CPP is the one defined benefit pension plan that every Canadian employee receives, so it is not surprising that I am often asked about when is the right time to take it.

I was asked about my thoughts on this very question by MoneySense Magazine.

This article expands on those thoughts and reviews when it is the right time to start receiving your CPP.

Is it better to take CPP at 60 or 65?

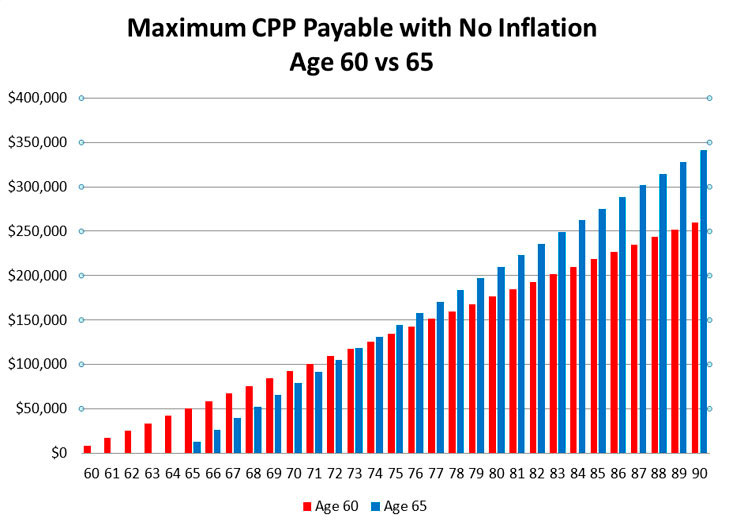

To answer this question, let’s take a look at the math, assuming the maximum pension is received either at 60 or 65. Based on the reduction factors for taking CPP early, the pension is reduced by 0.6% per month, or 7.2% per year, to a maximum of 36%. Ignoring the effects of inflation, the cumulative payment of CPP at 65 exceeds that at 60 around the age of 74. Putting it simply, if you live past age 74 you are better off taking CPP at 65 than 60.

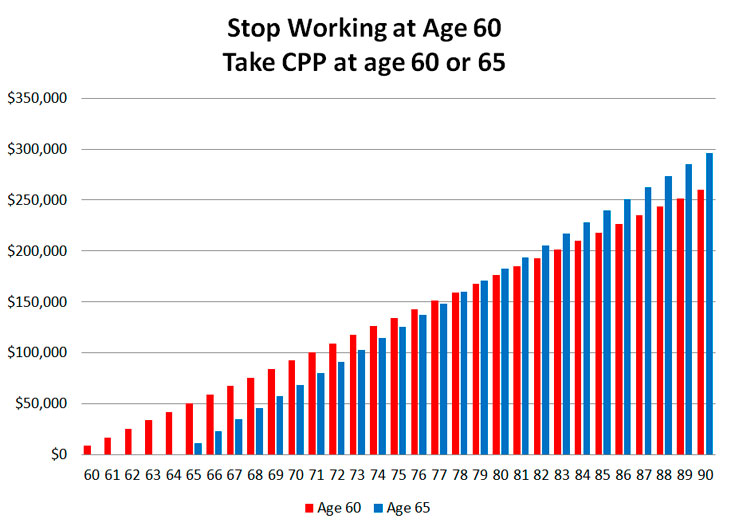

If I stop working at 60, should I take CPP at 60 or 65?

Again let’s take a look at the math behind this analysis. CPP works like a fraction with 47 years between ages 18 to 65. This is your denominator (bottom of the fraction). The numerator (upper part of the fraction) is based on your work history. You receive a “one” for every year you maximize CPP and a “zero” for every year you do not contribute at all. The rest of the years get a percentage between one and zero. These are added up and divided by 47 to get your percentage of maximum CPP payable.

However, the calculation does not end there. Everyone is entitled to the general dropout provision, which allows you to drop your eight worst years automatically, making the CPP fraction out of 39 not 47. For example, consider you retire at 60 with eight years of zero CPP contributions. You would receive the maximum CPP at age 60. If you wait until age 65, you will have five years with zero contributions. To determine which option is better, you only need compare the reduction in CPP. If you take it at 60, you will have a 36% reduction in CPP. If you take it at 65, you will have five zero years and a 13% reduction in CPP (100 – 34/39). Ignoring the effects of inflation, the cumulative payment of CPP at 65 exceeds that at 60 around the age of 78 in this example.

What other things can I do to maximize my CPP?

Other than the general dropout provision, which is automatically given to everyone, there is also a child-rearing dropout provision. The child-rearing dropout provision allows the primary caregiver to drop up to seven years of CPP contributions, following the birth of a child, that have earnings less than the maximum. If multiple children are born there may be some years which overlap. These can only be counted once. Unlike the general dropout provision, you must apply for the child-rearing dropout provision

You may share your CPP with your spouse or common-law partner. The portion of the pension that is available to share is based on the number of months you cohabitated while eligible to contribute. To share your CPP, both of you must be eligible to receive CPP and apply for it. This measure does not change the total amount of pension received by the couple; rather, it changes who the pension is paid to and subsequently how it is taxed.

What other considerations should factor into my decision?

What other sources of income do you have during the years you will not be receiving CPP. For many people the decision to defer CPP to 65 is no decision at all, as they need the pension to cover their everyday costs of living.

If your spouse or partner is much older than you, you may benefit from having the extra income now to enjoy with them. Your expenses will potentially decrease as your older spouse can no longer enjoy these activities or passes on.

How does your income compare to the OAS and GIS thresholds. By taking the CPP earlier, it may keep you below these thresholds in the future.

It may be beneficial to defer taking the CPP if you have RRSP assets to draw upon and no other income. You can draw down your RRSP and lower tax rates and the overall lower balance in the RRSP will reduce your future RRIF payments as well.

If your family has a history of longevity, you should include that in your decision. All other things being equal, the longer you expect to live, the more you should lean towards deferring.

The math favours waiting until age 65 to take your CPP for many people today. If you can afford to do so, it is preferable. That being said, you need to look at your personal circumstances and how this choice will affect you and your lifestyle. There is no single answer that is right for everyone.