Overview

The world is a difficult place to navigate in the best of times, and Q1 2022 was certainly not the best of times.

The world is a difficult place to navigate in the best of times, and Q1 2022 was certainly not the best of times.

In this quarterly review, we will look at:

- Interest Rates and Inflation

- TriDelta’s current view on stocks, alternative investments, bonds and preferred shares

- Some personal finance highlights from the recent Federal Budget – including Flow Through Shares

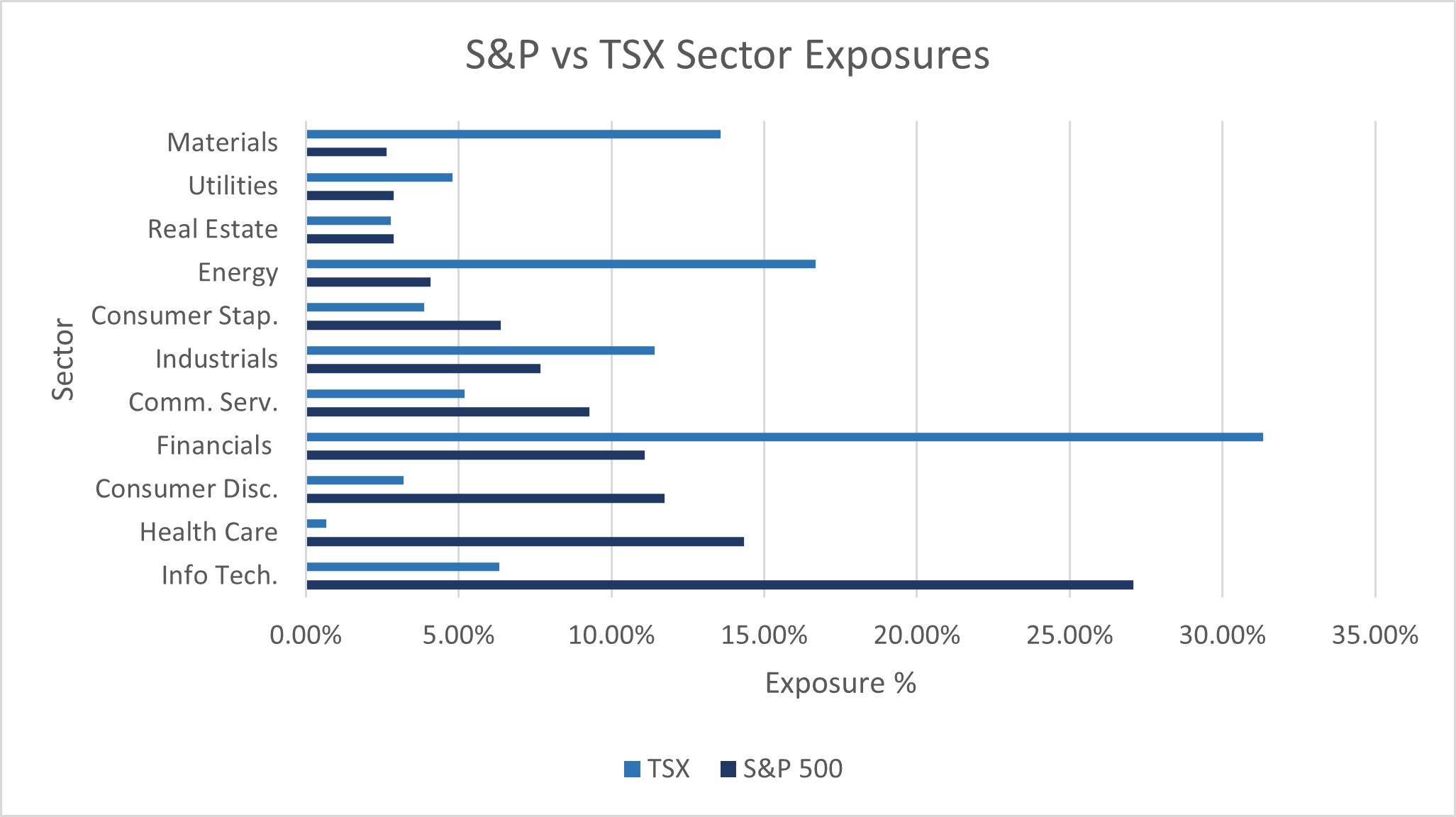

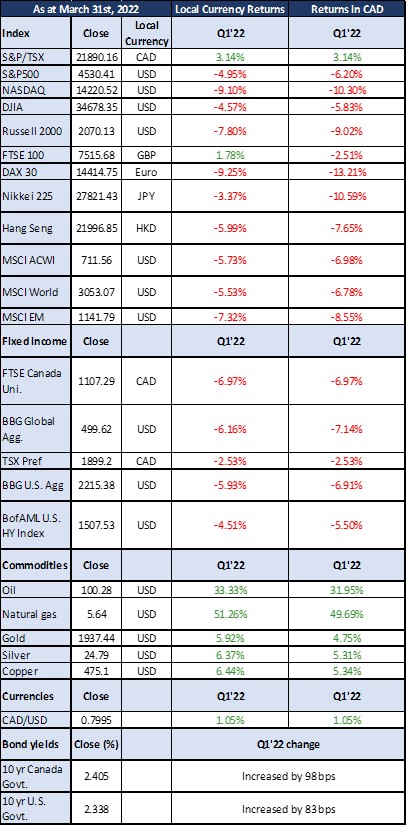

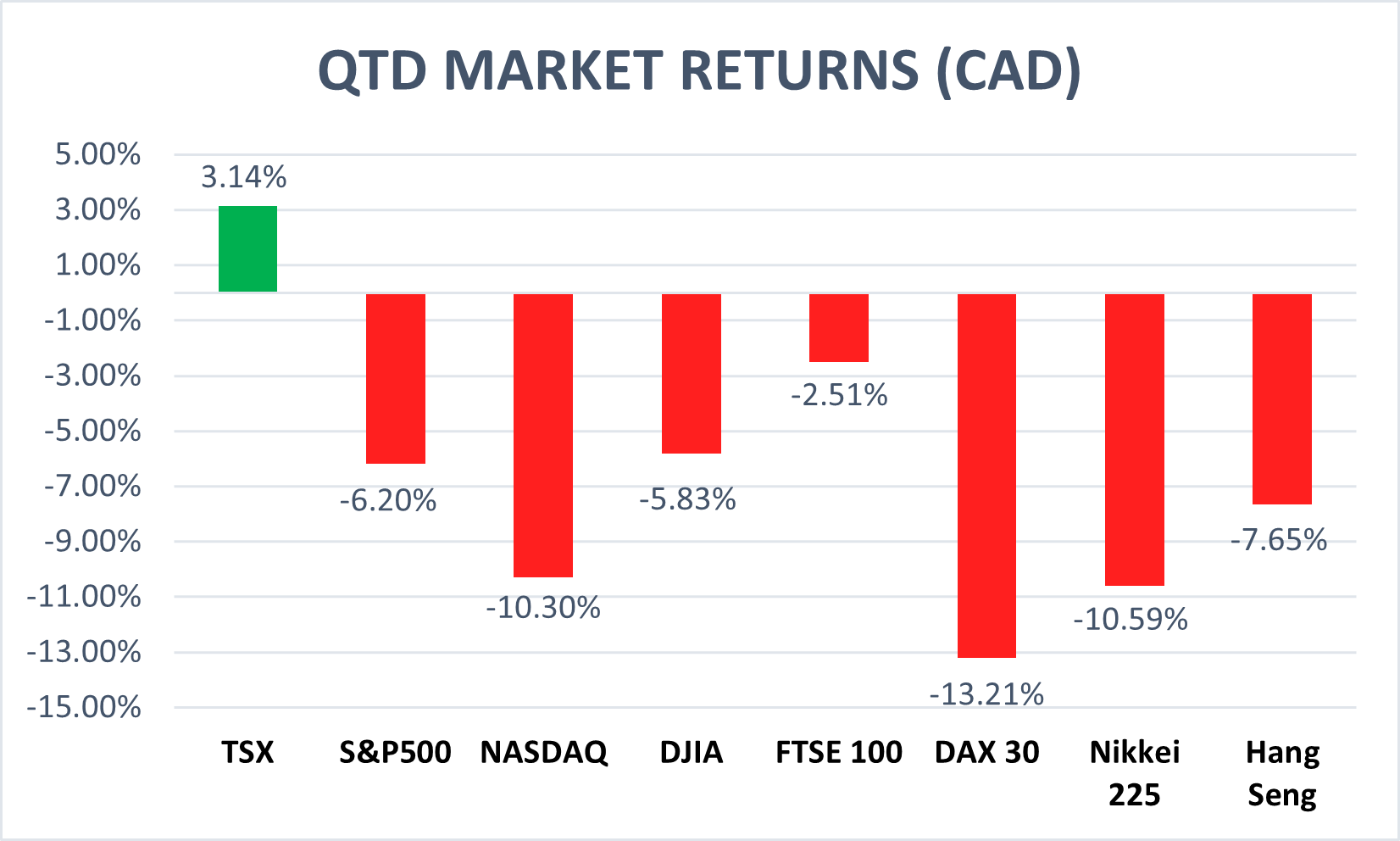

Q1 proved a difficult three months for many stock, bond, and preferred share markets globally but did also give rise to some positives and opportunities. While March was largely a positive month and provided a recovery from the first two months of the year, the U.S. had its first negative quarter in two years while Canada remained positive. Canada’s outperformance can be attributed to our greater concentration in Energy and Materials sectors which outperformed the broader markets. Notably, the US indices have less concentration in these sectors while our lower concentration in higher growth tech sectors provided further protection from the market turbulence.

Source: Bloomberg.

Q1 Market Returns

Interest rates and Inflation

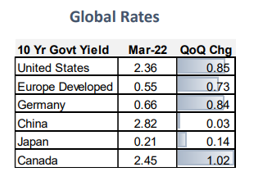

The economy is at a delicate moment in which high inflation could become entrenched. That has created a new urgency to raise interest rates, itself a source of risk for markets and the economy. Central Banks around the world have signaled more aggressive steps to fight inflation and here in North America we are no different as both the Bank of Canada and U.S. Fed raised rates in March with further expectations to do so throughout the year. There has also been a focus on reducing the size of balance sheets in recent months with the U.S. Fed stating they intend to cut their bond holdings by about $95 billion a month – nearly double the pace implemented five years ago when they last shrank their balance sheet. Financial markets now expect much steeper hikes than previously in the year. Higher rates from these Central Banks will heighten borrowing costs for mortgages, auto loans, credit cards and corporate loans. In doing so, they hope to cool economic growth and rising wages enough to rein in high inflation, which has caused hardships for millions of households and poses a severe political threat to those in power.

We are still positioned for higher inflation and higher interest rates but are open to buying into sectors that may be oversold. We continue to place a premium on active management in the face of immense uncertainty and volatility. The two TriDelta equity funds have performed well in comparison to global equity markets, with what we view as much less risk. The TriDelta Pension Fund was up 0.86% on the quarter, while the TriDelta Growth Fund returned -0.44% for Q1. This outperformed our benchmarks (which include Canada, the U.S., International and Emerging Markets) by 2 to 3 percentage points on the quarter. Outside of Canada, major equity markets globally fell as much as 5% to 15% in some cases.

TriDelta equity view – what we are doing and why

Three risks dominated headlines this quarter: the Omicron wave, the spike in inflation/Fed rate hike fears, and the war in Ukraine. Due to these concerns equity markets had a difficult quarter with high growth companies and those exposed to the Ukraine conflict suffering the most. The focus has continued to be on quality as investors have prioritized profitability, stability and realized growth. Coupled with a strong balance sheet there are companies which are still well positioned despite the risks moving forward.

The move in commodities has also been notable over the past three months. Energy, in particular, had a great move to the upside, justifying the gains in the equities and helping the TSX manage this tough quarter. Prices have been driven higher because of the lack of capital provided to this sector over the past few years and the sanctioning of one of the largest commodity-producing countries.

Into the remainder of 2022 TriDelta Funds continue to be nimble and active to take advantage of attractive opportunities.

- We continue to view this as a rangebound market and are focused on adding equities when oversold and trimming when overbought.

- In the funds, we are becoming more concerned about the cyclical sectors and have been trimming some cyclical exposure and adding to underperforming sectors like technology, consumer discretionary and financials.

- The world seems to be coming to the realization that the transition to clean energy will not happen over night and we will need a period of transition. Energy has been the leader, but we should also see strength across the materials sector going forward.

- There has been a common theme among many multi-national companies who have stressed the need to reorganize their supply chain to help insulate themselves from the issues currently being experienced. This will have a significant impact on these businesses and has been dubbed “de-globalization” by many influential investors and business leaders.

TriDelta Alternative View – what we are doing and why

The Alternative asset class provided greater insulation relative to being invested in a typical stock and bond portfolio.

On Real Estate,

- Real Estate continues to perform well and include critical inflation protection and steady yields.

- Many of the partners we work with were able to pass along the added costs of inflation to tenants in 2021 with some increasing rents 10-20% in some areas.

- Property types with short lease durations can reset lease rates more frequently and are in a more advantageous position to grow cash flow. Concurrently, lease structures offer inflation protection with built-in rate increases tied to inflation.

- North America continues to be a top performer while Europe and Asia have struggled.

- Moving forward North American Residential and Industrial Facilities are poised for further growth while high quality Office Space may be well positioned to attract tenants. We also share the view that the fragmented Self-Storage market offers an attractive opportunity.

On Private Credit,

- Private Credit returns remained favourable and, in many cases, offer protection from rising interest rates. Loans from these managers tend to be shorter term which offers them the ability to provide new financing terms to reflect the increase in interest rates.

- These managers continue to see increased deal flow and expect further opportunities as traditional bank lenders restrict capital to small and mid-size businesses. Moving forward, we see this as an ample opportunity.

- Borrowers continue to look to the private markets due to its relatively greater speed and certainty of execution, after many were burned by public markets and banks pulling back capital during more uncertain times. Equally, borrowers value the adaptability and partnership of private lenders.

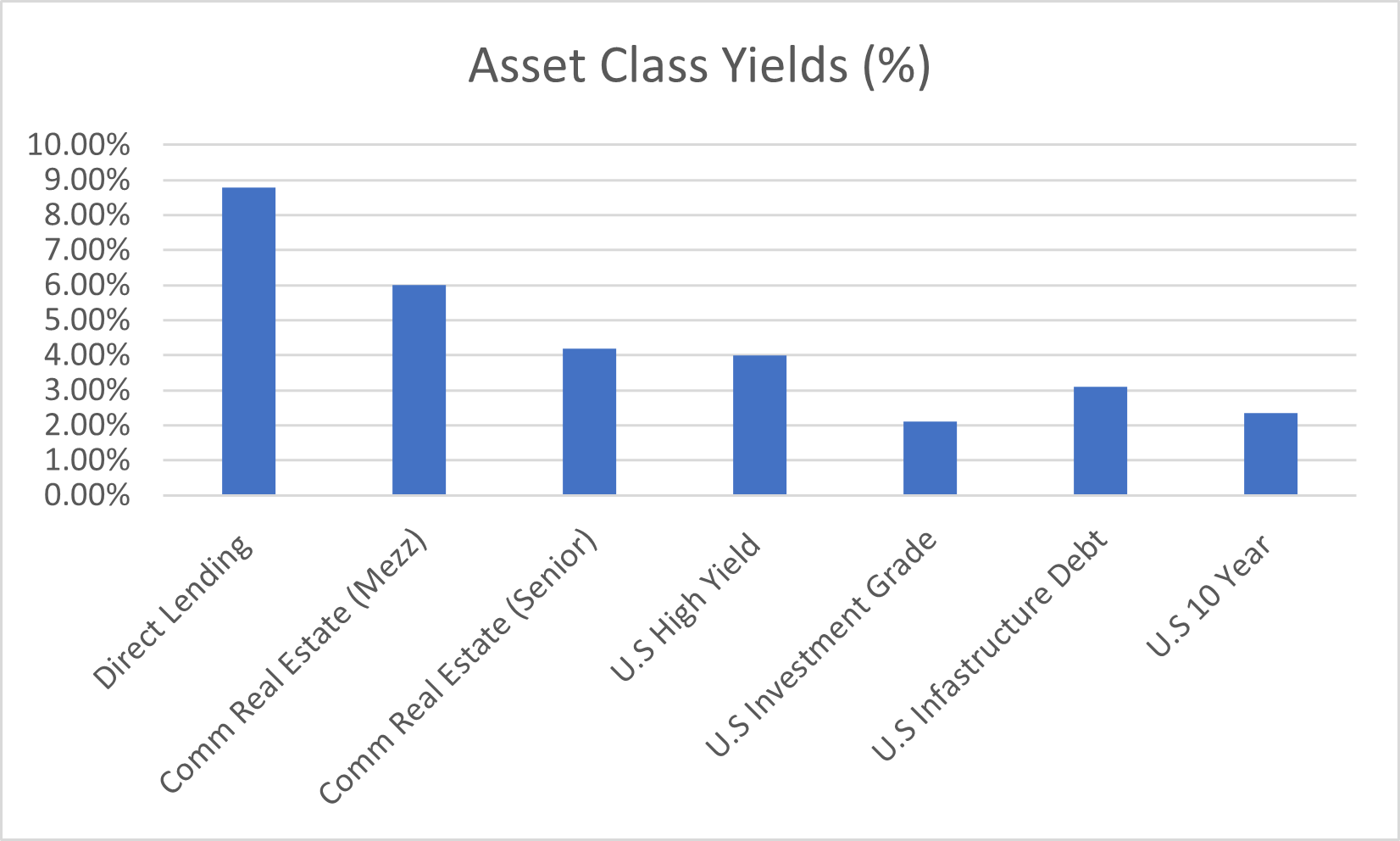

Yields on Private Credit and Real Estate remain much more favourable than investing in traditional bonds.

Source: BofA Securities, Bloomberg, Clarkson, Cliffwater, Drewry Maritime Consultants, Federal Reserve, FTSE, MSCI, NCREIF, FactSet, Wells Fargo, J.P. Morgan Asset Management. *Commercial real estate (CRE) yields are as of September 30, 2021. CRE – mezzanine yield is derived from a J.P. Morgan survey and U.S. Treasuries of a similar duration. CRE – senior yield is sourced from the Gilberto-Levy Performance Aggregate Index (unlevered); U.S. high yield: Bloomberg US Aggregate Credit – Corporate – High Yield; U.S. infrastructure debt: iBoxx USD Infrastructure Index capturing USD infrastructure debt bond issuance over USD 500 million; U.S. 10-year: Bloomberg U.S. 10-year Treasury yield; U.S. investment grade: Bloomberg U.S. Corporate Investment Grade.

TriDelta bond view – what we are doing and why

While we remain at historically low interest rates and ultimately view increased interest rates as necessary, the Central Banks walk a thin line with very little room for error. Here at TriDelta we share several views moving forward:

- Central Bank logic is twofold – (1) to rein in inflation (which is evidently no longer transitory) and (2) to raise rates surrounding a strong economy.

- Many perceive them to be too late on this front; we agree in terms of the underlying economic conditions, but not on inflation as, unlike other periods of outsized inflation, the drivers are largely structural, such as the inefficient deployment of physical capital and labour forces due to the COVID mitigation measure, the shifting landscape (including work from home), economic warfare, and ESG shifts are raising costs.

- Lowering the demand for money through raising the price of money does not address these long-term supply issues. This is occurring while the underlying economy, particularly in the U.S., is already slowing.

- Consumer demand has softened into 2022; corporate spending was already reduced; mortgage rates are up 1.75% year to date in the U.S.

- Coupled with fiscal support being withdrawn this year poses a significant risk to the economy.

- While it is possible to have a recession without monetary tightening, the opposite does not hold true; monetary tightening always happens with a recession.

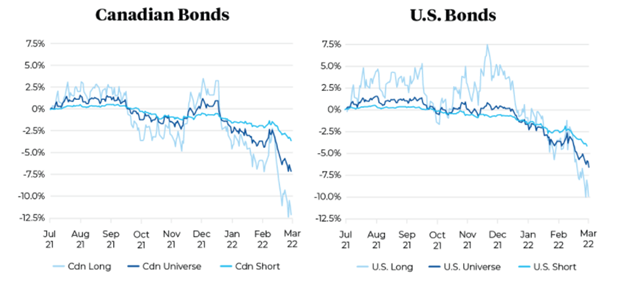

In recent updates we have continued to share our preference towards using a tactical approach to bonds and owning short term bonds for their greater protection in a rising interest rate environment. As you can see in the chart below this has proven the correct approach.

Source: Purpose Investments

We continue to view bonds as an important component of a diversified portfolio and advocate for a focus on being selective and tactical in our approach.

On Bonds,

- Central Bank intentions are clear, but they will not likely be able to raise rates as much as intended before underwhelming economic performance and falling markets derail their efforts.

- We believe we are at or near the highs in government bond yields.

- As opposed to 2021, the 1-5 year bonds represent the best value in our opinion as the yield curve has become exceedingly flat.

- The outlook for riskier bonds is uncertain. Spreads have widened in the high grade and high yield spaces and are likely to continue to do so as corporate bond supply is continuing to be issued while the extent of an economic slowdown has not been fully recognized.

TriDelta preferred share view – what we are doing and why

Preferred shares have had a volatile start to the year, with many cross currents in play. Down roughly in line with bonds, Rate-Resets have outperformed Straight preferred shares by about 3%. This is a continuation of 2021 when Rate-Resets outperformed by a large margin. Many institutional preferred share investors have shifted out of the space and back into traditional yield markets or into equity opportunities.

In our 2021 Q4 update we referenced one of the challenges in the preferred share market being that the market is shrinking as banks and some oil and gas names redeem issues in favour of cheaper financing via specialized bonds. Perhaps shockingly, the first three months of 2022 saw several new issues into this challenging market at yield “concessions”, rendering existing preferred shares relatively expensive.

Moving forward there are important trends we continue to watch closely.

On Preferred Shares,

- Higher rates should be a positive for Rate Resets and Floaters.

- Wider credit spreads are not, and resets will likely take their cue from corporate bonds.

- The shrinkage of the market is still a tailwind, and the recent selloff represents an opportunity.

- We continue to hold our allocation steady and pick away on further weakness while being comfortable with near term volatility.

- The rate pressure is the greatest challenge for Fixed Rate Preferred Shares but most of the backup should be behind the market.

Some personal finance highlights from the recent Federal Budget

- Very few negatives.

- No change to capital gains taxes.

- Flow Through Shares were largely left alone. These continue to be a great tax savings opportunity for those with taxable income of $275,000+ or those with a Corporation where you are drawing out $400,000+. Be sure to talk to your Wealth Advisor if you are in that category.

- There may be some changes to Alternative Minimum Tax in the Fall. It will be focused on those with taxable incomes over $400,000, who are currently paying less than 15% of Federal taxes.

- New Tax Free First Home Savings Account in 2023. This is meant to provide savings room for up to $8,000 a year and up to $40,000 in total, that can be used for a first-time home purchase. While this isn’t a negative at all (other than the tracking and implementation of another tax- sheltered account), it will likely have very little impact for younger people in saving and putting in down payments on a first home.

- There are all sorts of other details in the Budget, but these are the ones that would likely affect some of our clients.

In conclusion

The World is particularly complicated at the moment. In times like these, our general tilt is towards companies making solid profits, with reasonably low debt ratios, especially those with hard assets like real estate and commodities. Rate reset preferred shares and shorter term bonds, along with some higher yielding alternative investments, should work well in an increasing rate environment.

As always, we are here to help. If you have any questions, please don’t hesitate to contact your Wealth Advisor.