When the Bank of Canada lowered the overnight interest rate by 0.25% this week, the obvious benefit is for those with variable rate mortgages. They will see an immediate benefit in lower interest payments on their mortgage.

Another group who just received a big win may not even realize it: If you have a pension plan, and especially if you have ever thought about taking the cash value of your plan, you just saw an increase in potential value. In some cases, the rate cut could have added as much as $100,000 in wealth in one day. This option to ‘take the cash’ is usually open to those who are retiring or leaving their employer. Sometimes the option ends when the employee turns 50 or 55.

To understand how this wealth boost works, and how much your wealth could go up, can get a little complicated. The best way to explain it is to pretend that you want $50,000 of income per year and go from there.

You could buy a GIC to pay out $50,000 of income per year, and depending on the interest rate of the GIC, you could determine how much you need to invest: At 10 per cent interest, you could buy a $500,000 GIC. At one per cent interest, you would need to put in $5 million for the same return.

In the pension plan example, if they are committed to paying you $50,000 a year, then at today’s super low interest rates, your pension plan must set aside a lot more money to cover off $50,000 a year — just like the GIC example. Here is where your wealth potentially just grew: In many cases, you have the ability to ask your pension plan for this lump sum of money (often called the commuted value), rather than taking the pension as a monthly payment.

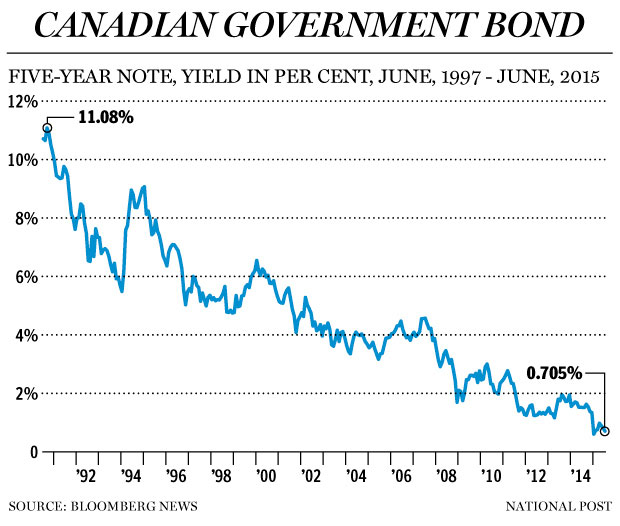

Below is a chart for the Bank of Canada Five-Year Bond Yield over the past 26 years. The highest yield was 11.6 per cent, in March 1990. The lowest yield happened this week at 0.7 per cent.

Imagine this chart represented an opportunity to lock in a lifetime rate for a loan. If you could choose any time to lock it in, this week would be the best time.

A commuted value of a pension works the same way. You are essentially locking in a value for life, and an important determinant of that value is interest rates.

Put another way, if you were ever going to take the commuted value of your pension, now would be one of the best times in history to do so.

For those who like the idea of a monthly payment guaranteed for life, you can purchase a pension any time by buying an annuity. Having said that, in many ways, at today’s low interest rates, now is perhaps the worst time to purchase an annuity.

One potential strategy is to take the commuted value of your pension today, when you would receive the largest amount. In a few years, if interest rates rise meaningfully, you can take your funds and buy an annuity that will pay you a higher monthly amount than you would ever have had with your existing pension.

The decision of whether to receive a pension in monthly amounts for life as opposed to taking a lump sum is a complicated matter. What I would suggest is that your pension plan does NOT want you to take a commuted value lump sum today. It will cost them too much. Based simply on that, you may want to take a good look at whether that option is open to you, and whether you might want to take it.

Reproduced from the National Post newspaper article 17th July 2015.