Market Overview

The third quarter brought much of the volatility we had been missing since earlier this Spring as the S&P 500 had its worst stretch since the U.S. banking crisis in March and the steam behind the AI (Artificial Intelligence) rally began to wane. In our second quarter commentary we spoke of the narrow rally among the Magnificent 7 stocks driving headline returns and, although these stocks have continued to influence the market, investors are having to look at greater options across asset classes.

In this quarterly review we will be discussing these key developments, what that means for investment decisions moving forward, and what actions we are taking to benefit client portfolios. Key themes discussed include:

- 2023 performance has been more challenging than the Magnificent 7 and AI stocks would have you believe, as the headline returns of the S&P 500 and NASDAQ have been heavily influenced by only a small handful of companies.

- Speculation about interest rates continued, with markets moving higher thinking the end of rate increases was near only to reverse with statements from the U.S. Federal Reserve noting rates may remain higher for longer.

- Declining stimulus and rising bond yields have been a negative for stock and bond markets globally and have led investors to evaluate investment opportunities outside of stocks.

- Canada continues to lag the U.S. and other global peers on the back of a weakened economic outlook and falling Canadian dollar.

- Oil traded below $80 per barrel most of the year. The commodity jumped as high as $88 in early September after Saudi Arabia and Russia said they would extend their voluntary production cuts through the end of the year.

- Expensive energy could dampen growth across the globe, especially in China, whose economy is under pressure due to the nation’s stop-and-go pandemic rebound, property troubles and debt problems.

- Inflation ticked higher in recent months, but this was largely a result of year over year comparisons and, more recently, the resurgence of oil.

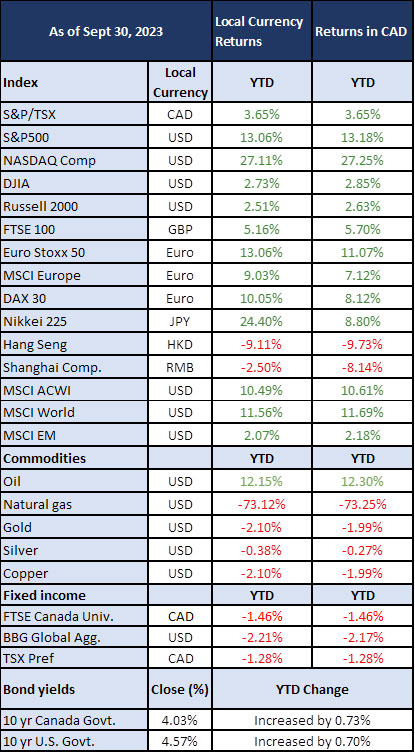

Year to Date Market Returns

An Update on the Magnificent 7

We wrote extensively in our second quarter commentary about the Magnificent Seven – Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta – and their dominance on headline returns in the U.S. stock market. We reviewed this dominance relative to how these returns compared to other U.S. and global stocks and especially the S&P 500’s equal-weighted peer.

To the end of September, the average return from the M7 stock group is +95% while almost half of the S&P 500 stocks remain negative and the equal-weighted comparable is -1.47%.

There are those who argue the rally in these stocks is justified by the implications AI will have, but our stance remains we will not disregard exuberant valuations with reality.

For example, Apple is largest company in the S&P 500, +38.8% for the year, and trading at 26.7 times 2024 earnings estimates. Despite the run up in its stock price, Apple is expected to grow revenues by less than 6% (after posting a negative revenue growth number this year). The wide consensus notes a global weakening economy, yet buyers of Apple’s stock (and others) are betting they will be immune from such forces. Apple is not a bad company by any stretch, but we continue to hold that price matters.

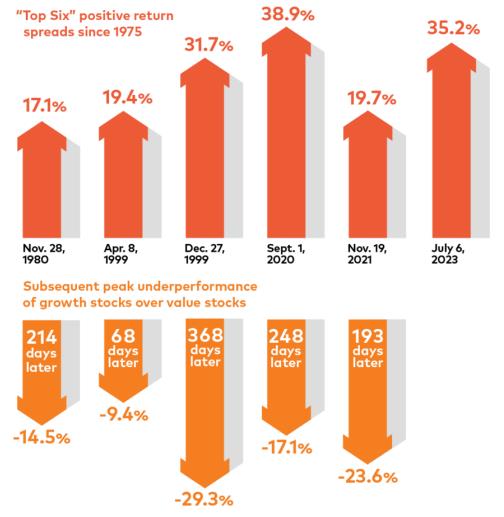

The interesting chart below expands on the six-month period we recently witnessed in growth stocks (driven by the M7).

Source: Source: AGF Investments using data from Bloomberg LP. Rolling six-month performance spread between MSCI U.S. Growth Index and MSCI U.S. Value Index. Full data set of research calculated from January 1, 1975 to July 31, 2023.

The substantial difference in performance between growth stocks (i.e., shares in companies that are expected to grow their earnings more than the historical average) versus value stocks (i.e., shares in companies that are trading at a price less than their intrinsic value) this year is significant. There has only been one period in the past 50 years when the difference was so wide and, as we have witnessed before, risk in these stocks can be highest after such periods.

Rising Bond Yields and Why They Matter

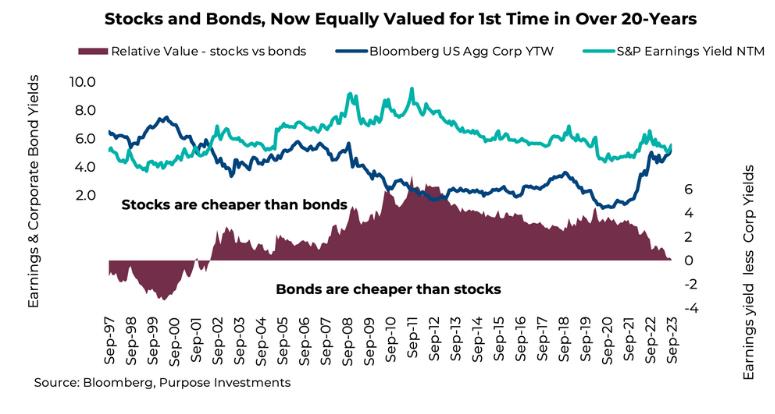

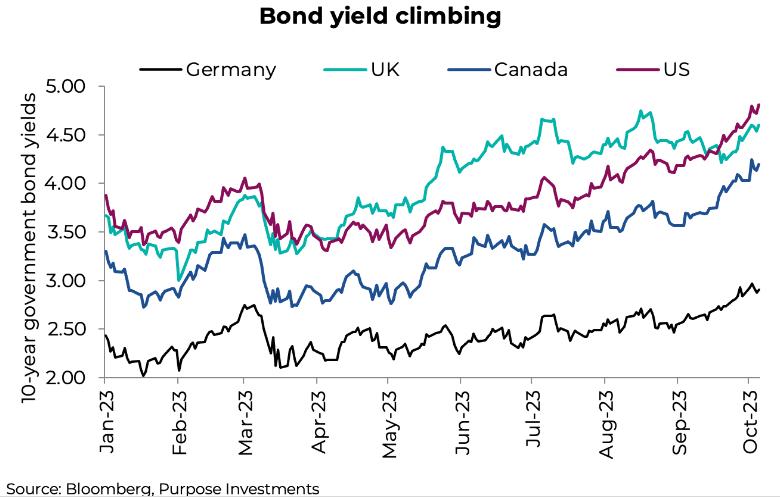

A topic of recent interest to investors has been the dramatic rise in bond yields, here in Canada and around the world. Just as dividend yields rise as stock prices sell off, as prevailing interest rates rise, the price of a bond will decline to reflect these changes (↓price = ↑yield). With higher interest rates and rising yields in bonds, investors have had to reassess the attractiveness of bonds relative to other investment opportunities.

For over two decades there has been no question over which asset class was the heart of returns for investor portfolios. On a relative basis, equities always looked cheap simply because bonds were so expensive (aka very low yield). It was this kind of model that encouraged the phrase TINA – There Is No Alternative. As the chart below demonstrates, high grade bonds and stocks now offer very similar yields on an absolute basis.

To the end of September, the U.S. 10-year Treasury is yielding 4.57% (4.03% in Canada), up almost a full percentage point since mid-July. It is not just North America; yields have been climbing globally. This has had tremendous implications for consumer and business borrowing as well as where the opportunities are for investors.

So, what’s the reason behind the recent rise in bond yields?

It comes down to several factors which have impacted both bond and stock markets.

- Investors are recognizing that interest rates will remain higher than they initially anticipated.

- After many months of fighting the central bankers, we witnessed a repricing of bonds as the market believes that the resilience of the economy through the march higher in yields might mean that interest rates will remain higher for longer.

- This has led to further selling pressure on longer-term bonds as investors reassess what this means for bonds and how stocks themselves are valued.

- As yields on lower-risk bonds have risen, it has changed the returns investors require from stocks in order to compensate stock investors for their higher risk.

- September saw massive new issuances of new corporate bonds as businesses looked to lock in current rates after a slow summer and aggressive statements from the U.S. Fed.

- This had the effect of making previously issued long-term bonds less attractive given their lower yields.

- As in any market, buyers will ask for more attractive prices in the face of increased supply.

What does this mean for investors?

- Higher yields mean that bonds are a more competitive alternative to stocks in investors’ portfolios. On the other side, it also means higher borrowing costs for businesses and consumers.

- That’s an essential element of the central bank’s campaign against inflation. Tighter financial conditions slow down the economy and spending, reducing the upward pressure on prices.

Overall, the fast pace of increased bond yields has led investors out of stocks and into bonds and other cash-like investments. This has put undue pressure on many areas of the stock market but also created significant long-term opportunities for investors seeking income and capital gains. There will always be points of the economic cycle where investors evaluate the relative attractiveness across asset classes in the near term and tend to disregard the long-term opportunities these shifts can provide. As students of market history, we have seen first-hand stocks as the primary drivers of performance for investors and an excellent way to protect purchasing power. While we are prudently making shifts to client portfolios, it is not all or nothing. We continue to maintain a diversified portfolio in line with your tolerance for investment risk. This is key to ensuring you can preserve wealth in volatility and generate returns over time.

What we are doing and why

Stocks

The first nine months of 2023 have continued to be characterized by the divergence of the few and the many as headline returns are dominated by only a small number of the large technology stocks. Now, into the summer it became apparent that the divergence further extends between Canada and our southern peers as the U.S. has continued to exceed expectations.

Key takeaways include:

- Global stock markets became more volatile in Q3 with bigger moves in stock prices and currency amid geopolitical tensions, inflation fears, and aggressive statements from central banks.

- U.S. stocks and broader economy continue to exceed expectations.

- Meanwhile, GDP growth expectations for Canada started to wane in early September and has been deteriorating ever since.

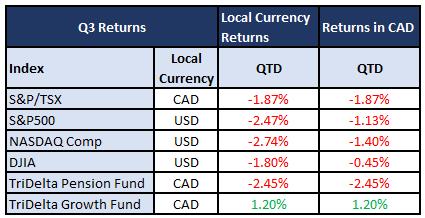

- Headline returns for major North American indices were broadly negative with Canadian investors in U.S. stocks benefiting from a strong US dollar.

- Typically, when oil prices are strong, the Canadian dollar outperforms its U.S. counterpart. That hasn’t been the case in 2023. Part of the reason is due to interest rate differentials which reflect the economic prospects of Canada and the U.S.

- In Canada, the TSX was supported by the health care and energy sectors but remains an underperformer on the year as the large dividend payers have struggled.

- Dividend paying stocks within the TSX, and globally, have been underperforming the broader market but increasingly attractive as investors are paid a premium for their patience.

- China, the world’s 2nd largest economy, is under pressure due to the nation’s stop-and-go pandemic rebound, property troubles and debt problems.

- The size of China’s economy has a material impact on commodities, global manufacturing, and trade.

- Historically, it has been government stimulus or changing of rules that has helped lift the economy out of a funk and, in many cases, helped the global economy. This can happen suddenly and without warning.

As we watch several major geopolitical issues, the new war in the middle east is one that adds potential risk to markets, but it depends on how things progress. In the much more likely event that the war is largely contained to Israel, Gaza, and the West Bank, we don’t see there being much of an impact on global markets. The fear is an escalation that would bring in major energy players like Iran and Saudi Arabia into the fighting in a way that would impact oil supply. While we are not seeing this today, there is a risk for much higher oil prices in the latter scenario.

The TriDelta equity funds continue to be very different than the broad passively managed stock markets. Year-to-date the TriDelta Pension and Growth Funds have returned -3.53% and 5.89%, respectively.

Outside of the heavily concentrated S&P 500, the TriDelta equity funds have performed in line with the broader markets.

The outperformance in the TriDelta Growth fund can be attributed to the approach of using quantitative information and historical patterns to be invested in areas of the market that have outperformed in similar market conditions as we have today. This unique strategy is proving to be of great value.

The underperformance of the TriDelta Pension fund compared to broad markets is based on the low volatility and dividend growth approach of the fund. As mentioned earlier, value and dividend growth that has found great success in companies like Enbridge, Royal Bank and Johnson & Johnson, has been hurt in this rare window of meaningfully rising bond yields. History has shown that these areas of the market have seen good long-term performance but also significant recovery after a meaningful period of growth outperformance. We expect to see this strength and recovery in the Pension fund.

Bonds

The U.S. Fed and Bank of Canada held rates steady but statements from the U.S. Fed noted interest rates remaining higher for longer which spurred volatility in both stocks and bonds. We have already discussed the attractiveness of bonds and implications of rising bond yields so we will use this section to provide an overview of what we are seeing in bonds today.

- Investment grade corporate bonds have given back most of their year-to-date gains, down 2.28% on the quarter.

- We continue to have a focus on shorter-term, high-quality investment grade bonds but have more recently found opportunities in longer-dated bonds.

- We are at a point in the interest rate cycle where risks of a policy mistake by central banks or missteps by governments would have significant implications for the economy.

- Investors have heard many tales of what a “soft” versus “hard” landing would imply and we believe this story is still dependent on possible corporate and consumer defaults, which in turn could lead to resurgent regional banking concerns like we saw in the spring.

- We believe we are at or very near peak interest rates, but rates will remain elevated for a time as inflation persists. This will have implications for governments, companies, and consumers and there will be growing pains as we begin this new (in some eyes old) normal.

Although the near-term outlook is uncertain and volatility will likely continue, we remain opportunistic as quality bonds continue to be attractive investments and a vital component of a diversified portfolio.

Preferred Shares

Preferred shares had another disappointing quarter that was highlighted by an institutional holder deciding to unwind their preferred share investment fund. Preferred shares being an already illiquid market meant that this decision further drove prices downwards.

The primary reason for owning this asset class remains to be the shrinking issuances of new preferred shares, as attractive yields in bonds have become more prevalent. One such example occurred in recent months when TD made the decision to redeem a rate-reset preferred share which would have had a coupon of 7.2% (and 8.3% yield at previous prices) had it stayed outstanding past the 10/31/2023 reset date. In one trading day the price of this preferred share bounced from $21.79 to $25.17.

Alternatives

Alternative investments – those not publicly traded – have continued to provide steady income and diversification benefits for investment portfolios.

Key considerations for our portfolios include:

- Private credit funds, which pool money from investors and then use it to lend directly to private companies, have seen a boom in lending opportunities and continue to raise capital to fill the gap traditional bank lenders cannot.

- Globally, $95 billion was raised in the first half of 2023, outpacing 2022.

- Private credit funds have benefited from several key themes which bode well for investors.

- The U.S. regional banking crisis and rising interest rates have forced bank lenders to seek liquidity. Coupled with more stringent requirements being placed on borrowers has led private companies to look elsewhere.

- Rising interest rates are largely being passed through to investors in the form of higher yields which remain attractive relative to cash and bond equivalents.

- Private real estate funds in Canada have continued to see positive returns as supply fails to keep pace with demand, pushing rents and prices higher.

- Significant differences exist between Canadian and U.S. real estate markets which we have spoken to in past market updates and articles. One of the most poignant differences is the average time it takes a developer to build a condo or apartment building. On average it takes 100 months to complete a new development in a major urban centre in Canada while only 24 months in the U.S.

- Real estate remains an increasingly attractive space for quality alternative funds with expertise in these areas and an important contributor to portfolio returns.

Alternative investments are a key component of building a resilient portfolio that will perform in a wide range of unknowable scenarios. In times of volatility, correlations between publicly traded stocks and bonds increase which does little to provide the stability clients may need.

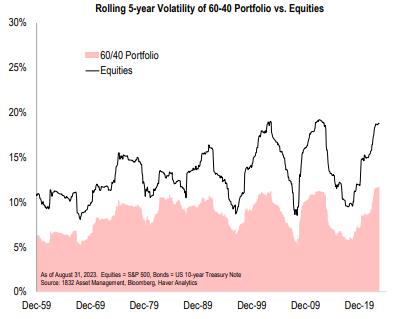

Adding bonds to an all-stock portfolio, like in the 60/40 portfolio depicted below, can dampen the volatility when stocks go down, but the addition of alternative investments can differentiate your portfolio and provide stability in a wider range of market events.

TriDelta Private Wealth Update

At TriDelta Private Wealth, our new name doesn’t change the services we provide. Having said that, it is a reminder of some of the ways that we might be able to help you and your family.

With interest rates rising recently in the mid-range of the yield curve (5-year bonds as an example), this has an upward impact on mortgage rates, even if the Bank of Canada holds tight on overnight rates. At TriDelta, your Wealth Advisor can help you or family members sort through the options as people are making decisions on new mortgages and renewing existing ones. Through our partnership with National Bank and independent mortgage brokers, we can often help clients and family members to get access to very good rates.

Our insurance arm can offer a wide range of solutions. These include risk management for families – using life insurance, critical illness insurance, and disability insurance. For active businesses, we can help to add value and possibly lower costs for group health benefits for small and mid-size companies. For estate planning, we can use permanent life insurance as a tool to meaningfully save taxes, and especially for those with holding corporations, as a unique tool that can add significantly to your net worth.

As a final thought, in volatile times, financial and estate planning can help you find greater peace of mind and control. At TriDelta, this is something that is available to all investment and insurance clients.

Looking forward

There are clear pockets of opportunity in the market today as we enter a regime change in which the dynamic for interest rates evolves. There will certainly be growing pains for companies and investors as we enter this new phase, but history has shown us time and time again, investments in quality companies have been rewarding over the long-term and an important component in protecting purchasing power.

As we find ourselves in the fourth quarter, stocks are moving from a seasonally weak time of the year to a stretch that has historically been among the best. We know everyone would prefer certainty, like ‘the market will be higher in 12 months’, but ultimately, that just isn’t how the world works. The future is uncertain; nobody really knows where we will all be in a year or the path to get there. And, as more information becomes visible along the journey, the scenarios, and probabilities of those potential paths change. What is important today is taking in as much information as possible and making the best decisions we can with the information available.

As for all the concerns out there, they’ve just created a new wall of worry for stocks to climb—but it’s one that shouldn’t prove insurmountable.