Market Overview

In a year which has seen continued armed conflicts and the fraying of decades long trade relationships, investors have been able to use the words “all-time highs” more frequently than most would have expected just a short time ago. Seemingly everything ended September at all-time highs as stock and bond markets demonstrated an impressive resilience to the uncertainty brought on by U.S. tariffs and the mixed economic signals that followed. Despite the positivity, the one question we hear most is: can this rally keep going?

In this review we will take the opportunity to share our thoughts on the renewed market momentum and lingering risks which are helping drive investment decisions moving forward. Key themes discussed include:

- U.S. tariffs continue to reshape economic relationships, but companies have demonstrated an impressive ability to adapt to trade disruptions and policy uncertainty.

- Tariff-driven inflation once looked like it would be a shock to the global economy. Instead, it has turned into a slow burn as companies gradually increase prices.

- Global stock markets have been supported by a combination of declining interest rates, increased government spending, and impressive earnings reports.

- Benefiting from rising gold prices and strong performance from the big banks, Canada’s TSX is one of the best performing markets globally.

- U.S. stocks continued their momentum into the summer but remain behind other major markets.

- Despite the positivity, the U.S. dollar is seeing one of its most challenging periods in decades, hurting returns for Canadians holding U.S. investments year-to-date.

- The Bank of Canada and U.S. Federal Reserve decreased interest rates in response to rising unemployment and tariff headwinds with further declines expected.

- Gold is up by more than 50% since the beginning of the year, putting it on pace for its best year since 1979.

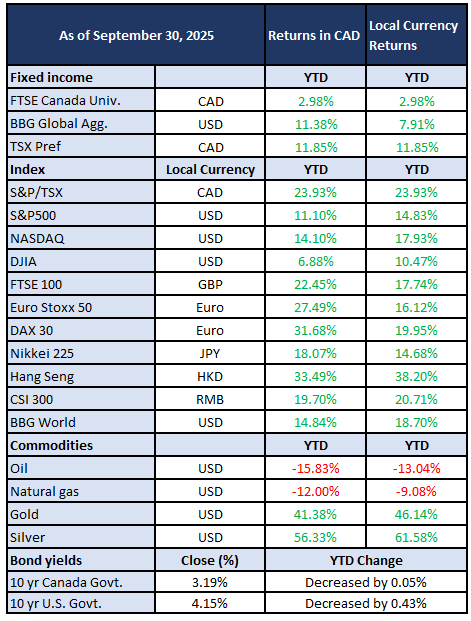

Market Returns

A Closer Look

The markets direction in the near-term is often the result of the push and pull of the optimists (the “bulls”) and the pessimists (the “bears”). Today, we find ourselves at all-time highs so clearly the bulls have been winning but, interestingly, attitudes appear fairly split in whether this positive momentum can continue or if we are due for reset.

While no one can know the future, there is a case to be made that the answer for what’s next is somewhere in the middle.

Tariffs & Inflation

Since the implementation of tariffs, now running between 15-20% for many countries, and the uncertainty that followed, the global economy has remained far more resilient than many thought possible. In fact, investors’ willingness to ignore the tariff headlines has been a key ingredient in the market rally.

- Businesses have demonstrated a willingness to absorb some of the tariff pain at many stages of the supply chain, meaning prices on consumers have only shown modest increases.

- Policy changes of this magnitude rarely have an immediate effect. Tariffs are still working through the economy and will lead to a sustained increase in prices for consumers and businesses.

- Nearly half of big U.S. businesses acknowledged raising prices in the last six months as a direct result of tariffs with additional expectations for increases between 5% to 15%, according to a September KPMG survey.

- There is a sizable gap between how large publicly traded companies can navigate these tariffs versus the small “main street” businesses.

The willingness of businesses to accept these costs over the long-term is uncertain and may play a significant role in how central banks navigate interest rates in 2026. While some nations have signed trade deals to help mitigate some of the impact and uncertainty, it is clear the U.S. administration is working towards a higher level of base tariffs regardless of concessions from trading partners. Canada has been in a favourable position in 2025 with most exports covered under the USMCA, however, this agreement is up for negotiation in 2026 and may drive further uncertainty and cross-border disruptions.

Artificial Intelligence & Concentration Risk

The promise of AI-driven productivity gains has been a pillar of the rally in U.S. stocks the past few years and companies have greatly increased their spending to build out the necessary infrastructure to support this technology. Along with valuations, expectations are high with one study stating that annual revenue from AI would have to be $2 trillion by 2030 to justify the expense.

The AI boom is not the first time money has chased technological promise. The Wall Street Journal points to several examples where infrastructure build-outs far exceeded demand:

- The Telecom Fiber Bust – in the late 1990’s, firms like Global Crossing and WorldCom raced to lay fiber-optic cable across continents, expecting internet traffic to surge. The supply came, but demand lagged.

- Global Crossing filed for bankruptcy in 2002, WorldCom collapsed in scandal, and billions in assets were written down.

- Dot-Com Data Centres – in the same era, companies overbuilt hosting facilities on the premise that every business would need a website and vast server racks.

- When the dot-com bubble burst, many of those centres sat empty and bankrupt operators were unable to cover the debt.

The common thread is simple: exuberance leads to infrastructure being built faster than demand can justify it. AI carries similar hallmarks today, with multi-billion-dollar campuses, long leases, short customer commitments and hardware that ages quickly.

A byproduct of the success of AI related companies such as Nvidia, AMD, Oracle, and Microsoft have been the increasingly concentrated U.S. indices which poses a risk to investors. At the end of September, the top 10 largest holdings in the S&P 500 account for almost 40% of the index, a level not seen since the early 1930’s.

- While the risks of concentration are apparent, this benefits active management and stock picking as there may be entire sectors or cohorts of businesses which appear to be lagging the market but warrant increased attention from long-term investors.

Gold

Doubling in less than two years, gold has gained more than 50% and has been a top performing asset in 2025. Several factors have benefited the price of gold:

- The ongoing efforts made by central banks to diversify their foreign exchange reserves has represented one of the most aggressive purchase programs in history.

- In sum, central banks have purchased over 1,000 metric tons of gold annually for four consecutive years.

- Its traditional role as a ‘crisis commodity’ and inflation hedge has been amplified by persistent global tensions and tariffs.

Gold companies have been an important driver in the positivity being seen in Canada’s TSX. In 2023, gold miners in the TSX contributed $6 billion in earnings for the index; it’s now over $21 billion based on forecasts for the next 12 months.

Only time will tell what the next move in gold looks like.

- Gold stocks generating significant cash flow, historically, would lead to a merger/acquisition binge. That hasn’t really taken off yet, and if it did, it could mean more upside.

- Declining interest rates have created a favourable environment for gold in the past.

- Following declines from the U.S. Fed, gold has seen average returns of 9% over the following 12 months.

- On the other side, the rapid rise brings forward the fear of a near-term correction as the gains can invite profit-taking.

- Technically speaking, things are extended. The RSI (relative strength index) of gold bullion is 71, TSX miners 78. Usually, anything over 70 is a sell signal.

Regardless of what’s next, the remarkable run has put gold on pace for its best year since 1979. Notably, 1979 was a year of double-digit inflation, a Mideast oil crisis and the Soviet invasion of Afghanistan. It was also a year the S&P 500 returned 11.6% despite the uncertainty.

U.S. Government Shutdown

There have been 20 shutdowns since 1977, lasting an average of eight days, according to researchers for the Bank of America Institute. Only seven exceeded that average. The longest shutdown started in December 2018 during President Donald Trump’s first administration and lasted 35 days.

Historically, government shutdowns haven’t hurt stocks all that much and any declines have proven temporary opportunities for investors.

What we are doing and why

Stocks

To the end of September, the TriDelta Growth and Pension strategies have returned 22.80% and 15.25%, respectively.

The prior three months saw investors benefit from broad momentum as investors rode the renewed AI wave, expectations for declines in global interest rates, and broad earnings strength. Our team is constantly looking to determine which investment style (or styles) should perform best in specific market conditions and then selecting stocks we expect to perform best in that environment. As we enter the final months of the year, we have put emphasis on companies with good cash flow, often carrying dividends, strong balance sheets, and those trading at more reasonable valuations. Additionally, we have focused on ensuring investment portfolios are rebalanced according to their long-term targets and increasing our flexibility as we navigate the prospect of near-term ups and downs in the market.

We continue to believe stocks will push higher over the long-term, but it would be wrong to assume that will occur in a straight line.

- Quarterly earnings reports had a low bar in the first half of the year in the face of tariff uncertainty, but investors are looking at the latest reports to determine the direction of the markets.

- If profits can deliver, it would go a long way towards making stocks’ winning streak justifiable.

- Globally, stock prices are being supported by the combination of central banks, the promise of AI productivity gains, and only modest tariff inflation.

- Like other international markets, Canada’s TSX benefited from cheaper valuations when compared to U.S. stocks at the beginning of the year. Globally, stocks are expensive, but Canada has benefited from increased attention as investors look to diversify out of the U.S.

- The positivity of the Canadian market is contrasted with a bleaker economic picture as tariff uncertainty will persist into the 2026 renegotiation of the USMCA and slowing growth expectations.

- The performance of international markets had made the case for geographic diversification.

- Markets in Latin America, such as Mexico and Brazil, have risen almost 40% in 2025 when converted to Canadian dollars.

- Europe was able to mitigate the tariff impact with an eventual trade deal, strengthening Euro, and a series of pro-growth fiscal policies.

- Asian markets are benefiting from pro-business policies in Japan and evidence of China’s economy recovering from a prolonged period of missteps.

For an update on our current positioning, you can learn more about our strategies here:

Bonds

Global bonds have delivered strong returns so far in 2025 with the Bloomberg Global Aggregate Bond Index gaining 11.88% in Canadian dollars. Investment Grade bonds in Canada have been more muted, gaining 2.98% to the end of the quarter.

- After a nine month pause, the U.S. Federal Reserve opted to reduce interest rates for the first time in 2025. The U.S. joined the Bank of Canada in recognizing the weaker labour markets with less concern for inflation.

- Despite this shift, U.S. inflation remains persistently above their 2% target, currently sitting at 2.9% since the latest available data.

- More interest rate declines are likely to come but the timing and magnitude of which will depend on how the labour market and inflation evolve.

- Trade policy decisions will play a significant role as there is evidence that people are staying unemployed longer, while policy uncertainty slows hiring.

- Credit spreads remain tight, reflecting that an economic downturn is not the base-case scenario for investors.

- We continue to focus on investment grade bonds as lower grade bonds, despite higher yields, don’t adequately compensate investors for near-term risk.

While bonds may face some turbulence from trade policy and inflation surprises, volatility is likely to provide an opportunity for investors at better valuations.

Preferred Shares

Preferred shares rallied alongside broader stock markets and finished the quarter up 4.92% and +11.85% year-to-date. The preferred space was buoyed by further redemptions of non-bank issuers as the shrinking availability of Canadian preferred shares continues to drive positive returns. In total, $4.5 billion of preferred shares have been redeemed in 2025, or 8% of the entire market.

Alternatives

An allocation to alternative assets and investment strategies can benefit diversified portfolios when used over the long-term. Given an increasingly uncertain outlook, we expect the need for additional diversification to benefit investment portfolios outside of traditional stocks and bonds.

Examples of alternative investments we use in portfolios include:

- Private equity; particularly in global infrastructure assets.

- Private lending to Canadian and U.S. businesses

- Music royalties

- Litigation financing

- Inclusive of law firm lending, injury settlement lending, and estate lending.

- Private real estate

- Inclusive of Canadian and U.S. apartment buildings, student housing, self-storage facilities, and new developments.

Looking Ahead

We wrote in July that global markets are once again at all-time highs and raised the usual questions: Is this as good as it gets – the perfect time to sell? Or just the start of more positive momentum? Clearly the summer months served investors well, but as markets have climbed, we’re reminded that even the tallest trees don’t grow forever.

As we enter the final months of 2025 and look forward to what’s to come, we continue to put an emphasis on being nimble and keeping ourselves in a position to seek opportunities from the ups and downs of the market, regardless of how unusual or surprising they may feel.