Alternative Investments

TriDelta Alternative Performance Fund

We recently launched our Alternative Investment Fund which is designed to provide:

- A high income stream

- Diversification among different strategies to reduce risk

- Lower portfolio volatility – low correlation to the stock market

- Enhanced returns with a target return of 8% to 10%

- Capital protection during periods of stock market decline

The case for investing in alternative investments

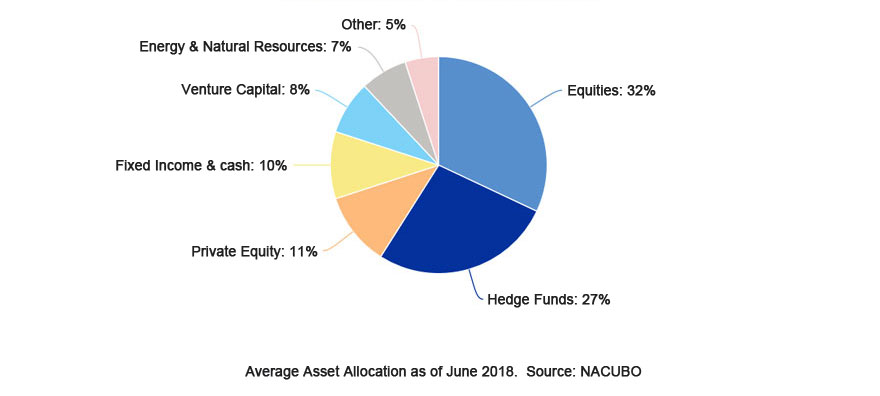

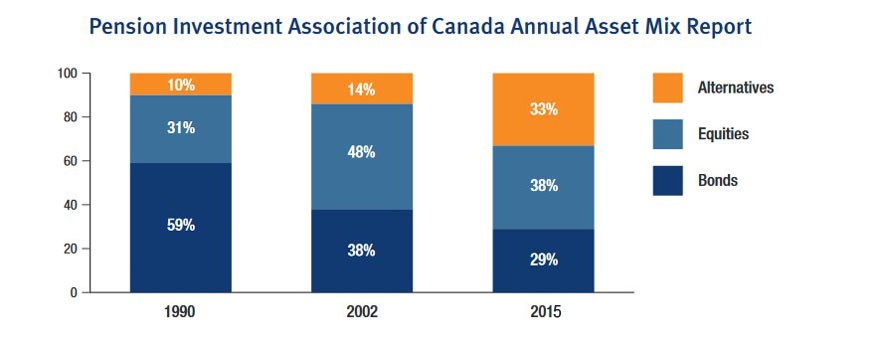

At TriDelta we research the marketplace for viable portfolio solutions including an analysis of where leading pension and endowment funds invest. They have been reducing their bonds and, to a lesser extent, their publicly traded stock portfolios. Under the catch-all phrase of alternative investments, many pensions and endowments have instead been investing between 25 per cent and as much as 75 per cent (Yale University Endowment Fund) in alternative investments.

What are Alternative Investments?

Alternative investments are essentially any asset that is not a public stock, bond or cash security. Alternative investments often provide higher returns than traditional assets by focusing on less efficient or private asset classes, such as infrastructure and private equity. They can generate stable, high levels of income by investing in private income oriented investments, such as real estate and private debt. Hedge Funds, such as Market Neutral Hedge Funds can also reduce volatility by using sophisticated hedging strategies.

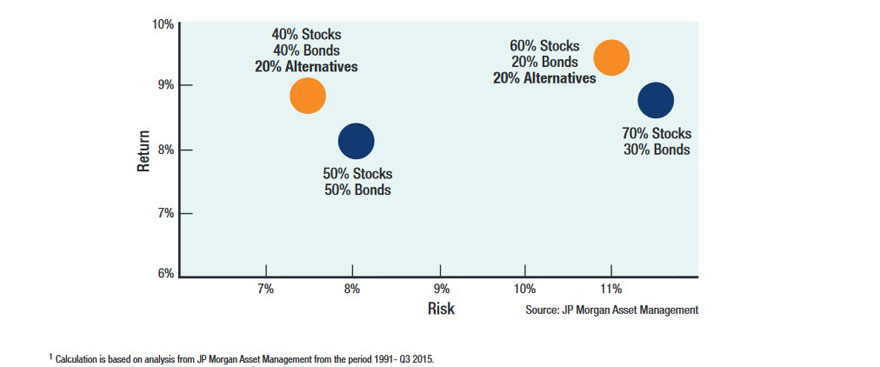

1. Returns can be meaningfully improved and risk reduced by including alternative investments

According to JP Morgan research, portfolio returns were improved by more than 10% p.a. and volatility was significantly reduced by adding 20% to alternatives.

2. Invest where the ‘smart money’ invests

The ‘smart money’ generally refers to professional investment managers. We research where they invest given that they have consistently achieved superior investment returns versus more traditional models. We then fine tune our own investment allocations and strategies.

Alternative Investments Make up over 40% of US University Endowment Portfolios