Market Overview

Coming off a difficult June, markets were optimistic heading into the early stages of the third quarter. By mid-August markets in Canada and the U.S. were strongly positive on several good news stories. Recession fears eased on the back of improving economic data and inflation showing early signs of having peaked, and company earnings from the second quarter were not nearly as bad as many expected. Some believed we had found our bottom in June amid several indications the market had grown too pessimistic.

As quickly as the market had seemingly reached a turning point, markets reversed course. The bounce off the June lows ran out of steam due to persistent inflation and indications the central banks of the world were going to continue aggressively raising interest rates. This was coupled with further escalations in the conflict between Ukraine and Russia, an ensuing energy crisis forcing European countries to begin rationing ahead of what is likely to be a very difficult winter, and a struggling consumer in China.

Central banks raising interest rates is worth further attention as it’s one of the primary drivers impacting markets today. It’s important to note that never in all recorded history have central banks all raised rates at the same time. While all central banks will act independently of each other, the U.S. Fed is ultimately the driver behind a slowing global economy and will not stop until its goal of bringing inflation down shows signs of life.

September, in particular, was a very difficult market for stocks which put the TSX and S&P 500 back down to their June lows. Bloomberg has coined this the “Everything Selloff” which is in direct contrast to the Covid rebound in 2020 termed the “Everything Rally”. With inflation at 7% in Canada, interest rates meaningfully higher, and major stock and bond markets negative, it’s true there have been very few places to hide this year. The question we need to ask ourselves; is it really all bad?

In this quarterly review, we will look at why there is opportunity in the face of extreme negativity and what we are seeing in the market today and moving forward.

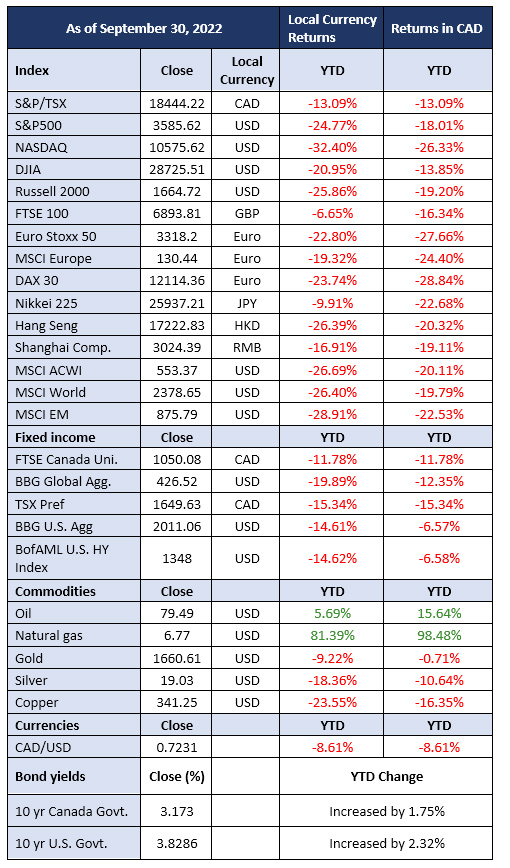

Year to Date Market Returns

Global markets are meaningfully lower and while each offer an interesting reference point, a traditional balanced portfolio has fared just as poorly. To the end of September, a passively managed 60% stock, 40% bond portfolio is down 15.1%. This has provided further evidence to the value of active management as our portfolios continue to outperform and protect on the downside.

Finding Optimism in a Bear Market

“In the real word, things generally fluctuate between “pretty good” and “not so hot”. But in the world of investing, perception often swings from “flawless” to “hopeless” – Howard Marks

There is no valuation metric or sentiment score that marks the bottom of a bear market. The end of such a market is always identified in retrospect and the reasons are not always clear. That said, there are indications we can use to help identify long term opportunity despite the near-term uncertainty.

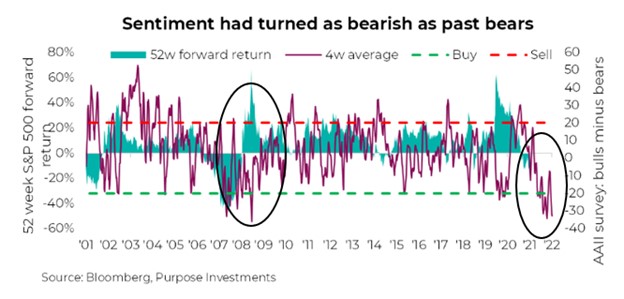

Sentiment (investor attitudes) has reached extreme negativity, which can be a positive indication markets have become oversold. The latest AAII Sentiment Survey showed bears (those seeing stocks lower in six months) topping 60%. This poll has been around since 1987 in which the last time we saw these extreme levels we were nearing the bottom of March 2009 during the Great Financial Crisis.

Readings at these levels tend to imply a strong market advance during the following 12 months.

Valuations offer another point of optimism for investors. While it’s true whether the S&P 500 or TSX is trading at a 15x or 20x price-to-earnings ratio will never, by itself, mark a bottom, as prices fall and valuations improve, the downside risk declines as upside potential rises. For example, we look to include high quality companies whom we have long term confidence in their ability to outperform the market. If we believe the appropriate price for a company is $100/share and it falls to $80/share, it may continue to fall but $80 still represents a better opportunity for a long-term investor. After all, we are not trying to catch a falling knife, we are investing in companies we believe will have a positive impact on client portfolios.

We tend to caution against drawing comparisons to past bear markets because no two are the same. The financial world is in much better shape than 2020 and even 2008/09. It’s easy to forget that during the late 2000’s there was very real concern the entire financial system would collapse. Major institutions either failed outright or required government assistance. Insurance companies were at risk of not being able to pay out policies and houses were being abandoned because speculators couldn’t afford payments on third houses they never should have bought. Today is not without its challenges, but we are increasingly seeing higher wages, companies continue to hire albeit at a slower pace with unemployment still at record lows, and banks and large institutions have had the eyes of regulators on them for over a decade to ensure the stability of the financial system.

No two bear markets are the same and although the future remains uncertain, it is uncertain regardless of whether the market has fallen 20% or has risen 20%. What’s most important is to take emotion out of the decision-making process and maintain a long-term perspective despite short term negativity.

The worst thing you can do in a time like today is turn temporary declines into permanent losses.

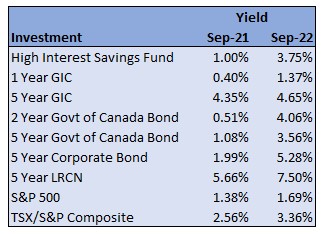

Yields on Investments Now Versus One Year Ago

The surge in bond yields and rise in interest rates are giving investors options they haven’t had for some time.

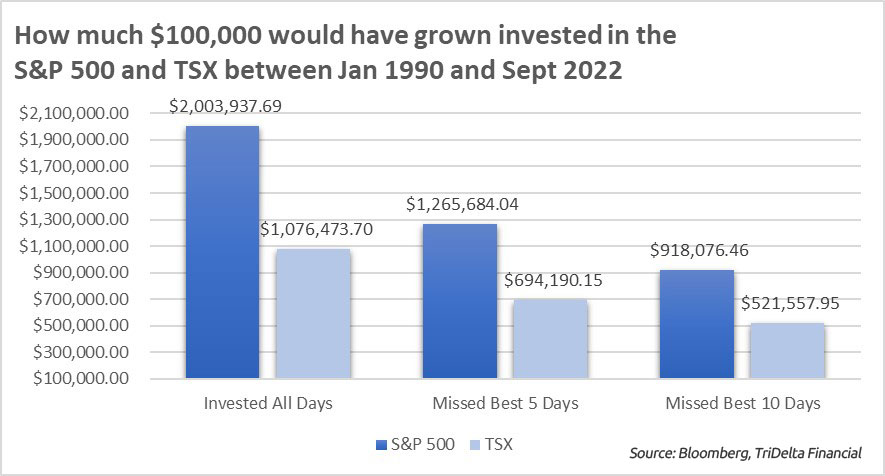

This is not to say that stocks don’t present an attractive long-term opportunity, but that our options for how we construct portfolios and make allocation decisions for individuals has increased. In fact, today is a great time to review why it pays to remain invested in difficult times. The following chart demonstrates what a $100,000 investment in 1990 until the end of September 2022 would look like if: you had remained invested for the whole time, had missed just the best 5 days of the market, and had missed the best 10 days of the market.

Clearly, patience pays off in the long run.

What we are doing and why

Equity

The factors weighing on markets during the first half of the year persisted into the third quarter and are expected to continue for the remainder of 2022. We reiterate from earlier in the year that markets are not likely to sustain a prolonged uptrend until we have greater clarity around the path of interest rates, and we remain highly active in our decisions to take advantage of near-term opportunities.

Moving forward, we foresee equities trading in response to what is happening elsewhere in the markets. Rising bond yields have had the dual effect of making bonds and cash an attractive alternative for income investors seeking stability and decreasing the valuations of public companies.

Here in North America, Canadian markets have continued to outperform much of our global peers. Canada’s reliance on commodities have benefited from a stronger USD and the supply disruptions happening abroad. Historically Canada has been more sensitive to global recession fears rather than inflation which is why the TSX was one of the best markets earlier in the year, before fears started migrating from inflation to recession.

The U.S. have continued to see strong employment numbers and wage gains. The markets have been especially hit hard due to their higher exposure to growth companies in relation to Canada and are expected to remain volatile with a highly polarized midterm election taking place in November.

Abroad, Europe has struggled in response to the conflict and associated sanctions on Russian energy. Europe’s energy infrastructure has failed in entirely foreseeable ways as policymakers have increasingly made short-sighted decisions and failed to adequately diversify their energy needs towards renewables.

In Asia, China has struggled amid slowing growth and a troubled real estate sector. Covid restrictions in the country also remain, with as many as 20 cities facing some form of lockdown in the past three months. This has hurt consumer confidence and economic activity.

Into the last three months of 2022, the TriDelta Funds continue to be highly active to take advantage of attractive opportunities.

- Bond yields declining in the months ahead should have a positive impact on equities and an indicator we continue to watch closely.

- We expect Canada to continue to perform well in comparison to markets globally and predict a potential recession in Canada would be mild as the Bank of Canada reaches a peak interest rate before the U.S.

- Global equities have felt the brunt of poor policy decisions and the ongoing conflict but pose an increasingly attractive long-term opportunity for investors willing to tolerate near term volatility.

- We have added to the cash positions in the funds as a defensive measure and to take advantage of near-term price swings.

- Future company earnings releases will be of key concern as the market gets a closer look into how today’s challenges are impacting companies bottom lines.

The TriDelta Pension and Growth Funds have performed well in the quarter and year-to-date relative to the broader markets. For the year ending September 2022, the Pension and Growth funds were down 9.00% and 16.01%, respectively. Presently, the yield on both funds is greater than 5% which marks the highest since the funds inception and poses an attractive opportunity for income investors.

Preferred shares

Preferred shares continue to see much of the volatility being experienced in the stock and bond markets as the yields have not yet increased enough to attract sufficient activity in the space.

Our preference is still towards rate-reset preferred shares but see the market trading in line with broader stock markets into 2023, limiting their ability to act as a diversifier in a portfolio despite the added income.

Limited Recourse Capital Notes (LRCNs)

We have recently shown interest in the market for Limited Recourse Capital Notes (LRCNs) for use in client portfolios. This is a relatively lesser-known investment that shares characteristics of both preferred shares and bonds.

There is now over $18 billion worth of these bank notes in Canada, but only recently have the banks come out with LRCNs paying 7+%. These bonds are technically higher risk given that they are secured by preferred shares in the issuing bank and are typically much longer term than we would include in portfolios.

An example of one of these notes technically is not due until November 2082, but it includes a rate reset feature based on the 5-year Government of Canada bond rate plus 4.10%. This will reset in 5 years, and we believe it is very likely that the note will be redeemed at $100 in 5 years.

We see these bonds as relatively low risk and offering an attractive yield for income seeking investors while also providing daily liquidity and the opportunity to gain in value if/when interest rates come down in the next 5 years.

Bonds

Typically, one would expect with stock markets lower, bonds would at least be holding their own but that has not been the case this year. Instead, bond markets have experienced their own bear market when the Bloomberg Global Aggregate Total Return Index of government and investment-grade corporate bonds fell 20% in August from last year. In fact, bonds are having their worst year since 1949 and instead of acting as a diversifier, bonds have been a driver of lower returns.

- Central banks, most notably the U.S. Fed and Bank of Canada, have recommitted to raising rates to bring inflation under control and the market is finally starting to take them at their word as economic activity slows and likelihood of a formal recession grows.

- Inflation is still of key concern, and we don’t believe it’s a matter of if inflation comes down but when. Inflation will recede but likely not quick enough to avoid policy rates in the mid 4 to low 5 percent range into early 2023.

- Presently, inflation in Canada and the U.S. sits at 7.00% and 8.26%, respectively.

- We continue to watch the inverted yield curve as an indication the market believes the inflation fight can be won. Our hope would be to see a more sharply inverted yield curve in the near term.

- Our focus heading into this year towards short term and high-quality investment grade bonds to provide insulation from interest rate increases have helped to insulate portfolios from the losses seen in long-term, low-grade bonds.

We remain selective with bonds we choose to include in client portfolios and have actively sought out attractive opportunities. As prices have fallen, we increasingly see the value in including bonds in client portfolios as a source of income and future return.

A Note on Currency

Fueled by rising global uncertainty, the U.S. dollar (USD) has been a notable outperformer in 2022. This has rewarded Canadian investors with bigger dividends and an offsetting boost for their investments held in U.S. dollars or simply through owning companies which derive profits from the U.S. consumer.

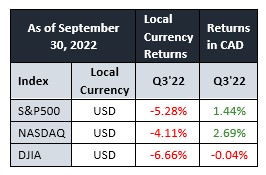

An example of this can be seen in the last three months alone where an investment in U.S. dollar assets have helped returns for Canadian investors.

While large swings in the dollar — in either direction — adds to uncertainty in the market, a strong U.S. Dollar is predicted to help many countries boost growth as their exports become more attractive. It may also be a positive for the U.S. to bring down inflation as cheaper imported goods cause disinflation. U.S. companies may also find it harder to compete with global companies whose prices are in other, cheaper, currencies. This isn’t great for the companies in question but is a positive for bringing down inflation in the near term.

Alternatives

Alternative investments, those not publicly traded, have offered support for portfolios. To the end of September, the TriDelta Alternative Performance Fund is +3.22%.

Our real estate partners have benefited on multiple fronts.

- Rising interest rates have made home ownership less affordable for many. This has added further demand for rentals which continue to see increases in average rents by 10-20%.

- Canada is not on pace to achieve affordable housing for Canadians. In Ontario, the CMHC estimates 1 in 3 people will be forced to rent in the next 10 years. An already tight supply for rentals represents a significant opportunity for investors as demand continues to rise across North America.

- Many of our partners refinanced in 2021 at the low rates previously available. Many are locked into those fixed rates until the mid-2020’s.

Our private credit partners have also seen positives.

- Rising interest rates have translated into higher returns on the loans they provide to small and medium sized businesses in Canada and the U.S. We have seen yields rise this year as the loans tend to be structured with variable rates and/or short term in nature.

- As rates have risen it has been difficult for these small and medium sized businesses to receive traditional bank financing due to the strict stress testing enforced by regulators. Our partners are seeing a greater pool of opportunity because of this.

- Our partner funds use little to no leverage as part of their fund’s strategy. This has put them in a good position to act opportunistically as their indebted peers may be less nimble to take advantage of attractive loans.

Alternatives have proven a valuable source of income and diversification in the face of volatile markets elsewhere. Our clients have benefited from this allocation as we continue to do further due diligence on several funds for inclusion in client portfolios.

In Conclusion

Market behavior this year has thrown a wrench in the traditional 60/40 strategy — the idea that if stocks are down, then bond performance will offset the losses, and vice versa. This traditional 60% stock and 40% bond portfolio is down over 15% to the end of September.

We believe strongly in the value of active management and have seen firsthand our ability to protect portfolios on the downside. Our portfolios have outperformed the traditional 60/40 portfolio and broader markets because of this active management and allocation to Alternative investments which have served investors well as a source of income and diversification in the face of volatility elsewhere.

The final quarter of 2022 is likely to continue to see heightened volatility. Seasonality, midterm elections, inflation, slowing economic growth, negative earnings revisions, and higher interest rates are all factors we will have to face.

Ultimately, we are confident that markets will recover regardless of near-term volatility and what the upcoming interest rate decisions may be. Central banks are not raising rates and reversing stimulus because they don’t like investors or are trying to wreck your home’s value – it is in response to inflation.

When, (not if) inflation comes back down, we think both stocks and bond markets will rally. This, on its own, may very well mark the end of the bear market, even if a recession or earnings recession looms on the horizon. After all, stock market bottoms rarely coincide with the bottom in economic activity as the markets are always forward looking.

As always, we are here to help. If you have any questions, please don’t hesitate to contact your Wealth Advisor.