Market Overview

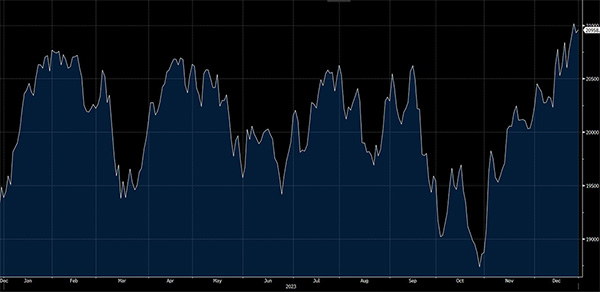

2023 will be remembered as an interesting year for investors and one which was making out to be a very lackluster year for most international markets until investors were gifted the “Santa Claus Rally” many craved. This gift came in the form of renewed hope for declining interest rates which spurred returns in some of the hardest hit sectors of the market. Investors do not need to look much farther than Canada which saw the TSX post an 8.12% gain for the year. To put this number in perspective, 7.25% (or 89%) of this growth occurred in the final three months of the year.

S&P/TSX Composite 2023 Performance

The U.S. proved an entirely different story throughout the year. It was late 2022 when Bloomberg Economics published the odds of a U.S. recession at 100% and these beliefs were not unfounded. Globally, central banks continued to increase interest rates at a dramatic pace and borrowing costs for consumers and businesses were skyrocketing for the first time since before the 2008 financial crisis. In March 2023, some of the cracks brought on by the rise in interest rates became all the more clear with the failure of three U.S. regional banks and one Swiss bank. Despite all that the U.S. continued to shake off recession fears and instead grew their economy at an annualized pace of 3.2% in the first three quarters and another 1.3% projected for Q4. But as we have covered throughout the year, not everything was what the headline index returns would have you believe.

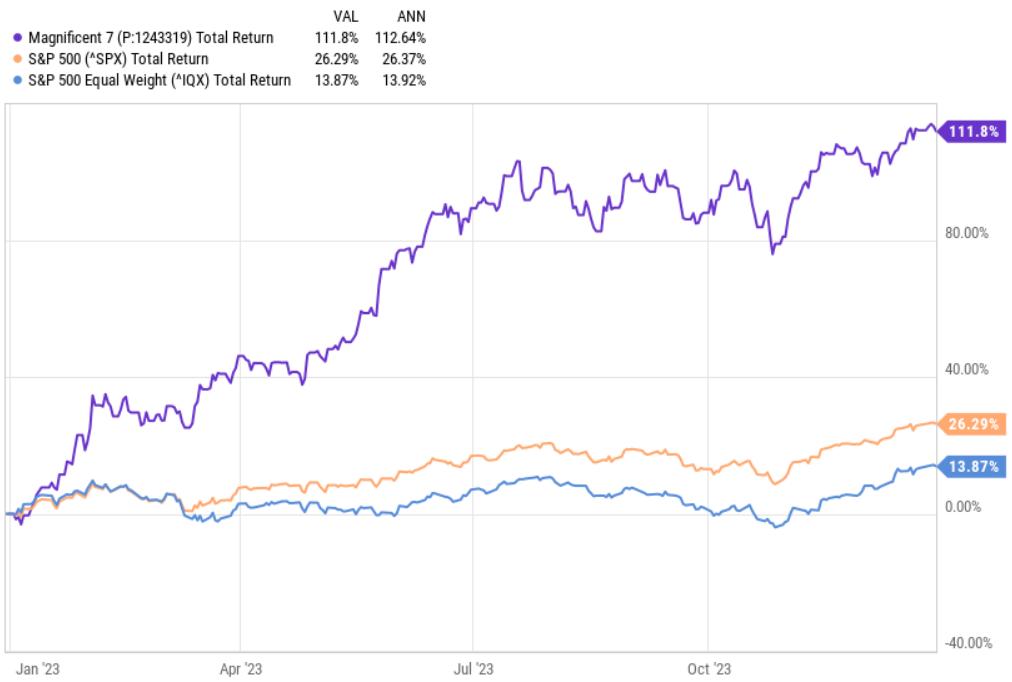

The Magnificent 7 Stocks vs S&P 500

It doesn’t take long to pull apart the returns to see that the overall numbers at an index level have been masked by the stunningly positive returns of a few mega-cap names. These 7 stocks alone account for over a third of the S&P 500 and carried a heavy influence on headline returns throughout the year.

In this year-end review we will be discussing these key developments, what that means for investment decisions moving forward, and what actions we are taking to benefit client portfolios. Key themes discussed include:

- The 2024 path of interest rates will be a key theme throughout the year with the consensus belief that rates will begin trending lower in the Summer.

- Investors begin 2024 on a high but that could spell trouble for the first half of the year as rates remain elevated and the central banks will likely keep us guessing until the very last moment.

- The dominance of the Magnificent 7 stocks persisted throughout the year, creating opportunities among the forgotten segments of the market.

- More companies are facing debt renewals. Even if rates trend lower in 2024, the elevated cost of this debt will put pressure on corporate profits and growth and may even trigger the long-awaited recession economists have been calling for.

- Falling interest rates and even a weakening economy could bode well for bonds which will benefit from falling rates.

Taking Advantage of Declining Interest Rates

But I can get 5% in a GIC? The advocates for GICs the past couple of years have got louder, but now we find ourselves in an environment where interest rates have likely peaked, inflation will be an ongoing concern, and some investors find themselves hesitant to pull the trigger on what to do with their GICs and cash investments.

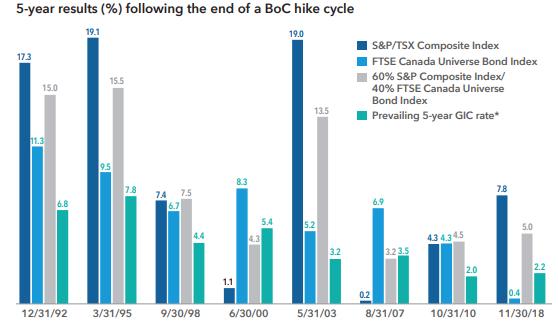

While GICs and cash can play a role in a portfolio that has short-term needs, we are entering a period where there will likely be greater reinvestment risk for those GICs down the road and the possibility of lost opportunity for those who have longer-term goals. The below chart looks at the last eight periods where the Bank of Canada raised interest rates and what the 5-year returns were following the end of peak interest rates for stocks, bonds, and GICs.

*The prevailing 5-year GIC rate was the rate available to investors on the last day of the month of the BoC’s final rate hike.

As the above chart demonstrates, there have been real opportunities for investors following periods of climbing interest rates and history suggests 5-year GICs will lag market returns after maturity regardless of what happens over those 5 years. But what about 1- or 2-year GICs? No one can say for sure how the markets will fare in the short-term, but if history is any guide, over the long-term there will be more good days than bad and those who exchanged certainty for a well-managed portfolio were ultimately better off.

While the above is interesting and makes the case for ditching those GICs in exchange for some ups and downs in your portfolio, it doesn’t answer the question over what to do now. There will be further sections in this review which specifically highlight actions we are taking but for now, we include a handful of points to keep in mind:

- If you hold the belief interest rates will come down from where they are today, then bonds stand to do well and you have the opportunity to lock in higher income yields with the potential for capital gains.

- Even if we see weaking economic growth and recession this bodes well for bonds as we could reasonably expect further declines in interest rates.

- The most interest rate sensitive sectors of the stock market will see the rebound they largely missed out on in 2023.

- The divergence in performance between the winning groups (technology-focused) and the losing (REITs, Utilities, Financials) was close to extreme levels. A reverse in interest rates should help narrow this gap and sector outperformance could flip.

-

- Healthcare stocks have a reputation for being resilient in the face of a recession.

- REITs have been one of the worst performing sectors since rates began to climb in 2022. History suggests that sentiment on the sector begins to turn positive ahead of interest rate cuts and we may already be in the early innings of this.

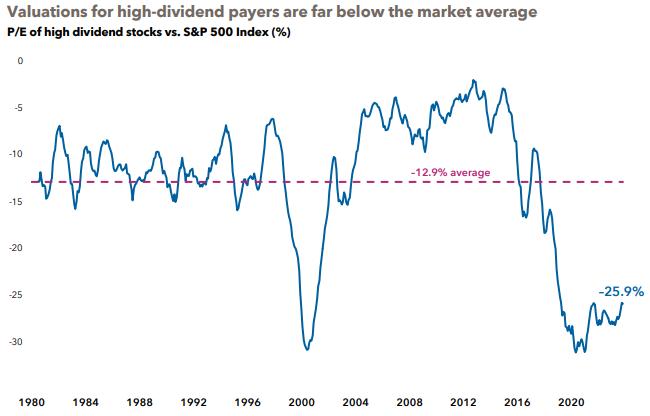

- Generally, dividend payers struggled during the year but managed some recovery in the final three months. Yields on many of these stocks have become increasingly hard to pass up for income seeking investors.

-

- The divergence in performance between the winning groups (technology-focused) and the losing (REITs, Utilities, Financials) was close to extreme levels. A reverse in interest rates should help narrow this gap and sector outperformance could flip.

What to Expect in 2024

With the new year comes new expectations for what’s in store for investors. 2024 could very well make out to be a transition year for investors, markets, and businesses as we continue to navigate the impact of a more normal environment for interest rates.

- In a reverse from this time last year, economists are calling for little recession risk in 2024, or a mild one at that.

- Whether this will be true remains to be seen. Corporate profits are being squeezed by the higher cost of debt, on top of already higher input costs and rising wages. Slower consumer spending and the risk of a mistake by the central banks could be enough to spoil the party.

- The risk of bad actors will be an ongoing issue. Global politics was noted as the key macroeconomic risk for 2024 by the annual Natixis Outlook Survey which interviews 500 institutional investors each year.

- The events of the past year make it easy to understand why this is at the forefront of many concerns and can cloud the outlook over the near term.

- The bottom line is investors can’t always plan or position around what may happen a world away but as we have seen in recent months, there is value in active management to help navigate some of these challenges and uncover where the opportunities lie.

- The 2024 U.S. election matters less than you think. Since 1936, the 10-year annualized return of U.S. stocks (as measured by the S&P 500 Index) made at the start of an election year was 11.2% when a Democrat won and 10.5% in years a Republican prevailed.

- Investor sentiment is high and any news which contradicts these views could spell volatility in the first half of the year. Investors have had the past three months to digest the likelihood of interest rate cuts in 2024 with consensus expectations for 4-6 declines during the year.

- While we agree rates should come down in 2024, we emphasize playing defense with the names and sectors which stand to do well when rates come down but also stand to be more insulated if the consensus view doesn’t work out the way markets expect.

- Interest rates have peaked but are not going back to their 2021 lows. This shift will be noticeable for consumers and businesses as we enter a decade of volatile inflation and a more normalized environment for interest rates.

- Canada can do well in 2024. It is easy to forget that the TSX was one of the best performing stock markets in 2022 but lagged in 2023 due to some of the themes already discussed. Due to that relative underperformance and exposure to sectors which stand to benefit from falling interest rates it is reasonable to expect Canada to do quite well. Not to mention many of the Canadian names are priced at much lower valuations than our U.S. peers which provides another layer of safety should 2024 not pan out as the consensus expects today.

- Active management will be key. Having more sectors participate in a move higher can lead to an environment that is ideally situated for active management and security selection. With the huge returns of a very few names, the index is as concentrated as it has ever been (U.S. market), and investors holding it are not getting the diversification they would normally expect.

- Bond markets should benefit from their traditional role as a haven during times of increased economic uncertainty, but also because central bank interest rate cuts would make existing bonds issued at higher rates generally more attractive.

Putting it all together, 2024 should remain volatile and we expect some form of a recession in North America. For some, this will be enough to spur investment into the underappreciated segments of the market and falling interest rates should be beneficial to a number of these areas. Bonds too stand to do quite well and pose an attractive opportunity for growth and income. There will continue to be uncertainty in the markets but much of this will be short-term noise. Far more important will be keeping an eye on the long-term and looking to any near-term market stress as an opportunity to add value.

What we are doing and why

Stocks

The last three months of the year proved to be good for markets as investors jumped on the belief interest rates will begin their highly anticipated descent in the latter half of 2024. The final three months were so good that we enter 2024 dependent on interest rates coming down 4-6 times in the latter half of the year. As already discussed, that could be problematic for stocks and warrants caution into the early stages of the year.

Key takeaways include:

- The extreme differences in sector returns tells us how different areas of the market are predicting the severity of any potential 2024 recession. We find this important for 2 reasons:

- It’s evidence that company fundamentals matter again and how a company or investment can handle higher interest rates and inflation is front and centre.

- Those underappreciated segments of the market offer more protection from the stretched valuations being seen in sectors which benefited from the 2023 tech/AI rally.

- Interest rate sensitive names should continue to do well into 2024 if rates come down.

- With investors swept up in the AI fervour, valuations for dividend-paying stocks have quietly drifted toward multi-decade lows compared to the broader market.

- These lower valuations offer a degree of safety should the market’s expectations not evolve as anticipated. Healthy income yields also pay investors for their patience.

- Investors tend to be forward looking but it’s important to remember the economy is slowing and it is essential to distinguish between real opportunities and companies with deteriorating business prospects.

- Lots has been written on the performance of the Magnificent 7 stocks that led the 2023 advance. There are several reasons why these few stocks have had such a strong year, and a good part of it is simply because they were down so much the previous year.

- Interestingly, reviewing all G7 markets, including Canada, found 169 companies with expected earnings growth above 25%. Only three Magnificent 7 stocks made the list.

- China was among the only stock markets that saw a decline to close out the year given real estate issues and weak domestic and foreign demand. This also played a role in declines for the energy sector during the year as investors attempt to determine the impact of a recession on demand.

- Energy did begin to gain momentum in the final weeks of the year but remains attractive given the continued underappreciation in how long a clean energy transition would require and the general necessity of oil and gas to support the global economy.

The TriDelta equity funds continue to be very different than the broad passively managed stock markets. In 2023, the TriDelta Growth and Pension Funds have returned 15.26% and 4.81%, respectively.

We finished 2023 with the lowest levels of cash in the funds we have had for some time as we looked to take advantage of the broad momentum in the markets. As we navigate 2024, we continue to favour names which we feel offer a healthy income yield, lower valuations than the broader market, and the prospect to outperform should the consensus view on interest rates evolve as expected or should we see a more drawn-out path towards lower rates.

Bonds

Canadian Investment Grade bonds rallied into year end, finishing the three-month period 8.15% and 6.69% for the year. This positivity was brought on mainly by the U.S. Fed which took a more neutral tone to interest rate declines in 2024. This was further helped by an improving outlook for inflation. The U.S. and Canada saw their headline inflation rates at 3.1% while the more closely watched consumer core inflation numbers are trending lower as well.

Moving forward:

- Risks remain and there is evidence investors are overly optimistic about the pace and magnitude of interest rate declines in 2024 but central banks will keep us guessing until the final moment.

- This will be a key theme throughout the year as investors closely monitor progress towards the prospect of falling interest rates. This can often be accompanied by over and under reactions to the data which may drive stock price volatility.

- The stunning bond rally in the final months of 2023 likely pulled forward some of the return investors had been anticipating in 2024 but opportunities remain.

- Despite not being at the central bank targeted 2% inflation, there is growing belief the policy makers are becoming more satisfied with the ongoing progress.

- It is reasonable to see the Bank of Canada cutting interest rates sooner than peers. Canada was among the most aggressive when rates began to climb, and consumers and businesses continue to feel the impact.

The opportunity in bonds is one we spent much of 2023 discussing but not all bonds are equal. There will be winners and losers and differing performance amongst the type of bonds (corporate vs government, investment grade vs high yield, short- vs long-term). To fully realize the benefit of bonds today, active management will be important to ensure we take advantage of the elevated income yields and potential for capital gains.

Preferred Shares

After a run of seven negative quarters, preferred shares had their best three-month period since early 2021. For most of 2023, preferreds have not kept pace with other investment assets over concerns for bank balance sheets and credit quality. While the hopes for lower interest rates in 2024 did well to attract money into some of these higher yielding investments, 2024 as a whole remains unclear. Preferreds stand to benefit from falling interest rates generally but that could be dampened by further issuances of new preferred shares and Limited Recourse Capital Notes.

Alternatives

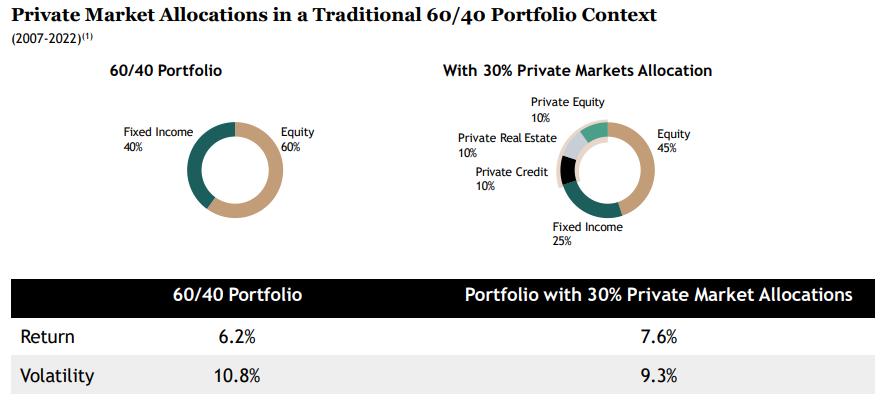

Alternative investments – those not publicly traded – have continued to provide steady income and diversification benefits for investment portfolios.

Key considerations for our portfolios include:

- Private credit funds continue to fill an essential void in traditional bank lending. Elevated interest rates have been felt by consumers and businesses alike at a time where access to financing has been most needed.

- Private real estate performance has been more mixed than in prior years. There are higher growth regions in North America and globally which have felt the impact of higher rates more acutely than others.

- Appraisals in these areas have generally come in lower but have been offset by the various value add projects our partners engage in. The continued rise in rents have also helped to insulate returns.

- As we enter a period with the prospect for lower interest rates, this bodes well for real estate values and general market activity.

- The continued lack of housing in Canada puts rentals in a great position for investors. Access to niche markets, student housing, and experienced management teams all help to complement investment portfolios, add income, and reduce volatility.

Alternative investments can play an important role in enhancing return while reducing the risk of portfolios.

TriDelta Private Wealth Update

As we enter 2024 you may have created new personal and financial goals for the year to come. A new year offers an important reset, and we are here to help in any way we can.

Regardless of what’s happening in the markets we have found the start of the year to be a great time for a financial plan. Whatever your goals, we want to help you make them a reality. By looking at your taxes, debt, income, estate planning and insurance, it allows us to put your investments in context with your overall picture, goals, and plans.

For some, a useful starting point might be our 2024 Canadian Retirement Income Guide to help answer some of your most important questions:

- How much income you will need in retirement

- 10 possible sources of retirement income

- Whether you are someone who should be drawing money from your RRSPs earlier

- How to best draw down on your Corporation

- When to begin receiving CPP and OAS

- How to maximize your Old Age Security

- The most efficient way to draw income from your investment accounts

Looking forward

The end of one year provides the opportunity to create new personal goals and reset expectations headed into the new year. While it may be tempting to apply the same one-year time horizon when looking at the financial markets, as long-term investors we much prefer to focus on larger trends and events that may shape not just the next year, but the next decade or more. We certainly don’t pretend to have all the answers, but it’s our job to explore all the possibilities and uncover ways in which we can protect capital in challenging environments and take advantage of the opportunities these challenges provide.

On behalf of everyone at TriDelta Private Wealth, we thank you and wish you a successful 2024.