Market Overview

If you only looked at your portfolio twice this year (in January and again in June), you may think all the news around U.S. tariffs, escalating tensions in the Middle East, or any of the other negative headlines in 2025 played little to no role in your investment portfolio.

If you are asking this question, we would argue you are half right.

Stock and bond markets managed to push higher in the first half of the year, but we know this did not happen in a straight line. 2025 has demonstrated increased variability in the performance between sectors and geographies. Even the U.S. which, despite a dramatic selloff in April following President Trump’s announcement of global tariffs, ended the quarter positive. Earlier in the year we wrote that “This Too Shall pass” in reference to the unfolding tariff regime and associated uncertainty which consumed investors in April. While we were confident in that prediction and took actions we knew would benefit investment portfolios, we admittedly did not expect to be so right so quickly as we enter the second half of 2025 with markets once again at all-time highs.

In this review we will take the opportunity to share our thoughts on the first half of the year and what to watch for the remainder of 2025. Key themes discussed include:

- U.S. tariffs dominated headlines and drove wide swings for investors. Trade news will continue to drive uncertainty for businesses and consumers, but there is growing evidence that investors have moved on.

- Canada and other international markets posted steady gains and outperformed U.S. markets.

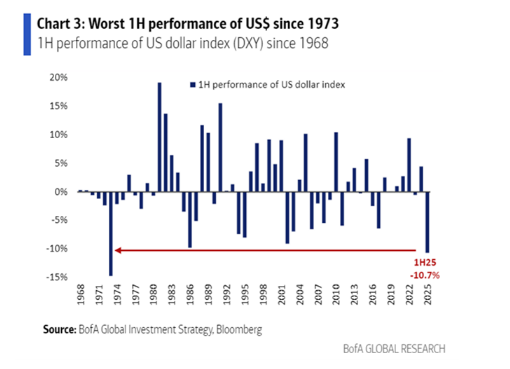

- While U.S. stocks recovered, the U.S. Dollar had its worst first half of a year since the collapse of its gold peg in 1973.

- The weakening U.S. dollar has been felt by Canadian investors as investment returns in U.S. assets have proved materially lower.

- Volatility driven by escalating tensions in the Middle East and Europe proved short-lived, but until these risks are resolved they will have the potential to move markets.

- Gold has risen 83% for the three years ending June 2025, while broad commodity benchmarks have been flat. Now, signs of rotation are emerging.

In this quarterly review we will be discussing several key developments, what they mean for investment decisions moving forward, and what actions we are taking to benefit client portfolios.

A Closer Look

There has been no shortage of headlines in 2025, and we recognize that it can often be difficult to sort through the noise to determine what matters most. For that reason, we wanted to take the opportunity to provide a closer look at these recent developments and what clues they may provide for the remainder of the year.

Tariffs

Tariff news will likely continue to dominate headlines in the near-term, as the 90-day pause was set to expire July 9th but quickly extended to August 1st. These dramatic, almost daily, shifts to trade policy have been a major source of volatility for investors and led to increased anxieties for consumers and businesses. Despite this, there is growing belief that investors have begun to move on from tariffs. Stock markets are forward looking, and current levels suggest that better news on tariffs is being expected as investors have been less reactionary to new developments in recent weeks.

While the worst-case scenario has largely been ruled out, tariffs are here to stay, and we need to recognize the implications for this new regime.

- Thanks to pre-tariff inventory buildup and hopes that a wave of trade deals will make elevated tariffs temporary, businesses have largely not passed the higher costs of tariffs on to consumers.

- This may be the primary reason why inflation has not ticked higher but if tariff rates remain high, businesses will be forced to pass on price increases to consumers.

- Companies rushed to build inventories early in the year to beat tariffs. Coupled with elevated consumer spending in those early months, may mean weaker demand reported in the second quarter adding to the already challenged outlook for growth.

A change in policy, whether well founded or not, creates market uncertainty. The rapid changes to policy decisions in 2025 have made this year especially difficult for businesses, consumers, and investors to navigate. The good news is that policy or event-driven selloffs are typically short-lived. Clearly, this one was, but markets will need time to digest the implications of these changes and whether more prolonged economic weakness follows in the coming months.

Valuations

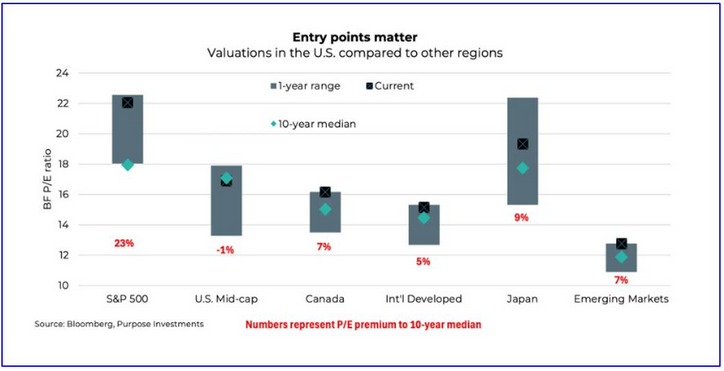

Soon companies begin reporting earnings for the second quarter and will offer clues to how executives are navigating the uncertainty. After the recent market rally, valuations are once again expensive. The S&P 500 has peaked at around 22x earnings a few times over the past five years and while the TSX is still relatively cheaper at 18x earnings, it sits at the higher end of the previous decade.

Although expensive valuations are nothing new, the challenge is that valuations are elevated while earnings growth is slowing. We would be more comfortable with these levels for the S&P 500 if earnings were still growing at 12%. But at 7%, investors need to demonstrate more caution. The same issue applies to Canada, but to a lesser extent.

- Though valuations in Canada and internationally are currently at one-year highs, they remain relatively in line with long-term averages and cheaper than U.S. stocks.

- Valuations naturally favour international companies, but that is usually the case given the differences between the make-up of a country’s stock index.

- For example, the U.S. has much more of the expensive technology stocks which have driven growth over the past few years. Canada has much more energy, materials, and financial stocks.

- Valuations naturally favour international companies, but that is usually the case given the differences between the make-up of a country’s stock index.

- Still in the U.S., there is reason to be optimistic. Expectations are reasonably low going into second quarter earnings reports and the U.S. dollar is also lower, which is generally positive for U.S. S&P 500 earnings.

- As we know, stocks can remain expensive for long periods and still push higher. Investors will be looking to support the stretched valuations and may find it by way of the recent tax cuts, prospect of deregulation, and continuing Artificial Intelligence (AI) momentum.

- Emerging markets continue to have a relative advantage over developed markets and stand to benefit from shifting global trade.

- Globally, most trade happens without the U.S. and it’s likely that foreign companies would be more willing to look to other markets rather than deal with the higher tariffs.

Investors should pay attention to how expensive stocks are as a key factor when predicting future returns. Historically, higher valuations imply lower future returns. Much like the beginning of the year, the current setup still favours stocks outside of the U.S., but opportunities will remain for active investors as market uncertainty persists into the latter half of the year.

Currency

As measured by the U.S. Dollar Index (DXY), the U.S. dollar has fallen over 10% since the beginning of the year, creating a material drag on performance for Canadians who own U.S. dollar investments. For the six months ending June 30th, the S&P 500 returned 5.50% which equated to -0.21% for Canadians given the strengthening Canadian dollar.

While this may seem a negative for Canadian investors, there are reasons why the weak U.S. dollar may provide opportunities.

- A cheaper U.S. dollar may provide a near-term boost for U.S. companies that earn much of their revenues internationally.

- Apple, for example, earns approximately 60% of its revenues from outside the U.S. and stands to benefit when these revenues are converted back to U.S. dollars for reporting earnings.

- Generally, the largest U.S. companies generate a material percentage of their revenues from overseas which could support the S&P 500 in the back half of 2025.

The reasons for the weaker U.S. dollar are more complex but centre around foreign investors ditching U.S. dollars and long-term U.S. government bonds amid concerns about the long-run stability of the U.S. economy. The recent U.S. tax legislation has not helped the matter as it is projected to add over $3 trillion to the national debt over the next decade.

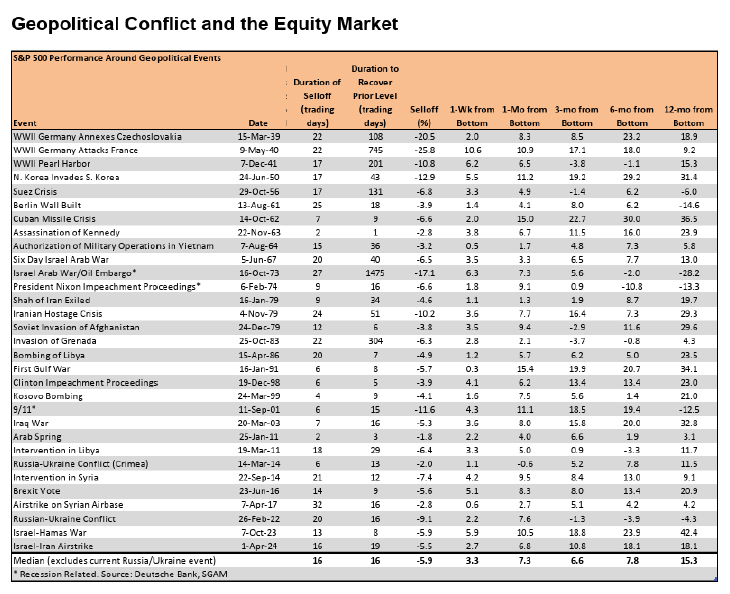

Global Conflicts

Geopolitical risks have been in the spotlight. We warn that investors should not become complacent, given that there remain risks associated with these conflicts which could span the short and long-term. Until these risks are resolved more definitively, they have the potential to move markets.

Regardless of what the future holds, the chart below demonstrates that it pays to remain the course in the face of this uncertainty.

What we are doing and why

Stocks

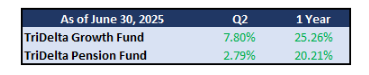

The TriDelta Growth and Pension strategies performed well year-to-date, returning 9.33% and 6.24%, respectively. The shifting headlines have meaningfully changed the outlook for 2025 but our disciplined process for investing has not. We entered the year with elevated cash levels and a more cautious approach to potential volatility. This served us well during the April selloff as an important opportunity to add longer-term value.

Although we believe stock markets will push higher over time, we don’t see it happening in a straight line, and this will continue to put a premium on remaining active in finding investment opportunities.

-

- First quarter earnings guidance from company executives left many questions for investors after many cited significant variability in what the remainder of the year may bring.

- Second quarter earnings should provide more clues to how companies are managing these changes and will take place over the next several weeks.

- Canadian markets may be hard-pressed to meaningfully move much higher without Energy names moving higher. Canadian bank valuations look elevated, and gold has already had a sizable advance.

- The U.S. market recovered since the April tariff lows and was led by the big technology stocks once again, limiting participation from other sectors. That said, we have seen more participation among different sectors in 2025, especially relative to what we saw in 2023/24.

- The so-called “Magnificent 7” may be no more. As of June 30th, only three of the seven (Meta, Microsoft, Nvidia) are positive. Given that the group makes up nearly a third of the S&P 500, if they are not all moving higher, it limits the potential upside of the overall index.

- International stocks are viewed favourably and have been leading global markets so far this year. Our broader view remains that international markets should continue trading higher, with European and Asian stocks being favoured.

- First quarter earnings guidance from company executives left many questions for investors after many cited significant variability in what the remainder of the year may bring.

- Europe’s economy has shown resilience, with data coming in better than expected and evidence of strong consumer spending. Increased infrastructure and defense spending, notably Germany’s €1 trillion stimulus package, are positive for European growth.

- China looks to be showing signs of recovering from their post-COVID struggles and real estate worries, adding to investor confidence.

Learn more about our strategies:

Bonds

Investment Grade Canadian bonds were down modestly in the second quarter but remain positive for the year, gaining 1.13%. Bonds have offered some stability as investors continue to benefit from elevated income yields and the prospect of additional declines in interest rates later in the year.

- While the Bank of Canada and U.S. Fed left interest rates unchanged in June, there remains expectations for cuts later in the year.

- In Canada, headline inflation has settled at 1.7%; In the U.S. it has stabilized at 2.4%, above its target range.

- During the quarter, the U.S. 30-year Treasury income yield rose past 5%. The two previous occurrences of this were the result of spiking inflation or a rapidly growing economy, the 2025 occurrence appears to be driven by risk: that is risk that the U.S. government may run into financial trouble due to a ballooning deficit.

- Although rising U.S. bond yields got most of the attention, this is not a U.S.-only story. Long-term bonds have been rising for many nations, including Canada.

- Longer-term, debt sustainability will remain at risk and if bond yields remain higher than growth for an extended period, there is greater risk of a crisis.

We continue to be very active in fixed income today. Regardless of whether your goal is to enhance portfolio diversification or achieve a positive return, we recommend looking outside of government bonds. Select corporate bonds, and structured notes offer meaningful advantages to building a diversified portfolio without jeopardizing overall returns.

Preferred Shares

Preferred shares were initially caught up in the tariff volatility during the quarter but were supported by a strong backdrop of redemptions in the space and finished up 6.72% for the year. The shrinking availability for preferred shares in Canada should continue to help prices and we remain focused on rate-reset over perpetual preferred shares given concerns for long-term interest rates.

Commodities

Up nearly 30% in 2025, gold has continued to lead the conversation surrounding commodities, but other opportunities in the space began taking shape in the second quarter.

- Over the past two months, gold has traded sideways while momentum builds in other areas – particularly metals like platinum, silver, and aluminum.

- This echoes a similar dynamic we experienced in 2020, when gold rallied first, followed by a broader commodity surge during the inflation wave.

- Uranium rose steadily in the second quarter on pro-nuclear statements in the U.S. and elsewhere as well as the increasing needs for electrical power to support advances in Artificial Intelligence.

- Oil rose sharply on June tensions with Iran and threats to global supply but quickly retreated as fears over an expanded conflict dissipated.

Alternatives

We are experiencing more unique market corrections, caused by single events and shocks like COVID, high inflation, global conflicts, or dramatic policy shifts. Given higher inflation and a more uncertain outlook for policy, we expect this volatility should continue.

While high quality stocks and bonds should remain the core defense provider for portfolios, today’s environment requires different types of diversifiers, particularly alternative investments – those not publicly traded.

Examples of alternative investments we use in portfolios include:

- Private equity; particularly in global infrastructure assets.

- Private lending to Canadian and U.S. businesses

- Music royalties

- Lot development financing

- Litigation financing

- Inclusive of law firm lending, injury settlement lending, and estate lending.

- Private real estate

- Inclusive of Canadian and U.S. apartment buildings, student housing, self-storage facilities, and new developments.

Looking Ahead

Stocks began 2025 hopeful that President Trump would include growth-friendly initiatives and tax cuts, with minimal disruption from tariffs and they seem to be ending June with a similar optimism. Global markets are once again at all time highs which will continue to raise the usual questions: Is this as good as it gets – the perfect time to sell? Or just the start of more positive momentum? These are investing questions which never go away, and we will continue to believe that taking a more calm, proactive approach to portfolio management is ideal to navigate market uncertainty, whatever the headlines.