Market Overview

Gloom-and-doom pessimists who predicted 2023 would be a year of economic misery have so far been wrong as the long-anticipated recession has failed to materialize while markets continued to rebound from their 2022 lows. Stubborn inflation, a debt ceiling brawl, banking crisis, and the likelihood of even higher interest rates have done little to sway the optimists, despite the challenges companies and consumers face.

In this quarterly review we will be discussing these key developments, what that means for investment decisions moving forward, and what actions we are taking to benefit client portfolios. Key themes discussed include:

- The stock market’s resilience in 2023 may be due to investors’ collective expectation that any potential recession (later this year or in 2024) would be a shallow one.

- The euphoria surrounding the year-to-date outperformers and AI frenzy began to spread to other areas of the market – a key focus for any sustainable rally.

- Despite this, headline performance numbers continue to be driven by only a handful of very large and influential companies.

- Canada has remained resilient but, along with other countries with deep ties to commodities, has lagged the US and global peers.

- Despite inflation trending lower, interest rates have pushed higher with further expectations for increases abroad – a notable change from earlier in the year.

Year to Date Market Returns

“The Magnificent 7”

In our Q1 commentary we wrote that much of the headline market gains in the US were being driven by only a few of the very large, and thus very influential, companies. Now nicknamed the “Magnificent 7”, these seven companies alone account for 28% of the total weight of the S&P 500 and have continued to have an outsized impact on headline returns. In fact, removing these seven stocks would see the year-to-date return of the index be only marginally positive.

The “Magnificent Seven” includes Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta. In a rally fueled by excitement about their exposure to Artificial Intelligence and the perception interest rates will soon decline they’re up a combined 90%.

The stock market has a long history of creating nicknames when reporting on exuberant returns.

- In the late 1960s and early 1970s, the “Nifty Fifty” were a group of seemingly indestructible stocks — including Polaroid, Sears, and Eastman-Kodak — that captured the minds of investors.

- In the late 1990s, the “Four Horsemen” — Microsoft, Cisco, Oracle, and Intel — led the markets.

- Excitement over investments in emerging markets in the mid-2000s was accompanied by the usage of “BRIC” — Brazil, Russia, India, and China — as the term for the fast-growing nations at the heart of the latest frenzy.

- More recently, “FAANG” — Facebook, Apple, Amazon, Netflix, and Google — were the market darlings.

The concentration of market gains in these companies and many of those perceived to benefit most from the emergence of AI can be seen best in the year-to-date performance of the tech heavy Nasdaq (+31.73%) which posted its best start to the year in 40 years. This is also due to these seven stocks which account for over 60% of the total Nasdaq 100 weighting; recently the index announced a ‘special rebalancing’ to reduce this concentration.

Important implications of this dominance are worth reviewing.

- The influence of US stock market returns over the previous decade has led global indices to become overconcentrated in US stocks.

- To the end of June, almost two-thirds of their geographic exposure includes the US.

- The overuse of passively managed Exchange Traded Funds (ETFs) may increase the risk of investment portfolios by creating an illusion of diversification.

- While owning an equal weighted S&P 500 ETF provides equal exposure to the 500 companies included in the index, the more widely owned market capitalization weighted ETF can become concentrated in the outperformers of the day.

- Year-to-date there has been significant disparity between the performance of the concentrated market-capitalization weighted S&P 500 relative to the equal weight index.

Performance Difference Between S&P 500 Market-Cap Weighted and Equal Weight Index

Source: AGF Investments, Performance spread between the three-month rolling return of the S&P 500 Index and the S&P 500 Equal Weighted Index.

- Over the past 20 years, the outperformance of the market-cap index has never been greater than today. Although this doesn’t point to what’s next, an interesting takeaway is the downside protection the equal-weighted index has provided in difficult periods.

- As the chart below demonstrates, the performance of the equal-weight S&P 500 lags previous market “bottoms” significantly.

It remains true that headline growth in the US has been driven by only a select few but as June rolled on, more companies began to participate in the rally. One of the key takeaways from the disjointed charts above is the concentration risk if performance turns negative or volatility rears its head.

Interest Rates and Inflation

After pausing interest rate increases earlier in the year, the Bank of Canada made the decision in June and July to raise rates once again.

Many anticipated Canada would already be in a recession by now and it is difficult to pinpoint a reason for why we have remained so resilient. Record immigration and increasing worry over Federal Government spending remain considerations, however, housing strength continues to be a key focus.

In June, President, and CEO of TriDelta, Ted Rechtshaffen published an article explaining why it’s time for interest rate increases to end.

2.5% inflation means Bank of Canada’s interest rate hikes should end | Financial Post

- The May CPI recorded a 3.4% year over year increase – a drop from 4.4% in April. While inflation continues to push lower it’s worth noting what this figure would be if the mortgage interest cost index – the measure of price induced changes in the amount of mortgage interest owed by the population – is removed.

- Logically, this measure will increase as people are spending more on their mortgages due to rising interest rates. In May, if the mortgage interest cost index is removed, the year-over-year CPI is 2.5 per cent, very close to the central bank’s target inflation rate.

- Despite this, the Bank of Canada made the decision to raise rates again in July but are expected to pause increases for the remainder of 2023.

To the south of us, the US Fed is attempting to carve a winning path between two losing scenarios: giving up the inflation fight too soon, which would risk a severe recession later, or pushing rates too high and sending the economy into a tailspin as soon as the second half of this year.

- After 15 months of increases, the US Fed made the decision to keep interest rates at 5.25% but emphasized the need to continue increases for the remainder of the year.

- US inflation fell dramatically in Q2 from 6% to 4%, due to high inflation months in 2022 rolling out of the year over year calculations.

We continue to believe the global rise in interest rates will test the strength of a generation of companies that grew up in a low interest rate environment and haven’t had to function under tighter monetary conditions. The current economy has long grown used to low rates, and some aspects of the economy have even become dependent on them.

What we are doing and why

Stocks

The first half of 2023 has been a tale of two markets as investors seem to be applying much different views of risk to different sectors. While some parts of the market are paying no mind to valuations and letting euphoria drive price, others are feeling the brunt of negative expectations for the future.

- The latest AI enthusiasm has electrified growth in the US with investors looking for the next frenzy, regardless of risk.

- Interestingly, many companies are looking to catch investor favour with references to AI in their latest press releases. Regardless of the implications for AI moving forward, there is a lot of noise currently driving the narrative.

- Outside of the US, it is cheap, beaten down value stocks in Europe and Japan which have driven performance.

- Globally, countries with deep economic ties to commodities, like Canada and Australia, have lagged. Asia has also struggled on the back of China’s troubled reopening and reduced expectations for growth.

Apple is a well-known company that provides an interesting case study to the optimism surrounding the Magnificent 7 and AI frenzy. Apple is the largest weighting in the S&P 500 and second largest in the Nasdaq 100. To the end of June, its stock has risen 49% despite its earnings falling 2% in 2022 and only estimated to grow 5% in 2023.

The companies we own may appear boring on the outside but in many cases have significantly better growth opportunities in the near future. Hilton Hotels (HLT) is one such holding which is trading at a 10-year low price-to-earnings multiple, experienced earnings growth in 2022 of 135% and is expected to increase earnings in 2023 a further 20%.

As investors, we know that risk is greatest when prices feed on overly optimistic views of the future and become exceedingly less grounded in reality.

The TriDelta equity funds continue to be very different than the broad passively managed stock markets. Year-to-date the TriDelta Pension and Growth Funds have returned -1.11% and 4.66%, respectively.

To the end of June both funds have returned less than these broader indices due to the continued defensive positioning within each fund. We continue to view this as the most prudent path forward as we work to pick up quality companies at a temporary discount.

Key takeaways include:

- We do not believe investors should become complacent with market gains concentrated in only a few companies. Our funds remain highly active and continue to find exceptional value we anticipate has not been recognized by the broader markets.

- Given the disjointed market rally there remain opportunities for returns in quality companies able to navigate the challenges being faced.

- There are strong indications that the growth experienced in the “Magnificent 7” is overdone and advise caution in overly concentrated passively managed ETFs.

- The lagged impact of interest rate increases is still working its way through the global economy, impacting economic growth, and drying up pandemic savings for consumers.

Bonds

Bond returns were muted in Q2 but remained positive year-to-date. The increase in bond yields since the rate increases began in 2022 has created much more opportunity in the bond space for both enhanced income and the potential for capital gains. Although the near-term outlook is uncertain, we remain opportunistic as quality bonds continue to be attractive investments.

- At the start of 2023 many had anticipated rate decreases towards the end of the year. As the year has progressed the reality of statements made by the central banks have been suggesting a continued bias towards higher for longer rates.

- Despite this, North America is viewed as softening their outlook for rate increases and moving towards a more normalized environment for interest rates.

- Elsewhere, interest rates continue to climb as the decline in inflation seen here in North America has not been uniform globally. The Bank of England and European Central Bank maintain an aggressive stance towards bringing down this inflation.

- Inflation continues to be the primary motivator for interest rate decisions. While inflation has trended lower, all eyes will be on the remaining half of the year as inflation has traditionally increased during this time of year.

- For inflation to continue its decline, companies would need to accept lower profit margins and consumers would need to adjust spending habits – both of which are not evident today.

Preferred Shares

Preferred shares largely gave up their Q1 gains and are flat to the end of June. The primary reason for owning this asset class remains to be the shrinking issuances of new preferred shares, as attractive yields in bonds have become more prevalent.

Presently, preferred shares have an average income yield of 6.2%.

Alternatives

Alternative investments – those not publicly traded – have continued to provide steady income and diversification benefits for investment portfolios. To the end of May, the TriDelta Alternative Performance Fund is +0.95% and 1-year return is 3.43%.

Key considerations for our portfolios include:

- Private real estate strategies have not performed in unison with publicly traded real estate investments. Presently, there exists the widest disparity between public REITs and privately owned real estate since 2008.

- This divergence in price has created an opportunity for globally diversified real estate strategies with investments in both private and public real estate.

- The stability of privately owned real estate has not been uniform across sectors as several high growth areas in North America have struggled with the rising costs of debt while others have been insulated from the impacts of rising costs due to fixed rate debt and continued demand.

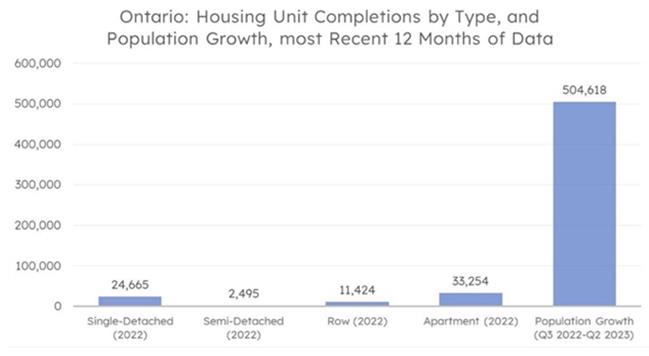

- Here in Canada, Ontario offers an example of the reality many provinces are facing today as people struggle to find housing due to a growing population and associated increase in demand – a favourable support for real estate investments today.

- Here in Canada, Ontario offers an example of the reality many provinces are facing today as people struggle to find housing due to a growing population and associated increase in demand – a favourable support for real estate investments today.

- Private credit funds have continued to experience the positive effects of rising interest rates and without much of the associated rise in defaults. Managers of these strategies do rigorous stress testing on each borrower prior to any engagement and as an ongoing matter.

- As interest rates have risen, more small and medium sized businesses find themselves without access to traditional bank financing, providing an expanded pool of opportunity for quality private credit managers.

Alternative investments are a key component of building a resilient portfolio that will perform in a wide range of unknowable scenarios. A primary consideration in determining an allocation to alternative investments is the illiquidity associated with these strategies and only have a place in client portfolios with long-term time horizons.

The Value of a Financial Advisor Rose in 2022

Each year Russell Investments Canada aims to use their objective study to quantify a full-service advisor’s increasingly complex role to serve clients. Their 8th annual report found those working with an advisor in 2022 were 3.90% better off than those who did not and credited behavioural couching with adding the most value – something which was of extreme importance in a difficult year for investors.

Difficult and uncertain periods in the markets can provide an important check-in for your financial plan. Vital to any successful plan is stress testing the performance of various market conditions and providing a reminder that market returns are not always a straight line. In working with a full-service team like TriDelta, we can help you be sure you are still on the right path.

Whether it’s time for review or you are looking to get started, speak to your TriDelta wealth advisor today.

Looking forward

Complacency gives way to panic and, with this in mind, we will continue to cut through the noise and not become swept up in the euphoria driving narrow gains in the market. We are committed to seeking out long-term value for client portfolios and believe today offers a significant opportunity for investors willing to ride out any near-term volatility. Relying on optimistic underlying assumptions is rarely part of a prudent investment process and although emotion is certainly a consideration in the near-term trajectory of markets, we far prefer to focus on the opportunities afforded to those able to take an unemotional view of what lies ahead.

If you would like to discuss your financial plan or investment portfolio, please give us a call or send a note.