Overview

While it’s undoubtedly been a difficult first six months of the year, there are still positives. A strong job market, companies buying back their own stock, signs that pessimism had gone too far, and strong bank balance sheets have helped provide some support. The consumer has also largely continued to spend, helped by rising wages.

While it’s undoubtedly been a difficult first six months of the year, there are still positives. A strong job market, companies buying back their own stock, signs that pessimism had gone too far, and strong bank balance sheets have helped provide some support. The consumer has also largely continued to spend, helped by rising wages.

On the other hand, investors are particularly focused on rising interest rates and the possibility of a recession. Central Banks globally have continued with their interest rate increases. That shift has pushed bond yields higher and squeezed stocks. Earnings estimates have held up for most individual stocks and sectors, but the concern is that with Central Banks raising rates, it could spur an economic downturn, forcing earnings forecasts to fall and pushing stocks lower.

In this quarterly review, we will look at:

- Bear Markets

- Inflation & Central Banks

- TriDelta’s current view on stocks, alternative investments, bonds, and preferred shares

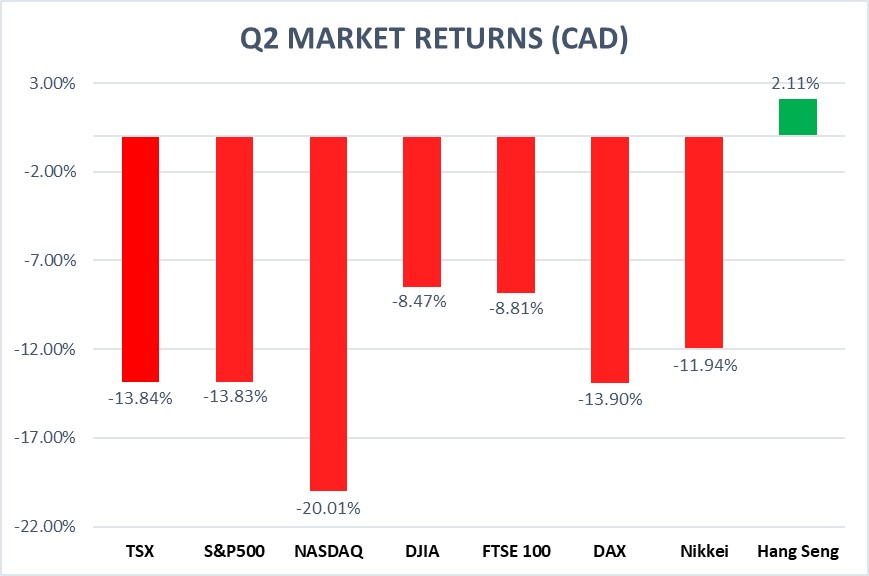

Year to Date Market Returns

The unavoidable reality of investing is that markets do drop. Bear markets arrive. There is nothing any of us can do to control this so we must focus on what we can control. While we can’t force the economy and stock markets to be any better than they are, we can control how we respond in times like these.

After all, panic is not an investment strategy. To overcome these periods of stress, we build investment portfolios directly tied to your time horizon and specific circumstances which leads to a diversified portfolio of stocks, bonds, preferred shares, and alternative investments. No one likes to see the value of their investments declining but it helps when you have been here before and can look back at history as a guide for what may be to come.

So, what is a bear market? A bear market is typically defined as a period where prices have fallen 20% from a recent peak.

The S&P 500 officially entered a bear market June 13th and while it may be tough to see any positives when stocks are falling, a look at past bear markets shows there is good news and bad news for investors once the S&P 500 has crossed that largely symbolic threshold.

This year’s declines have marked a quicker-than-average descent into bear territory, at 111 trading days since the S&P 500’s January 3rd record high, according to Dow Jones Market Data. Among the past 10 bear markets, only the 1987, 2009, and 2020 versions took fewer trading days to achieve a 20% drop. The S&P 500’s average bear market peak-to-bottom decline has been almost 36% taking about 52 days to bottom after reaching this 20% threshold. That would put the bottom in roughly late August. The key word is roughly.

No two bear markets are the same and while no one knows when we will reach a bottom, history suggests the long-term returns after reaching a bear market are quite positive. In bear markets since 1950, the index has been higher 75% of the time three months later, by an average of 6.4%. A year after falling into a bear market, the S&P 500 has been positive 75% of the time and climbed 17% on average.

While we don’t know what the next few months hold, we do know that bear markets don’t last forever and often offer the most attractive opportunities for those looking long term.

Inflation & the Central Banks

It remains our view that the inflationary pressures will begin to fade later this year, but we don’t expect it to be smooth. Central banks have continued to raise interest rates globally to fight inflation with Canada’s benchmark rate presently 1.50% and the US Fed at 1.75%. To the end of June headline inflation in Canada stood at a multi-decade high of 7.7% and 8.6% for our neighbors to the South.

The higher cost of borrowing is now starting to slow economic activity, but the subsequent slowing of inflation can take even longer.

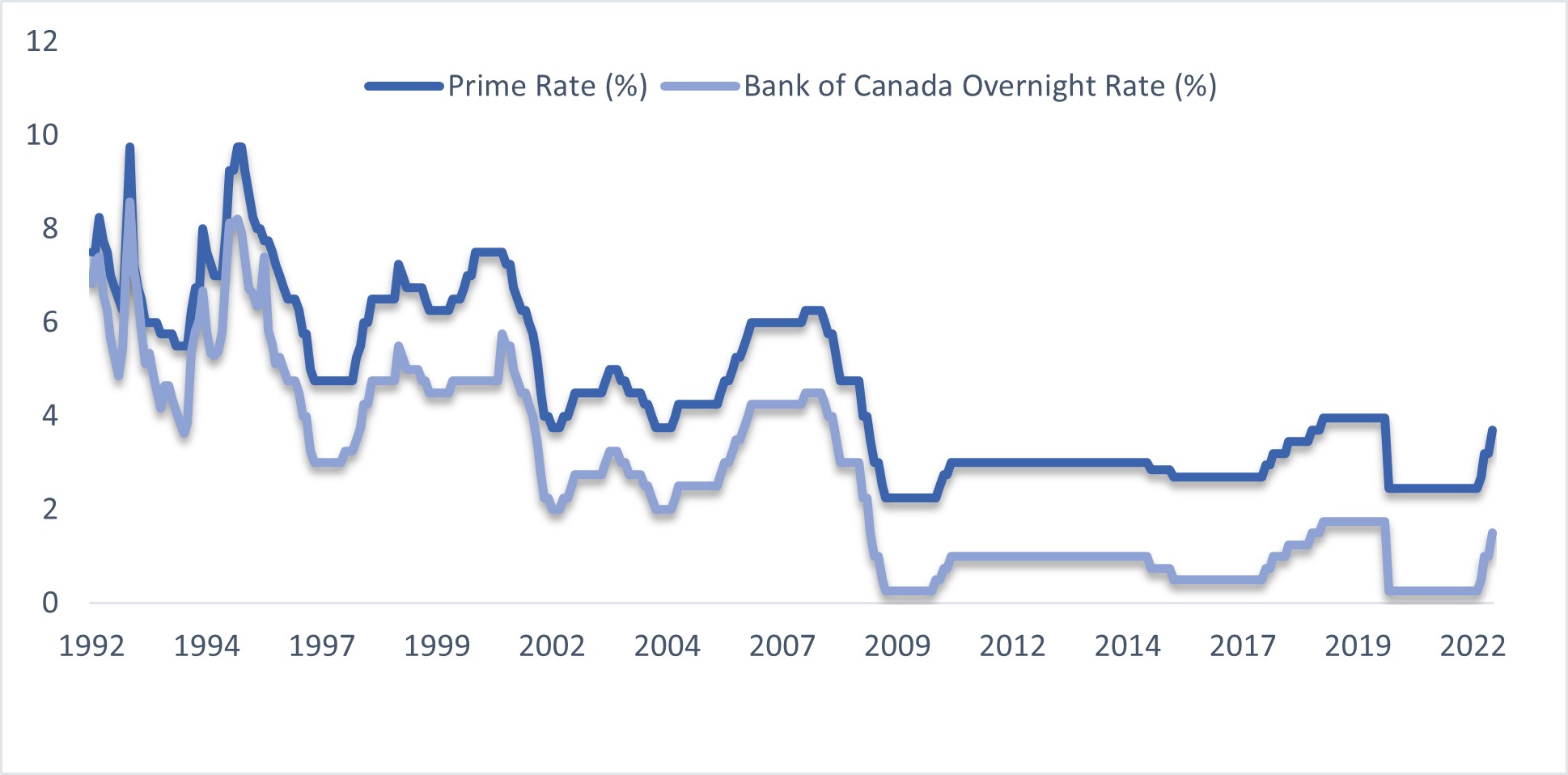

One question we receive frequently is how long these interest rate increases will go on for and how high will they get. While it is nearly impossible to predict with perfect accuracy, the below chart shows us that in the past 30 years there has been six tightening cycles and, in each case, rates came right back down within two or three years.

Source: Bloomberg

The key takeaway is that over the past 30 years, Canadian rate hikes have not been a one-way street. There has usually been a corresponding decline to each period of rate hikes and people should not be fearing long term significantly high interest rates. History suggests that we may have a relatively short window of ‘high’ rates.

Central Banks continue to walk a very fine line. Too much too quickly can trigger a recession while too little too slowly can propel inflation out of control leading to even more aggressive action. This is an area we are watching closely and are beginning to see a possible opportunity in bonds, but also believe the stock markets of the world cannot see a bottom until Central Banks begin to ease the reins of the current rate increase cycle we find ourselves in.

What we are doing and why

Equity

The market stress in the second quarter was focused on global Central Banks’ ability to achieve a so-called “soft landing” or raising interest rates just enough to slow inflation without triggering a recession. June was particularly difficult for equities as the markets expectation for a recession has grown and while, in some areas, stocks still do not look cheap, they are becoming increasingly attractive despite the potential for near-term volatility.

The one-year forward price-to-earnings multiple, an estimate to gauge future relative value, for the S&P 500 dropped from 21 times at the start of the year to around 16 times last month. (Since 1990, the median multiple is 15.4 times.) This doesn’t mean equities are cheap, but value has improved.

Despite the uncertainty surroundings businesses, a report from BMO determined earnings expectations have largely held firm, with 2022 profit growth for S&P 500 companies expected at just under 10% compared to 9% at the start of the year. One of the keys moving forward will be examining the impact Central Bank tightening has on earnings forecasts potentially forcing stocks lower.

Global stocks have fallen for many of the same reasons we are seeing in North America but amplified because of the conflict between Ukraine and Russia. One of the bright spots have been China. In June China posted one of its best months since July 2020 as the government eased COVID lockdowns and eased their extended crackdown on the tech sector.

While we acknowledge it has been a difficult year investing in equities, we remain focused on owning high quality businesses we feel are well positioned to perform regardless of how their stock price does in the near term. During COVID some businesses saw their revenues more than cut in half yet rebounded very quickly. We would argue the businesses we own are even better positioned today to weather the economic storm clouds above.

Into the last half of 2022 TriDelta Funds continue to be highly active to take advantage of attractive opportunities.

- We echo other market commentators that the market likely will not see a bottom until we have greater clarity on when interest rates will peak.

- Contrary to the start of the year, commodities struggled in the second quarter and while we still see value in this asset class. we had trimmed some of the top performing energy names in favour of other areas which had been oversold.

- We have continued to reduce exposure to cyclical stocks and throughout the quarter increased exposure to the US while decreasing exposure to Canada.

- Defensive companies and those with the ability to pass along rising costs to consumers have provided some support.

- We have remained flexible with the amount of cash in the Funds to allow us to take advantage of opportunities in the markets. We began the second quarter with 8% cash which increased to 12% in April and is presently at 5%.

- Our team is closely watching company earnings reports to better gauge company health, inventory and supply chain issues, as well as gain a better picture of the resilience of the economy as a whole.

Bonds

Uncertainty remains around bonds, but if the focus shifts away from interest rate increases towards weakening economic data, we would expect this to provide support for bonds and potentially equities if markets view that the current interest rate hiking cycle is fully priced in.

- Our view is that bond markets have priced in the current interest rate hiking cycle, even more than what the Central Banks have indicated.

- Presently, we see government bonds being traded close to fair value while, for corporate bonds, we prefer high quality investment grade bonds. Concerns remain over potential defaults in light of weakening economic data and because of this we have stayed away from low quality investment grade bonds in danger of credit downgrades.

- We continue to keep a close eye on credit spreads for corporate bonds and see a wider spread from where we are today as a positive indicator to increase portfolio weightings to bonds.

- High yield bonds have done very poorly as lower grade credit has been heavily hit with higher rates and a slowing economy.

- We remain focused on short duration bonds to provide insulation from rate hikes as we stay patient for an attractive entry point.

Bond prices have fallen dramatically this year, which means their yields have risen sharply. These higher bond yields are becoming increasingly attractive following the selloff in the first half of the year.

Look no further than Apple as an example on the corporate bond side. It’s one of the most creditworthy U.S. companies — sitting on loads of cash — and its bonds are trading for 70 cents on the dollar, down from around 100 last fall. Yielding around 4%, compared to 2.7% when Apple issued them last August, this is one of the increasingly attractive opportunities in the asset class.

Preferred Shares

Preferred shares have remained volatile since our last quarterly commentary but, on a relative basis, have held up slightly better than broader equity and bond markets.

The asset class has benefited from continued redemptions of existing preferreds. So far in 2022, $6.7 billion have been redeemed which equates to 10% of the entire market. We see this as one of the key factors for why preferred shares have performed well.

- Rate Resets, which should be more attractive as rates rise, have yet to perform as we would expect.

- Institutional participation has shown little enthusiasm this year and some investors are opting for conventional asset classes at cheaper levels (bonds and equities). This has created liquidity issues in the market.

- We continue to hold our allocation steady with a focus on picks we believe may be redeemed in the next six months. Along with the income component, we see this as a significant value add in taking advantage of the market dynamics which are pushing the asset class to shrink.

- The rate pressure is the greatest challenge for Fixed Rate Preferred Shares.

Alternatives

Alternative investments have been one of the brightest spots for portfolios this year and have helped to reinforce why they are an important component in a diversified portfolio. Our primary focus has remained in Real Estate and Private Credit.

On Real Estate,

- High quality apartment buildings continue to see strong demand. The lack of supply in Canada and abroad remains which has made this an increasingly attractive space for investors.

- Broadly speaking, rents are rising everywhere in North America as people are priced out of homes and increases in interest rates have made mortgages out of reach.

- Despite rising interest rates impacting individual homeowners, large real estate managers continue to be well positioned for the inflationary environment we find ourselves in.

On Private Credit,

- Private Credit returns remained favourable and, in many cases, have offered protection from rising interest rates. Loans in this space tend to be shorter term, and in some cases floating rate, which helped returns.

- The borrowers engaged with these lenders often work closely with each other, which provides these managers unique insight into giving strategic business advice to assist companies in a variety of market environments. To date, we have not seen any notable increase in defaults.

- Rising interest rates can make it more difficult for small and medium sized businesses to borrow from the large banks which have helped to increase the pool of potential borrower’s credit managers have access to.

TriDelta Recognized as Top Wealth Manager

We were pleased to be selected as one of the Top 10 Wealth Managers in Toronto for 2022 by AdvisoryHQ. AdvisoryHQ has a strict selection process that is designed to identify the best financial advisory firms in multiple cities across Canada.

In conclusion

Since WWII there have been 12 different bear markets, all with specific reasons or fears around what was happening at the time. While no two bear markets are the same, the biggest mistake people have made time and time again is letting emotion take control over logic and reasoning.

Panic is not an investment strategy, and you would not drive your car looking out the rearview mirror. Our focus remains on looking forward and building portfolios suitable for each individual and family we work with. Managing risk in good times and bad is one of greatest value adds we can provide but almost more important is helping keep emotion at bay and focusing on the things we can control. No one can say what tomorrow will look like, but we do know the current bear market, like all others, will come to an end.

History has shown repeatedly that in the long run there will be more good days than bad and, in our experience, the best days in the market often come right after the worst.

Source: S&P 500 Index, Bloomberg.

As always, we are here to help. If you have any questions, please don’t hesitate to contact your Wealth Advisor.