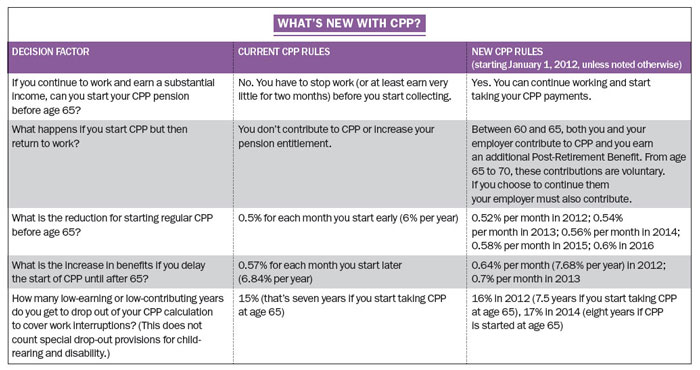

Two thirds of Canadians take their CPP benefits before age 65, but determining what’s best for you demands that you better understand your options. First let’s consider the rules around taking CPP – which changed January 1, 2012. The chart below from www.moneysense.ca provides a nice summary.

You can start collecting CPP (Canada Pension Plan) any time after age 60, but this will result in a reduced amount based on how many months prior to age 65 you are when you begin collecting. Given this reduction, part of answering the question on whether or not to take CPP early will involve crunching some numbers. Our new ‘Early CPP Calculator’ can help, and is found in the Resources section of our website.

Understanding how much CPP you may be entitled to is an important first step, but is not the only variable to consider. Other factors to consider include:

- Cash flow. If you need the funds in order to pursue interests while you’re still healthy, this would likely trump any other factor.

- Poor health. This likely means that you will have a shorter life expectancy than average and as a result you should start drawing CPP earlier.

- Excellent health and longevity in the family. This would suggest you consider delaying the start of your CPP payments because you’ll collect more over time if you live a long life.

- Tax implications. Taking CPP increases your taxable income and may affect your decision on when to take it (OAS, GIS thresholds).

The most difficult variable of course is not knowing when you will die. For this reason, outside of a few scenarios that may strongly suggest certain action, the CPP decision will always remain a calculated guess. A personal financial plan can help identify how CPP should fit within a broader retirement income strategy. For more information on CPP visit the Service Canada website.