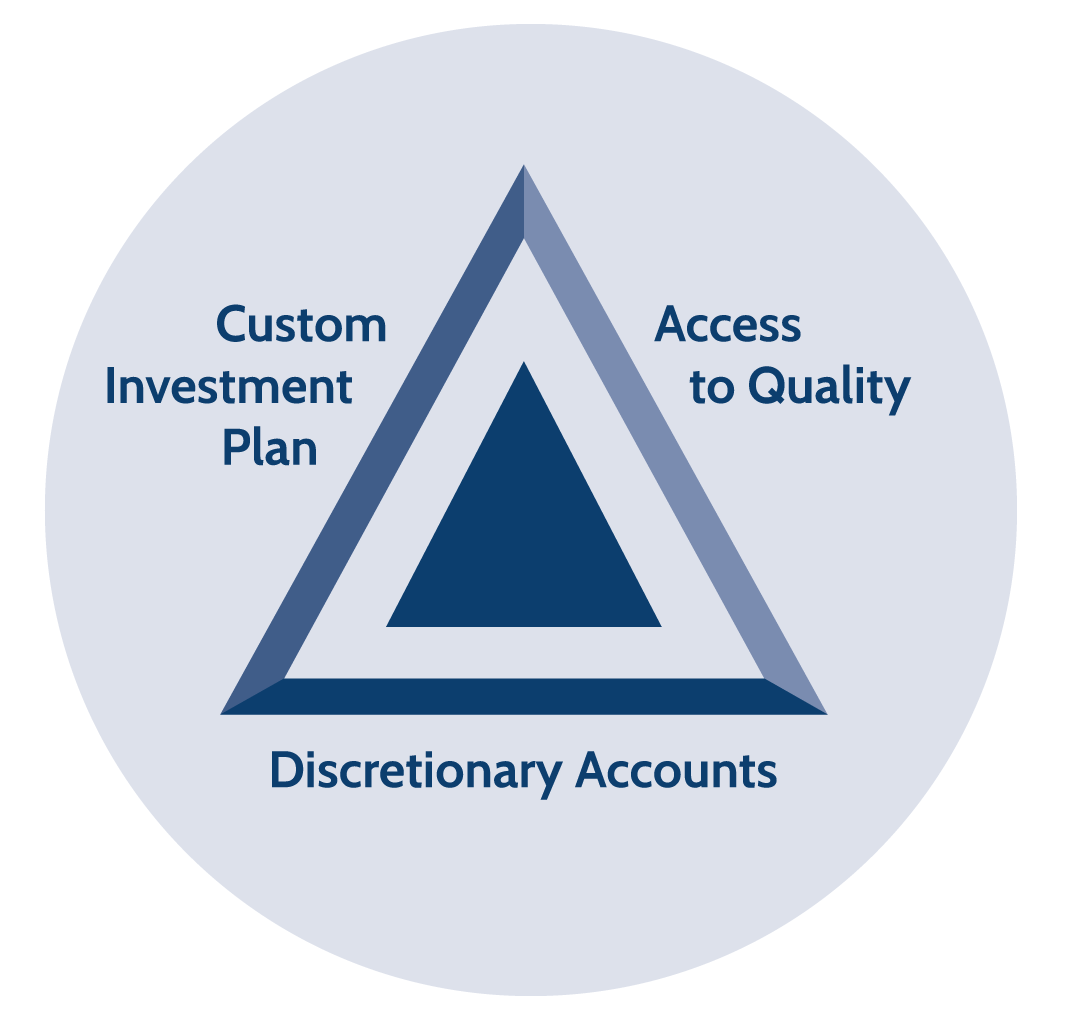

Building your custom investment plan

Your custom investment plan puts your specific needs and circumstances at the forefront. After establishing your goals and conducting a thorough risk assessment we’ll work together to develop a detailed investment policy statement. This document defines the expectations between you and your advisor over time. It will also be used to build your portfolio which will be regularly tailored and refined to your evolving needs.

Privileged access to high-quality investments

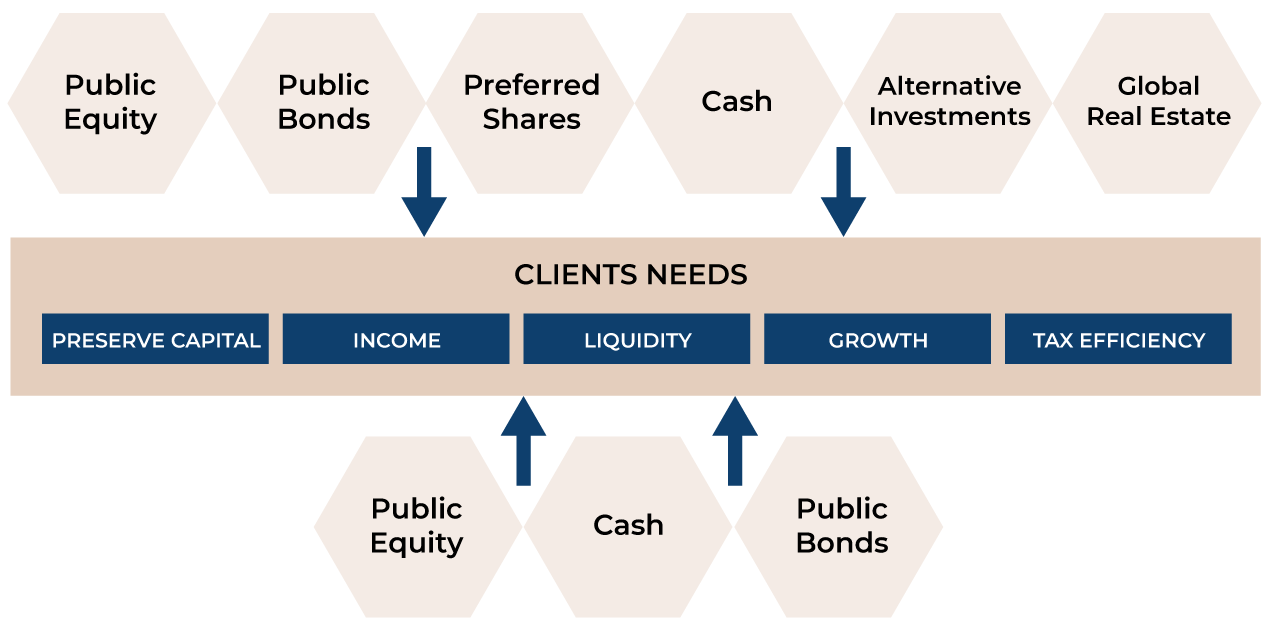

In an investment world where banks are providing fewer choices, we leverage our independence to offer a wide array of investment solutions at the lowest cost, including Accredited Investor solutions not typically available to the vast majority of Canadians.

Alternative investments

are also available

-

Stocks

-

Bonds

-

Exchange Traded Funds (ETFs)

-

Mutual Funds

-

Segregated Funds

-

Guaranteed Investment Certificates (GICs)

-

Money Market Funds

-

Preferred Shares

-

Limited Recourse Capital Notes (LRCNs)

-

Flow Through Limited Partnerships

-

Alternative Investment Funds

Fees that make sense

We take the day-to-day stress out of investing by managing your investments on a discretionary basis. Our fee-based model ensures our interests align with yours. We work for you. Your goals are our goals, and when you make more money, we make more money.

TRIDELTA Preferred Fee Schedule

| Assets Under Management | Fee (plus applicable taxes) |

|---|---|

| First $500,000 | 1.69% |

| Next $500,000 | 1.35% |

| Next $4,000,000 | 0.99% |

| Assets over $5 million | 0.75% |

Have questions?

Connect with an advisor for a no-obligation free consultation!