification away from strictly stock and bond portfolios.

Investors are keenly aware of inflation and have looked for any signs of easing inflation as a likely positive for the market as a whole. On the other side, any sign of a strengthening economy has actually been a negative as investors see this as evidence inflation is not falling and will therefore lead to higher interest rates. We have looked closely at all our portfolios and continue to be confident in our ability to protect on the downside and take an unemotional view of the markets to see opportunity where others may see risk.

The uncertainty we saw in 2022 and continue to see moving forward will keep many investors fearful of the future. We remind ourselves regularly that, despite this uncertainty, risk is lowest when price is lowest and coming off a year where stocks had their worst year since 2008 and bonds had their worst year ever, there are decisions we can make today which will have positive long-term value for our clients.