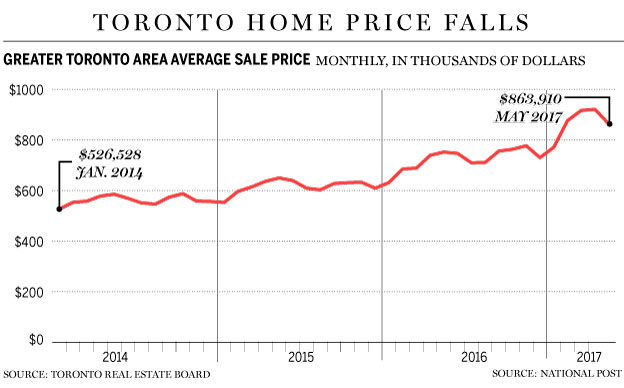

There are early indications that residential home prices in the Greater Toronto Area are starting to level off. Between changing mortgage rules, a new foreign buyers’ tax, and banks placing tougher standards on property valuation, there is definitely some downward pressure from many sides.

This possible peak often gets my older clients to think harder about their biggest asset. One of the most common questions I receive is, “Should I sell my house now?” This is often followed by “If I decide to rent or move to a retirement residence, how can I best fund all of the fees?”

While these questions can best be answered as part of a broader financial plan, here are my basic answers:

‘Should I sell my house now?’

The decision to move from a house to a condo or to a retirement residence should be driven by lifestyle more than money. It is extremely difficult to time any market, and the real estate market is no different. The time to sell the long-term family home is when you are ready to make that next step — physically, emotionally, and if necessary, financially.

The one concern is that people occasionally make the move from their long-term home later than they should. It really is best done before you are forced to move for physical reasons. Change is hard for everyone, and it can be a very emotional decision for some people. In my experience, if you are starting to seriously consider moving, it probably means that you should have done it a couple of years before.

‘Should I rent or should I buy something else?’

One of the biggest real estate costs is the transaction itself. From real estate commissions to land transfer taxes to staging costs to legal and moving costs, getting from property A to property B can cost you as much as 8 per cent to 10 per cent of the average cost of the two properties. This is effectively wealth that has disappeared. The only way to recover that cost is to own real estate that is going up in value, and to amortize it over many years by not moving very often.

This is crucial to answering the question of whether someone in retirement should buy or rent. My rule of thumb is that unless you expect to be in your new property for at least 6 years, you should definitely be renting. Like most life decisions, nothing is guaranteed, however, given your age and health, and expected plans, you should be able to make a pretty good guess at this question. If you are going to do an extra buy-and-sell transaction that could easily cost you over $100,000 in expenses in Vancouver or Toronto, you want to be fairly sure that your time in the new property will make it worthwhile.

‘How will my house proceeds pay for all of the new monthly fees I might face?’

If you move from your paid off house to a rental property or retirement residence, suddenly there are monthly expenses that you never had before. Nice retirement residences can now easily see fees of $4,000 to $6,000 a month. Rent on a nice condo will often be $2,500 to $3,500 a month. Obviously these are higher-end estimates, and each area of the country will have different costs. The key is, how best to fund these new expenses. Even if you choose to sell your house and then buy a condo, there could be monthly fees north of $1,000 a month.

Before the sticker shock causes you to stay in your house for another few years, the first thing to think about is how much of these costs are actually additional, as opposed to simply replacing current expenses. If your house taxes are $6,000 a year, and your average repair bill is $12,000 annually, that works out to $1,500 a month that you are no longer spending. In some cases, there are also utility bills covered in monthly costs — especially in a retirement residence.

For the sake of argument, let’s say that you are adding $2,500 a month in living expenses, or $30,000 a year.

Let’s also say that in selling your house, you cleared $1 million. This means that depending on tax rates, maybe you would need to generate 4 per cent or $40,000 of income on this portfolio pre tax to cover the extra $30,000 in living expenses — without touching the capital.

Here is a sample portfolio that we might put together for this type of goal:

• 15 per cent bonds — yields 3 per cent

• 15 per cent preferred shares — yields 5 per cent

• 15 per cent TriDelta High Income Balanced Fund, mix of bonds, stocks and alternative income — yields 5 per cent (with some additional capital growth)

• 20 per cent Select Alternative Income Funds in Global Real Estate and Private Lending (with no Canadian real estate exposure) — yields 8 per cent

• 35 per cent Dividend Growth stocks — yields 3.5 per cent (with some additional capital growth)

• Total portfolio yield: 4.8 per cent

• Long-term capital gain expectation: 2.5 per cent

• Expected long-term return before fees: 7.3 per cent.

• Expected long-term return after fees: 6 per cent + (fees would depend on the overall size of portfolio managed and would be tax deductible).

It is important to keep in mind that this focuses on selling real estate to fund living expenses for the rest of your life. It doesn’t look at other savings and other expenses.

Is now the time to sell your long time family home? Only you can really answer that question. What I can say is that in the vast majority of cases, the monthly costs of rent or retirement home fees shouldn’t be holding you back from selling your home. The growth and income alone from your house sale proceeds (especially in Toronto and Vancouver) should cover you for life.

Ted can be reached at tedr@tridelta.ca or by phone at 416-733-3292 x221 or 1-888-816-8927 x221

Reproduced from the National Post newspaper article 6th June 2017.